Pre-open market analysis of daily chart

Friday saw the E-mini finally break above the 4,000 Big Round Number, closing on its high above 4,000.

Previously, it went sideways for several days, to a couple of weeks, at every prior Big Round Number since 3,500. Traders are now expecting the E-mini to go sideways for at least a few days, but it could continue to rally for a week first. This is only the 4th multiple of 1,000 in the 100-year history of the S&P 500 so this is a rare event.

Last Thursday, E-mini gapped up, which means there was a small gap on the monthly chart. These usually close before the bar closes, and therefore the gap should close this month. If not, then it'll probably do so within a few months.

There were buy climaxes on daily, weekly, and monthly charts, but no top. Traders will continue to expect higher prices until there's a strong reversal down.

A streak of 6 consecutive bull bars on daily is unusual, and therefore unsustainable, and climactic. As such, there's an increased chance of a bear bar today or soon at lease. Over the past several weeks, most days have had at least one swing up, and one swing down, so that is likely today.

Since the market is at such an unusual Big Round Number, there's an increased chance of a surprisingly big move up or down. Remember, there are only three other data points (1,000, 2,000, and 3,000) in the history of the stock market, so there aren't enough to have an opinion about what will happen based on the multiple of 1,000 alone. But we're in a bull trend, so higher prices are likely.

Today will probably gap up on both the daily and weekly charts.

And since we're seeing an extreme buy climax on both charts, there's an increased chance of 2 or 3 sideways days. Bears will want gap down and island top. Bulls will want bull flag and resumption of a strong bull trend.

Overnight E-mini Globex trading on 5-minute chart

- Up 26 points in Globex market, so we'll have a big gap up today.

- Big gap increases the chance of a trend day in either direction.

- If there is a trend, up is more likely than down.

- If there is a series of strong trend bars up or down in the 1st hour, then there's an increased chance of a trend day.

- Most days have their trading range open for the 1st hour or two. That is most likely to happen today.

- Most days have at least one swing up and one swing down.

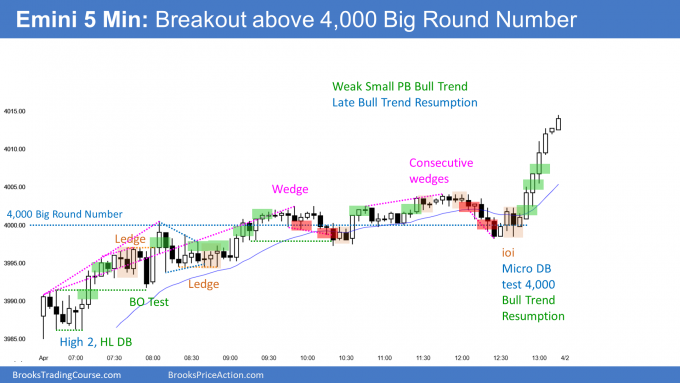

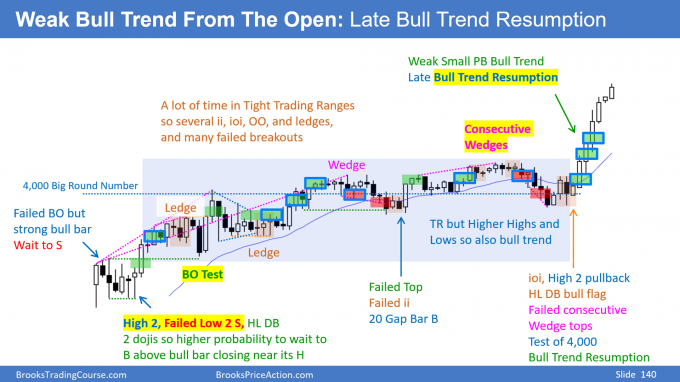

Thursday’s E-mini setups

Above is the version that I post every day. Because I often get questions about what readers to Daily Setups see, today I am including the example below of that version.

Here are several reasonable stop entry setups from last Thursday (pre-Good Friday holiday). I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro E-mini.