Emerging markets equities have lagged in 2018 and throughout most of the last decade. Recent fund outflows have been extreme. Fund managers are underweight the region. Their currencies and commodities are not liked. The region is now "cheap" and it might be ready to outperform.

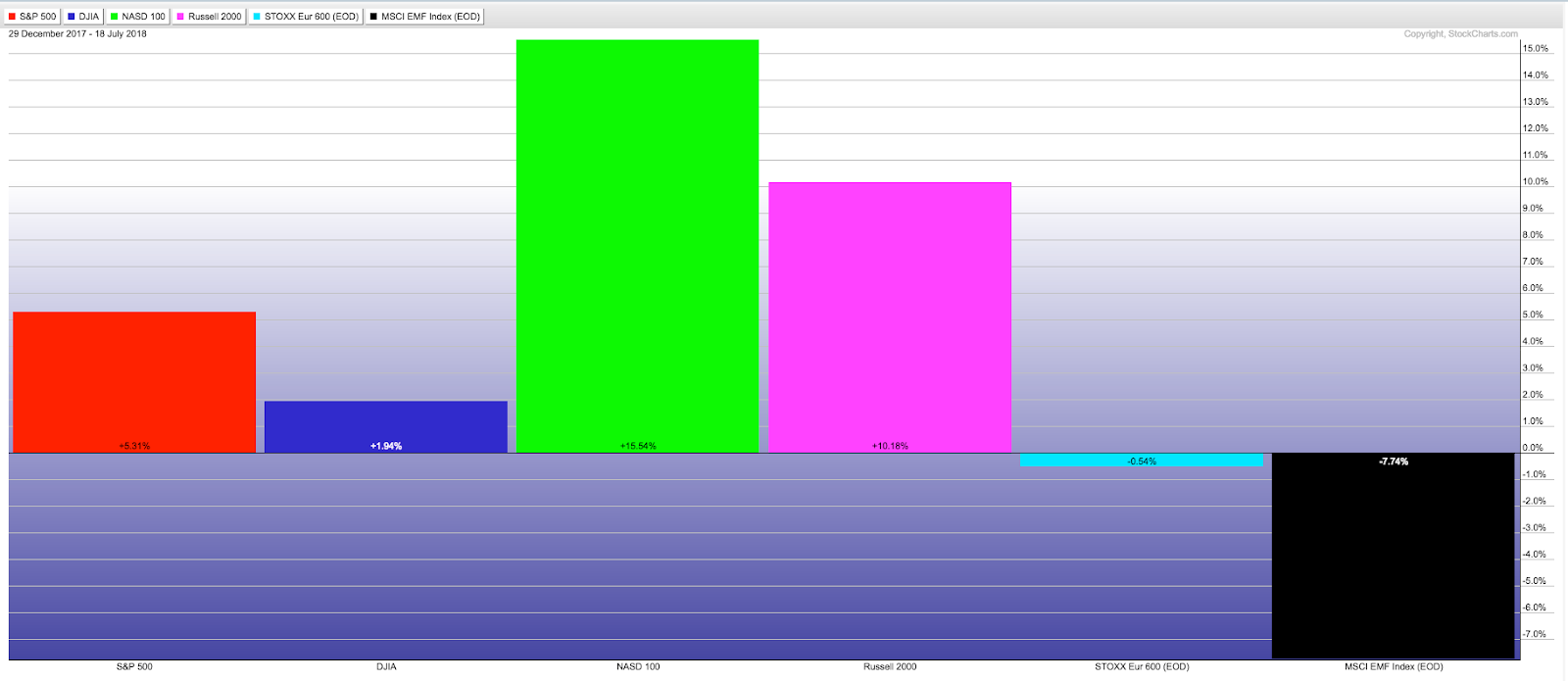

2018 has been a tough year for emerging market equities. The index is down nearly 8% while the S&P 500 is up more than 5% and US small caps are up 10%. Enlarge any chart by clicking on it.

