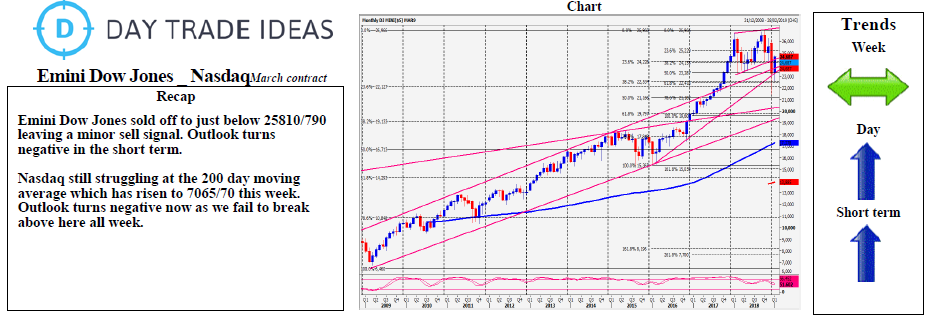

Emini Dow Jones outlook negative & a break below first support at 25810/790 targets 25745 then good support at 256670/660. Watch for a low for the day. Longs need stops below 25620. A break lower is another sell signal initially targeting 25540/530.

Bulls need a sustained break above 26000 to kill the negative signals. A break higher tests the December/February high at 26080/088. Above 26100 is a good buy signal & can target the November high at 26236/268. Nasdaq failure to beat 200 dma resistance at 7065/70 is a sell signal targeting 7033/30 & first support at 7010/05. On further losses look for 2nd support at 6980/76 & the best chance of a low for the day. Longs need stops below 6968.

The challenge for bulls is to beat 7090/95 before the close to target quite strong resistance at 7135/40. On further gains look for 7160/65 & 7190/95.