Holy MOSES, what a boring Friday! As I write, the ES is up .12% and the NQ is down .12%. Average ’em out, and you get a Saturday trading session. So I’ll just put up the good ol’ TLT chart, which is utterly core to my options portfolio (two positions – TLT and XLU January 2019 puts).

As shown below, it broken its trendline ages ago, and it’s about 90% done with what could be (if complete) one of the greatest topping patterns ever.

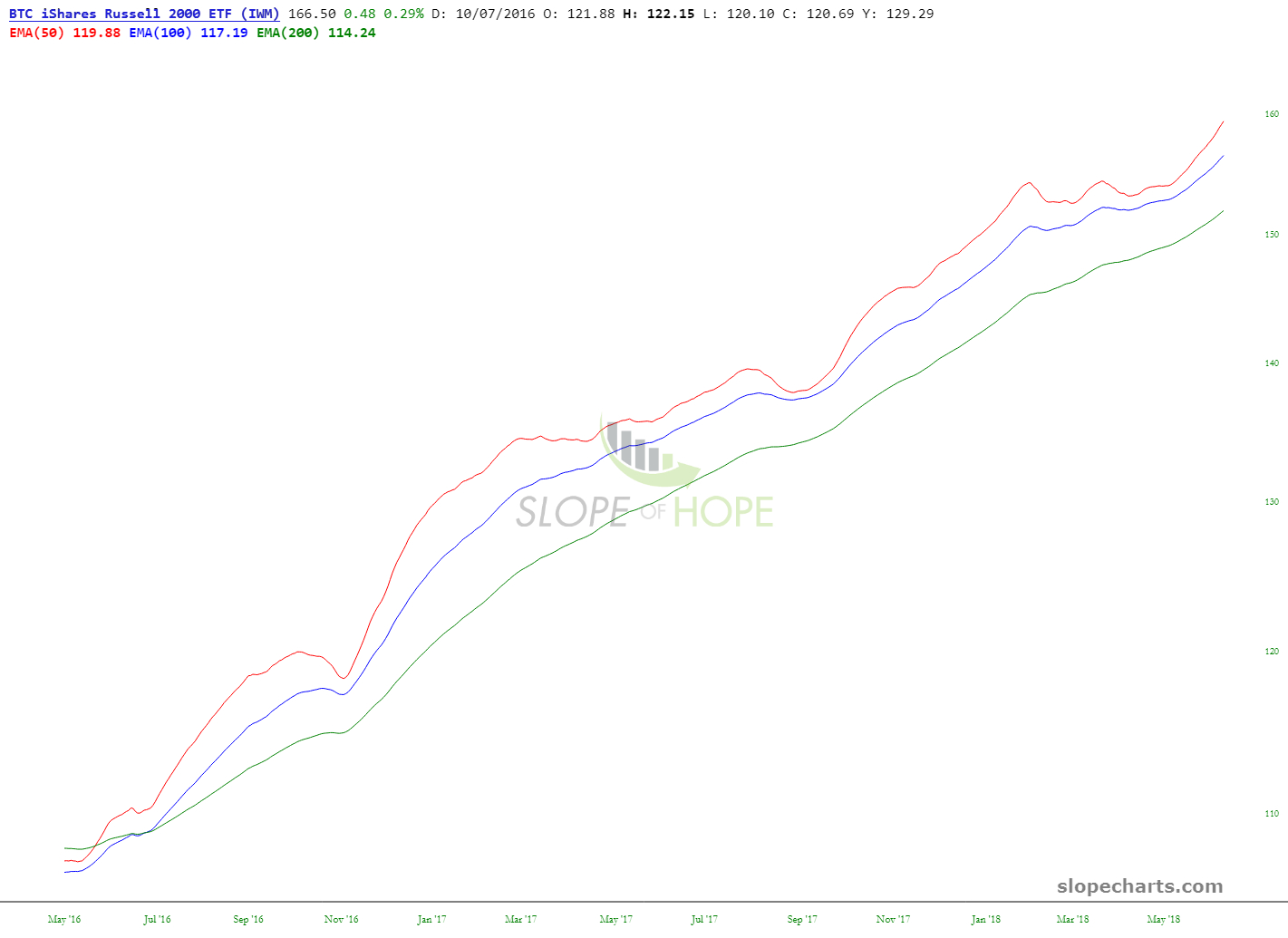

Stripping away the price data and drawn objects, you can see the trio of moving averages slowly pivot lower. The market could still be “saved,” of course, as it has before, but I am optimistic we’re at a major pivot point.

In sharp contrast to, oh, say, the Russell 2000 small caps!