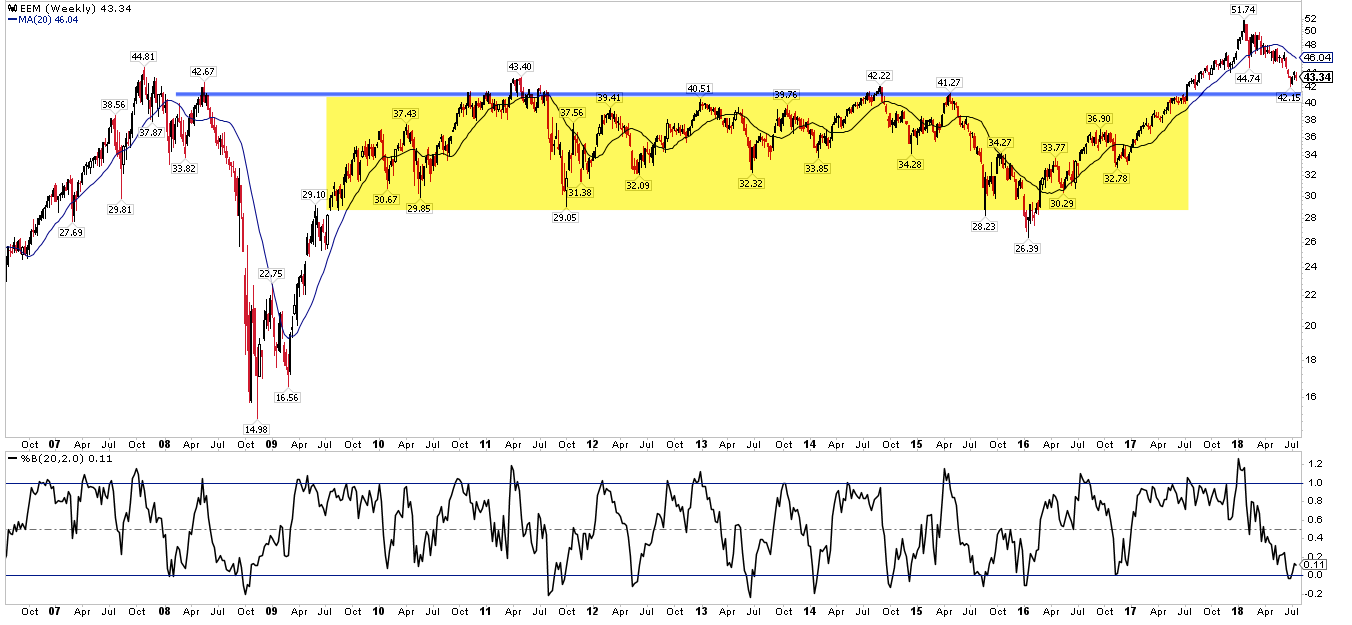

Actually, this chart understates how bad it's been for EMs lately. The index peaked 7 years ago, in 2011. While the rest of the world has been pushing above their highs from 2007, EMs have not. The index has twice fallen 30% in the past several years (circles). From its January high, the EM index is down 17%, close to another bear market.

This is in marked contrast the global equity bull market a decade ago, in which EM equities easily and substantially outperformed the US, Europe and Japan. This period coincided with economic emergence of China, India, Brazil and others. Jim O'Neill, chair for GSAM, coined the term BRIC in 2001 to signify the looming importance of this hugely populated and under-developed region.

There are a few reasons to suspect the fortunes for EM equities may be nearing at least a short term reversal.

