As the ultimate step in its strategic portfolio restructuring, Emerson Electric Co. (NYSE:EMR) inked a definitive agreement to divest its ClosetMaid business to Griffon Corporation for $260 million.

ClosetMaid, a leader in home organization and storage systems, currently comes under Emerson’s Commercial & Residential Solutions business, and has been a strong revenue driver for the company in the last few years.

Emerson anticipates the deal to conclude within 30 days, with minimal impact on net earnings and earnings per share. Roughly $180 million will be generated in after-tax cash proceeds from the divestment.

Portfolio Repositioning

Over the last two years, Emerson has been executing restructuring activities to reposition its portfolio, and fuel efficiency and growth. The company is following a strategic plan to transform itself into a leaner and more focused organization by offloading certain segments of the business.

In fiscal 2016, the company sold three of its businesses — Network Power, Leroy-Somer and Control Techniques — and generated $5.2 billion in proceeds. Notably, Network Power was sold to Platinum Equity for $4 billion. Post this transaction, Emerson retained a subordinated interest in Network Power. Similarly, Japan-based Nidec took over Leroy-Somer and Control Techniques businesses to Nidec Corporation for a purchase price of $1.2 billion.

These restructuring actions will enable Emerson to capitalize on its growth platforms. The company’s actions seem to have been received well by investors, as its shares have appreciated 13.4% in a year’s time, outperforming the industry average of 7.2%.

Acquisitions Galore

Emerson has been also active in the acquisition space, in order to expand its core business. In April, the company completed the acquisition of Pentair Valves & Controls — a business unit of Pentair plc — for $3.15 billion.Integrating Pentair’s Valves & Controls business will enable Emerson to fortify its automation portfolio and help it offer complete valve solutions portfolio and sturdy service network, thereby elevating the company’s brand value.The company is now aggressively working on integrating the Valves & Controls business. It expects the acquisition to be earnings accretive in fiscal 2018 and contribute meaningfully to operating cash flow.

Further, the company entered into an agreement to buy leading non-intrusive corrosion monitoring technologies provider — Permasense Limited. The Permasense buyout will fortify Emerson’s footprint in the integrity and corrosion management solutions business. It also expanded its global capabilities in fresh food monitoring, on the back of the Locus Traxx and PakSense buyouts. These two companies will assist Emerson in facilitating steady and safe control of food, and other temperature-sensitive goods.

During first-quarter fiscal 2017, the company acquired Blending & Transfer Systems business of FMC Technologies (NYSE:FTI) — a leading provider of systems for lubricant, grease, fuel and chemical blending applications — to fortify its presence in advanced flow measurement and control technologies. We believe these buyouts will help the company create a solid core business model and drive profitable growth, going forward.

Industry Trends & Impact on Emerson

Emerson’s process automation business has finally got over its recession, with orders turning positive in late 2016 and organic revenues growing. After the sale of a major chunk of this segment to Nidec Corporation, Emerson now generates more than 60% of its revenues from this segment. Improving industry trends bode well for this segment’s growth in the quarters to come. In fact, Automation Solutions platform reported an impressive 12% year-over-year growth in net sales in third-quarter fiscal 2017.

Going forward, ongoing recovery in oil and gas is likely to be the most significant profit driver for Emerson.

The company is enjoying broad-based growth, driven by favorable trends in energy-related, hybrid and general industrial markets, as well as strong demand in HVAC and refrigeration markets. Emerson expects increasingly favorable global market conditions and positive trends in capital spending, which will likely drive underlying sales growth across both platforms in the coming quarters.

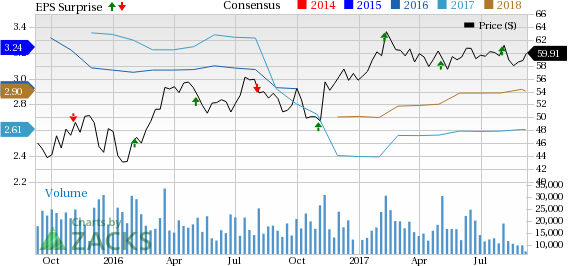

Emerson Electric Company Price, Consensus and EPS Surprise

Summing Up

In light of the recent optimistic order trends and recovering end markets, Emerson recently raised its outlook for fiscal 2017 for the third consecutive time. It now expects net sales for the year to grow about 5%,with underlying sales to be up about 1%. Further, backed by a strong operational performance, the company now projects earnings per share for fiscal 2017 to be in the range of $2.58-$2.62 (earlier guidance: $2.50-$2.60).

Emerson expects Automation Solutions net sales to be up 4-5% (earlier projection: down 3-4%), while Commercial & Residential Solutions net sales are anticipated to be up 5-6% (in line with earlier projections).

Solid order trends, successful multi-year restructuring initiatives, and momentum in both its platforms will likely prove accretive for the company’s sales. However, a strong U.S. dollar, volatile industrial spending, and uncertainties in emerging and mature economies remain concerns for this Zacks Rank #3 (Hold) company.

Stocks to Consider

Some better-ranked stocks in the broader space include Barnes Group Inc. (NYSE:B) , IDEX Corporation (NYSE:IEX) andRBC Bearings Incorporated (NASDAQ:ROLL) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Barnes Group has a solid earnings surprise history for the trailing four quarters, having beaten estimates each time for an average of 11.6%.

IDEXalso has a decent earnings surprise history, with an average beat of 4% over the trailing four quarters, beating estimates thrice.

RBC Bearings generated an average positive surprise of 4.7% over the trailing four quarters, beating estimates all through.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Emerson Electric Company (EMR): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

IDEX Corporation (IEX): Free Stock Analysis Report

RBC Bearings Incorporated (ROLL): Free Stock Analysis Report

Original post

Zacks Investment Research