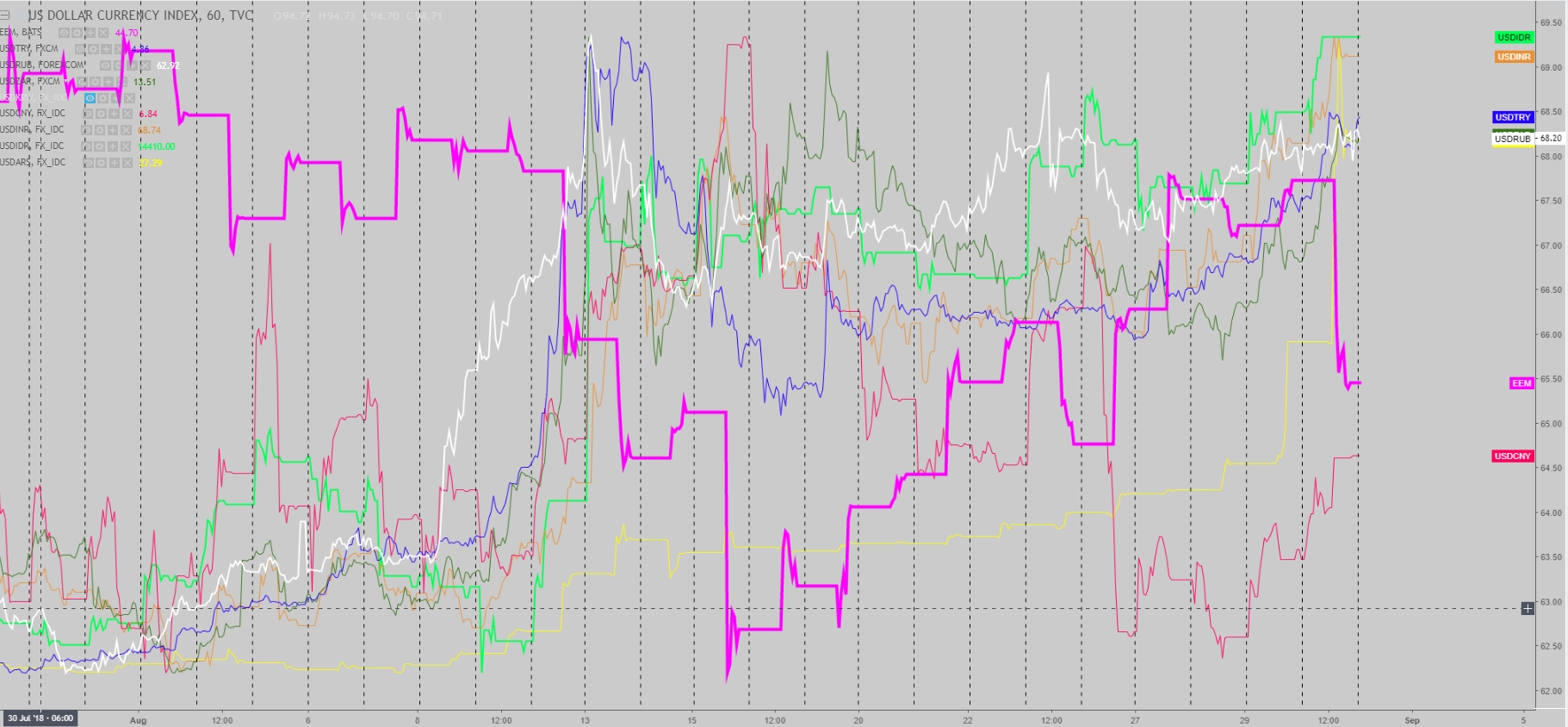

As we come to the end of August and roll on to a new month of trading, the picture in capital markets is not looking as rosy as in the prior 2 weeks, with risk aversion returning to the market, as emerging market currencies implode once again. While in other circumstances the Argentinian peso wouldn’t be taking the spotlight, that’s how relevant emerging markets have become,and the South American currency embodies like no other the loss of confidence by investors, down as much as 20% at one stage on Thursday, which led to an unsuccessful intervention by Argentinian authorities (sold $330m) and the IMF agreeing to revise its bailout terms to assist the battered country’s economy.

