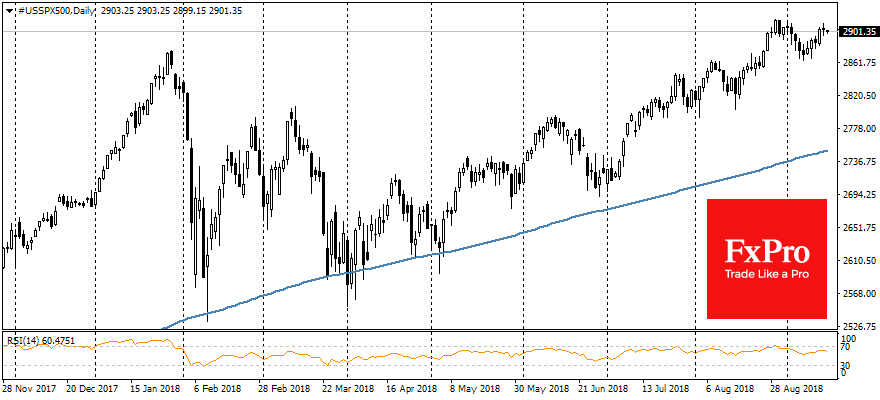

Asian markets have turned to a decline with a renewed force. After the rebound of last week, the index iShares MSCI AC Asia ex Japan (HK:3010) loses 1.2% and is only 1.5% above the 14-month lows. Futures for S&P 500 have returned to 2900 area, lost 0.4% from Friday’s intraday highs. The pressure on the markets increased after reports that the U.S. intended to announce the introduction of tariffs for the U.S. goods up to 200 billion as early as on Monday. China threatens to abandon the negotiations announced last week, in case of new tariffs.

We have previously warned that the current recovery of markets is nothing more than a correction rebound after a strong oversold. Both China and the United States are difficult negotiators, and earlier this year there have already been a number of negotiations, which have not resulted in any breakthrough.

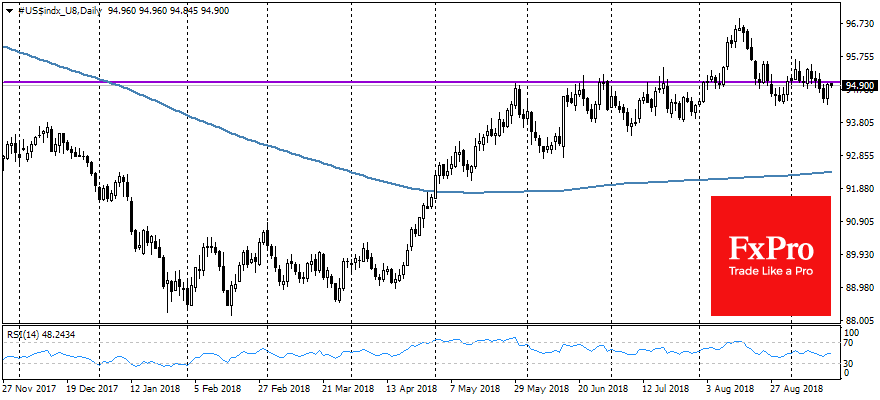

In addition to the renewed concern about a foreign trade, the strengthening of the American currency reinforces pressure on the emerging markets. The dollar rose on Friday after the start of active trading session in America. The dollar manages to hold its positions on the start of a new week on demand for it as a protective asset. The dollar index adds 0.6% to Friday’s lows and is near 94.90, one step away from the important resistance at 95.0. EUR/USD once again were unable to sustain in the area above 1.1700, and trades at 1.1630 now.

The dollar is adding in spite of the weak data on retail sales, which added 0.1% in August against expected 0.4%. In addition, it is worth paying attention to the sharp (by 0.6%) drop in import prices, which has become another confirmation (after a weak CPI and PPI) of not as serious inflationary pressure as analysts have feared. Despite this, the markets are still ignoring the weak inflation rates, bowing to the fact that a sharp increase in wages in the nearest future will cause a rise in prices.