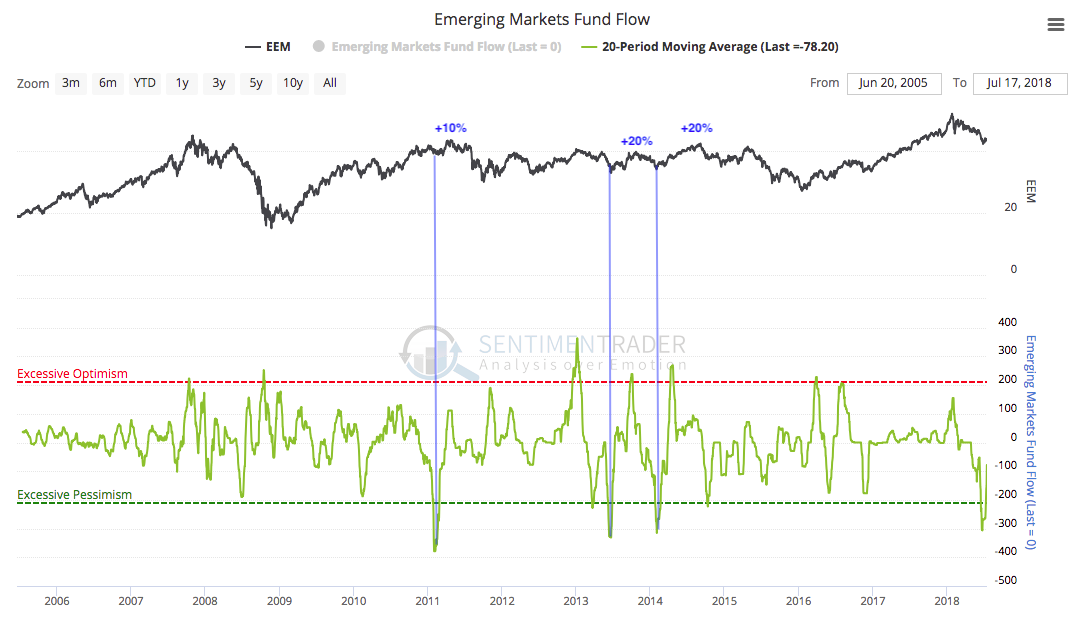

First, the region's poor performance has led to an exodus of foreign investors. Fund outflows over the past month reached an extreme equalled only three other times, in 2011, 2013 and 2014. After each of these, EM equities rose 10-20% in the following months (from Sentimentrader).

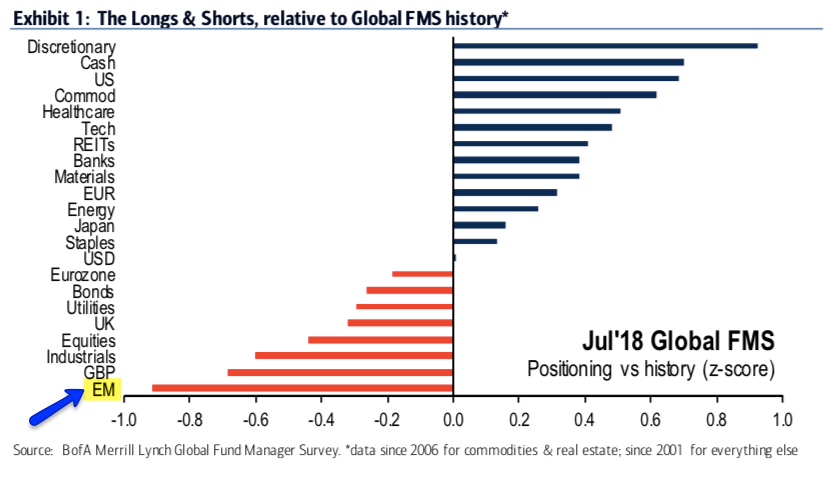

Similarly, fund managers surveyed by BAML now view EM equities as their least favorite asset class (relative to history).

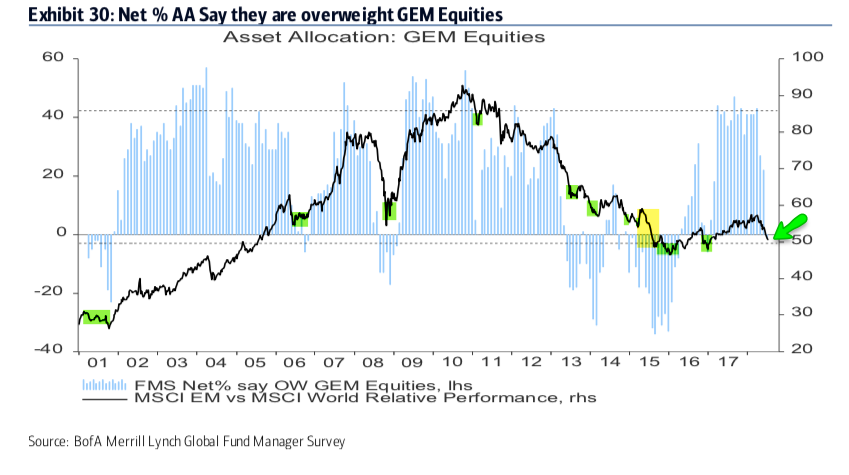

Fund managers' allocation to EM equities fell to 1% underweight this month, the lowest since January 2017 (and -0.9 standard deviations below its long term mean). This has typically preceded at least a short term period of outperformance for the region (green shading). Clearly, these allocations can fall much further; funds were 33% underweight in January 2016, for example (yellow shading). It's a modest contrarian long now, but if the region's equities fall much further, it will likely become an extreme.

