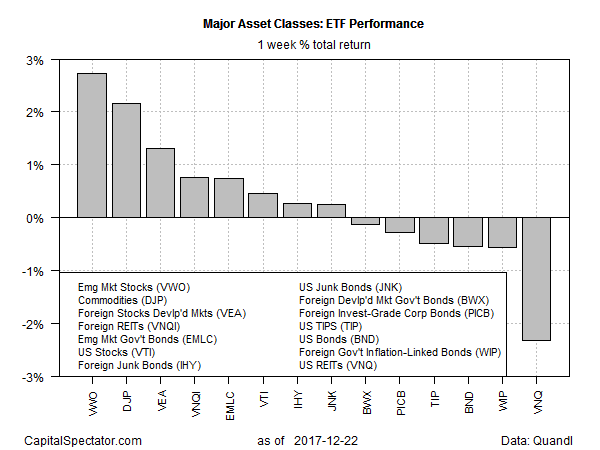

Stocks in emerging markets head into the final week of trading for 2017 with a bullish tailwind. Rising for a third week in a row, equities in this corner posted the strongest gain among the major asset classes for the five trading days through Dec. 22, based on a set of exchange-traded products.

Vanguard FTSE Emerging Markets (NYSE:VWO) rose 2.7% last week, lifting the ETF to just below its highest level of the year.

The Wall Street Journal reports that “net capital inflows in emerging markets are at their highest in two years.” Meanwhile, “ JPMorgan forecasts growth across emerging countries to reach 4.8% for the year, mostly driven by domestic demand. The asset class seems better placed to withstand rising US interest rates than at the time of its last major selloff in 2013, the so-called ‘taper tantrum.’ ”

Last week’s bottom performer: US real estate investment trusts (REITs). Vanguard REIT (NYSE:VNQ) fell 2.3%, the ETF’s biggest weekly setback since September.

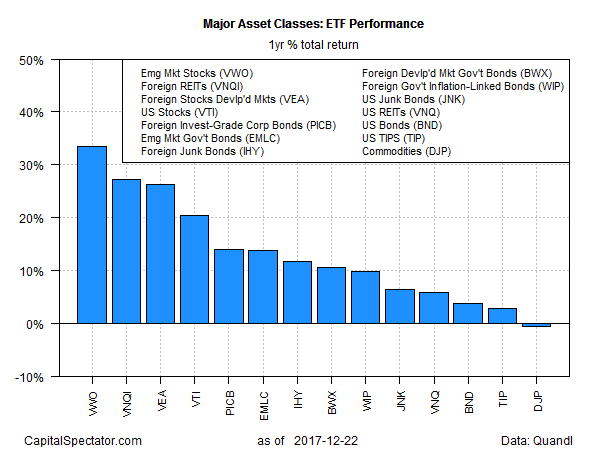

For the one-year trend, emerging markets stocks are the top performer as well. VWO is up a strong 33.5% on a total-return basis for the year through Dec. 22.

Meantime, commodities remain the weakest performer for the major asset classes in the one-year column.iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) is down 0.5% for the 12 months through last week’s close.