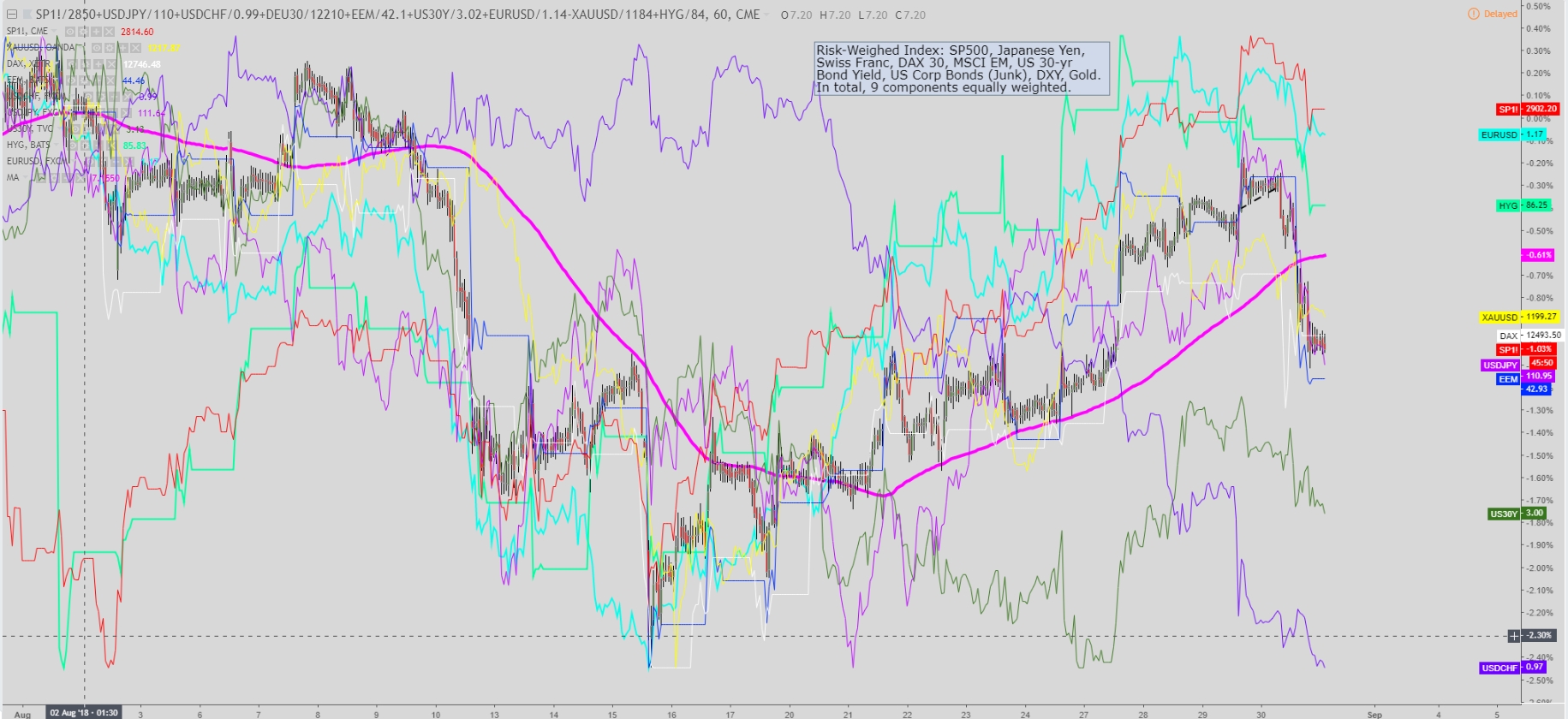

The deterioration in the value of emerging market currencies, including a troubled Turkish lira, was not immune to the S&P 500 this time,although the moderate 10bp decline should be seen as a victory judging by the performance of the Yen or EMs. The MSCI EM index, after a meritorious 2-week recovery, also suffered the consequences by falling from 44.09 to 42.92, erasing the latest 4 days of gains. Demand for US bonds was significant across the board, with 30-Year Treasury yields down 3bp from this week’s peak, currently at 3.01%. Meanwhile, US corporate credit (junk bonds) followed suit and sold off as investors run to safer assets, while we saw further evidence of the decoupling of gold as a safe-haven vehicle, unable to find enough buyers to keep the $1,200.00 even on such fractious ‘risk-off’ environment in emerging markets.