Widening credit spreads also reflect heightened fear within EM economies, brought about by continuing trade war rhetoric. Those spreads are at a 1-1/2 year wide, although they were much wider during the oil crash in 2015-16 (from theatlasinvestor.com).

Second, EM equities have a strong tendency to trade inversely to the US dollar: as the dollar strengthens (black line; inverted), EM equities (red line) tend to underperform.

That's especially true on a relative-performance basis (red line is EM relative to the S&P 500; black line is the inverted dollar).

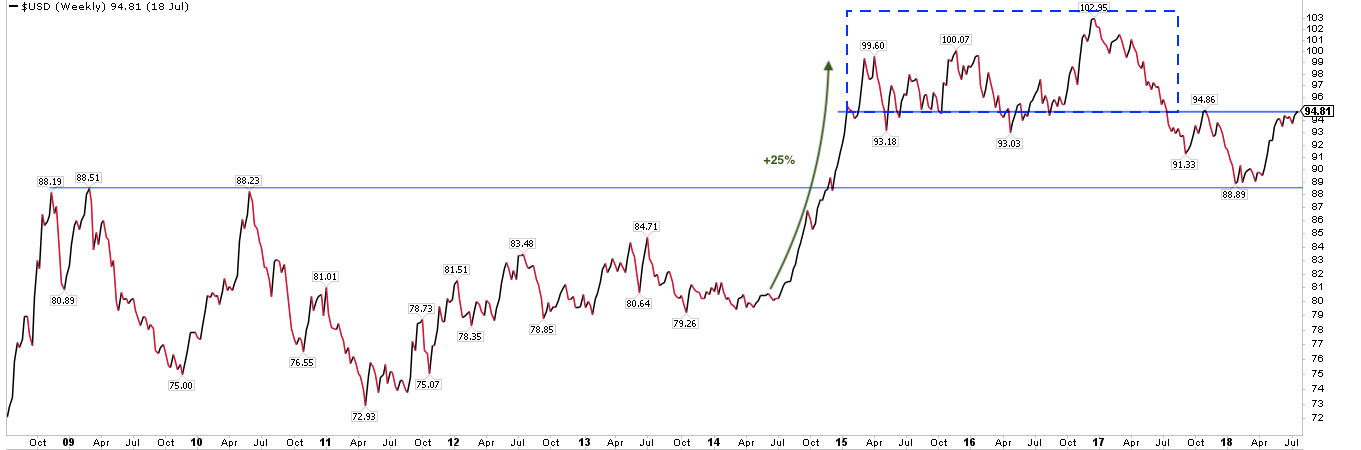

EM equities were hard hit when the dollar appreciated 25% in 2014-15. The dollar then treaded sideways for the next 2-1/2 years before falling in 2017. EM equities gained more than 50% in 2017 as the dollar dropped, an indication of just how important this relationship can be.

Was 2017 the dollar's top? The dollar is now at a key level; higher suggests it will reenter the range from 2015-17 again. This would likely be quite negative for EM equities.

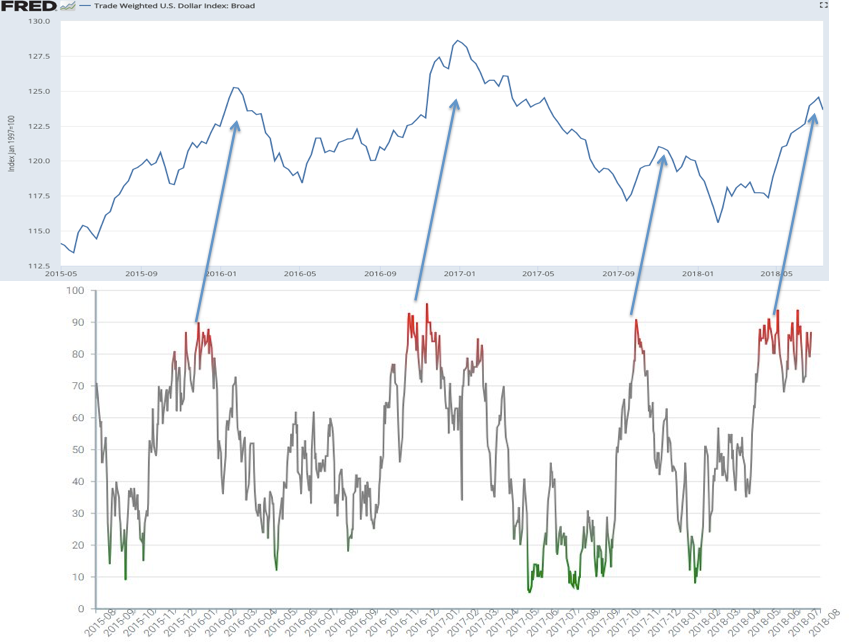

One reason to suspect the dollar might fail at resistance is that dollar sentiment is very bullish (bottom panel). It's not an exact fit, but the dollar has weakened, with a lag, when sentiment has been this bullish over the past 3 years (DSI data from Thomas Thornton).