This negative backdrop in EM led to a deleveraging of risk, and capital flocked off back into the Yen and to a lesser extent the Swiss Franc, which nonetheless, continues to prove the best performing store of value this August. It’s also worth noting that the US Dollar, while stronger against the weakest currencies such as the AUD, NZD, is finding it harder to exploit the renewal of risk aversion as it did back in August. One of the reasons, as explained in a previous report, is a potentially fundamental shift in the US yield curve, suggesting a significant slowdown in capital inflows into the US.

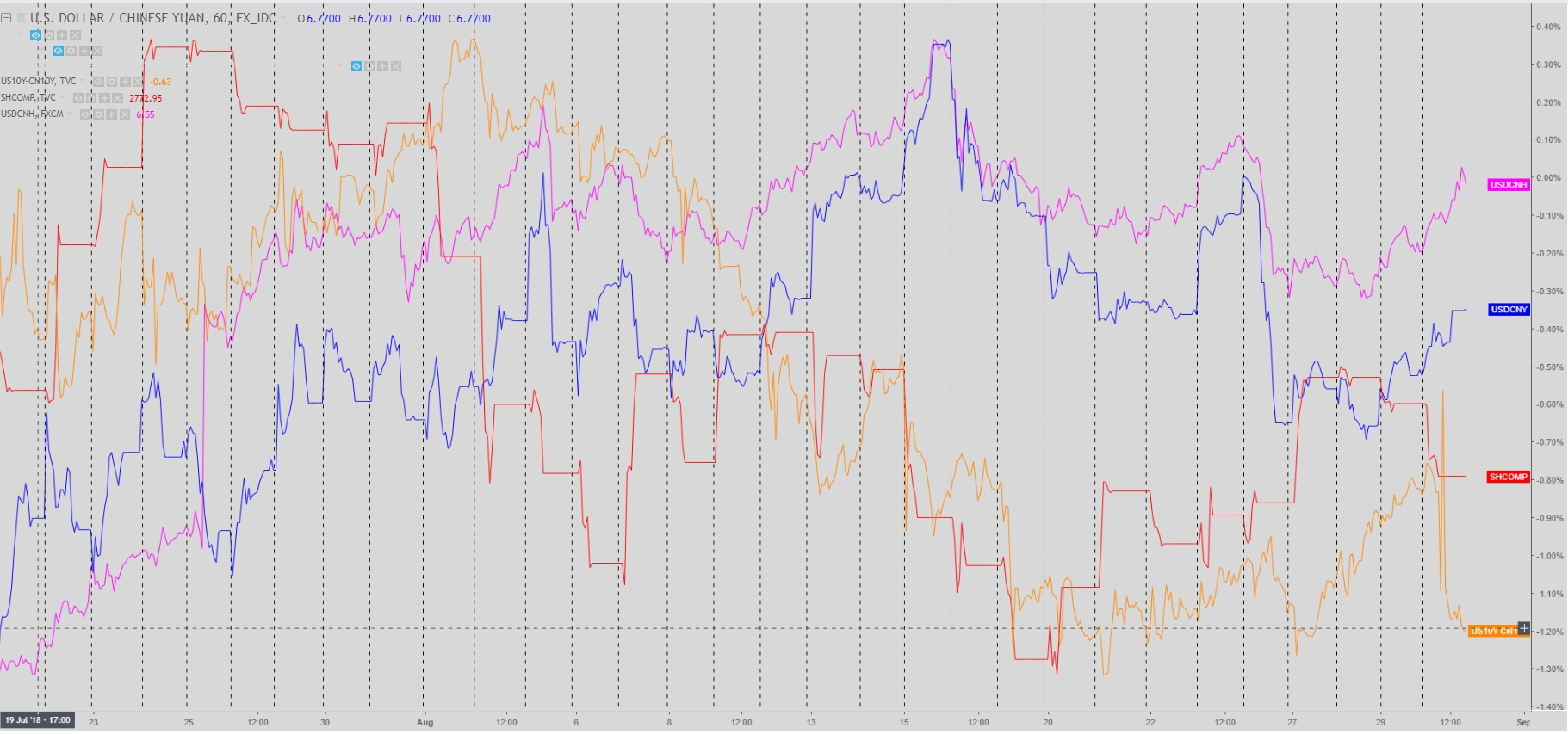

Even as the risk off swing had already been in motion, one key driver anchoring the sell-off was no other (no surprise here) than US President Trump, who succinctly fired back to the Chinese by threatening to impose the pending $200b worth of tariffs on Chinese goods as early as next week. Markets had been clinging to certain glimmers of hope that the introduction of further punitive measures towards China might be delayed all the way up to late Oct.

It’s hard to tell how much of a strategic move to build pressure on China these comments are. Understandably, it led to a reignition of uncertainty, despite in the grand scheme of things, the moves were underwhelming and it feels as though, if this story evolves, it could really put a more long-lasting dent in the appetite of investors to bid risk, as it would confirm the dreaded ‘full-blown’ trade war crisis and a major step backward in globalization, leaving many unpredictable outcomes up in the air, such as to what extent will this affect the USD going forward? Will the Chinese economy slowdown and send shockwaves to the wider Asian region?

One of the risks that appear to have been removed is the relative stability investors should expect in the value of the Chinese Yuan after the reintroduction of counter-cyclical measures by the PBOC, which means that disorderly moves are not anticipated. Today, USD/CNY and the offshore CNH rate, are trading at 6.84 and 6.86 respectively, with the Chinese PMI as a key focus.

Amid such foggy global environment, and with economic data still coming to the soft side, the Australian and New Zealand Dollar were both punished, finding consistent supply. When it comes to the Aussie, on top of Westpac’s mortgage rate hike decision on Wed (more dovish RBA), a disappointing set of data including Aus Q2 capex and building approvals, sent a reminder of the jitters surrounding the economic outlook and housing; add a weaker Chinese Yuan, and the Aussie was thrown all the ingredients to go through some pain. Similarly, the Kiwi had to endure mounting selling pressure too, mainly on a depressed ANZ business confidence survey, which fell to -50.3 from -44.9 prior, and makes the reading the lowest since the GFC a decade ago.

Turning to the Euro, while soft, it’s definitely finding a lot more buying interest in this current risk-off environment than what we saw in the first episode of risk aversion in early August. The EUR/USD doesn’t trade far from 1.17, last at 1.1670. It might have to do with an overall weaker outlook on the USD in light of a possible slowdown in capital flows, implicit upward pressure applied via an, up until recently, overly long USD market, caught wrong-footed, or even fewer worries that the Turkish crisis may set out a wave of contagion across European banks, now that it’s been reported that some financial assistance is being considered via Germany or others. Fundamentally, as we move into Sept, there will be many moving pieces affecting the Euro, and as a taste of the many inputs to consider, on Thursday we learned that the EU is ready to scrap car tariffs in a trade deal with the US, which would have been positive and still may be, despite Trump threw cold water by blustering that is not enough and adding that the problem on trade with Europe is as bad as with China, but of a smaller magnitude. Scoping out the latest German preliminary CPI for August, the headline came around expectations at 0.1% and should be overall comforting for the ECB going forward.

Two other currencies receiving plenty of attention as of late include the British Pound and the Canadian Dollar, each having to deal with its own drivers, far from being water that can pass under the bridge. UK’s currency, which saw one of the largest gains this year on Wed, failed to find follow through, as the conundrum of Brexit headline risks keep capital flows into the GBP largely on hold for now. If on Wednesday Brexiters were blaring the trumpets on the optimistic comments by EU’s Brexit negotiator Barnier, who surprisingly said “we are prepared to offer a partnership with Britain such as has never been with any other country”, it only took 24h for the wave of excitement to moderate, after Barnier told a German radio that “we must be prepared for any and all options on Brexit”, adding that a no-deal is part of the planning considered. GBP/USD exchanges hands anchored around the 1.30 level. On the other side of the pond, the Canadian Dollar was buffeted by a lower-than-expected Canadian Q2 GDP release, which should not move the needle on a hawkish BoC. The downward pressure seen on the Canadian Dollar, not only reflected the miss in data but the uncertainty surrounding the NAFTA talks, although by assessing the latest headlines, it points towards an eventual deal judging the constructive comments so far.

Looking ahead, the attention for Friday will turn into the Chinese PMI figures as a critical measure to keep track on the economic outlook for China, with the escalation of the trade war with the US posing risks to economic activity. In Europe, German retail sales and EU CPI flash estimates will center stage too, while in the US, the Chicago PMI is due. Remember, this is the last day of August, and from next week, the economic calendar will start heating up, which adds to a quite volatile risk environment, with plenty of moving pieces, from emerging markets, Brexit, NAFTA talks, Chinese vs US trade war, expect Italy to get more airtime, North Korea… the plate is full.