Moreover, EM currencies are now "undervalued," suggesting that they might be set to appreciate. This has been a significant tailwind for EM equities (arrows; data from Bloomberg).

EM equities are also correlated to commodities, especially industrial metals like copper (black line) which are produced and consumed in this region.

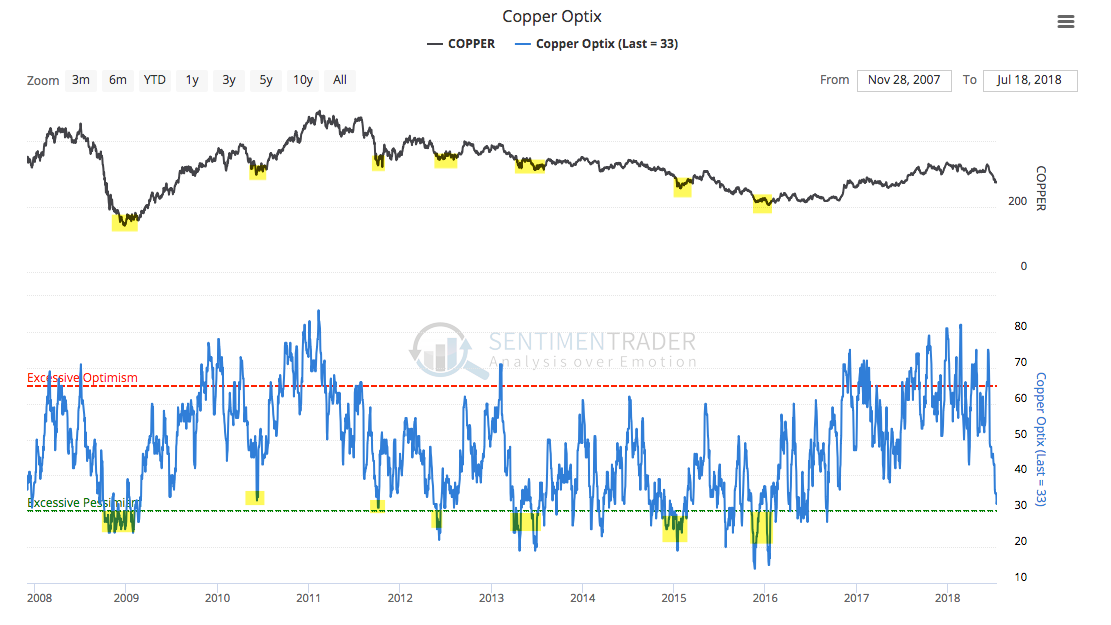

Copper sentiment is also reaching a bearish extreme. That has often been a positive, except when the dollar is rallying hard like in 2014-15 (from Sentimentrader).

Finally, EM equities' valuation is now considered relatively cheap; their P/E discount to US stocks is the largest in 16 years, equalling the lows in 2004, 2008 and 2014. The index rallied at least short term each time (from the WSJ).

EEM (daily) is trading under a declining 50-d (blue line). This has been key resistance in downtrends (red arrows) and support in uptrends (green arrows). The index is 2% above a late June low. Technically, the index is downtrending until it can regain that 50-d, and the 50-d starts to slope higher.

Optimistically, that June low was a backtest of the last 7 year's trading range (yellow). So long as that low holds (blue line at ~$41), the last year qualifies as a "breakout" after a long consolidation. Below that level, the odds suggest a failure is more likely.

In summary, emerging markets equities have lagged in 2018 and throughout most of the last decade. Recent fund outflows have been extreme. Fund managers are underweight the region. Their currencies and commodities are not liked. The region is now "cheap" and it might be ready to outperform.

If you find this post to be valuable, consider visiting a few of our sponsors who have offers that might be relevant to you.