Investing.com’s stocks of the week

"Politics is not a game. It is an earnest business." - Winston Churchill

As the sun rises on a new trading week, emerging market currencies are proving the inimitable Winston Churchill’s wisdom once again. Over the weekend, there were two key election in emerging markets that had a major impact on EM FX traders.

First, in Brazil, incumbent President Dilma Rousseff narrowly won a run-off election against pro-business challenger Aecio Neves. A few weeks ago, when Neves came storming on to the scene with a strong showing in the original election, Brazilian assets rose on hopes that a new president may reform the structural issues with Brazil’s economy, including weak growth, high inflation and growing debt. Unfortunately for Brazil bulls, the win by Rousseff has dashed these hopes, and both Brazilian equities and the real are falling sharply today.

Meanwhile, fully 10,000km (6640 miles) away, the preliminary results from Ukraine’s parliamentary elections suggest the pro-Western parties led by President Petro Poroshenko and Prime Minister Arseniy Yatsenyuk the will win when the final votes are counted on Thursday. While this is seen as a win for Europe, the implications for the ongoing conflict in Eastern Ukraine is less clear; indeed, the growth in support for Yatsenyuk’s People’s Front party may delay any resolution with Russia, as the anti-Russian Yatsenyuk is unlikely to entertain any sort of negotiated peace resolution.

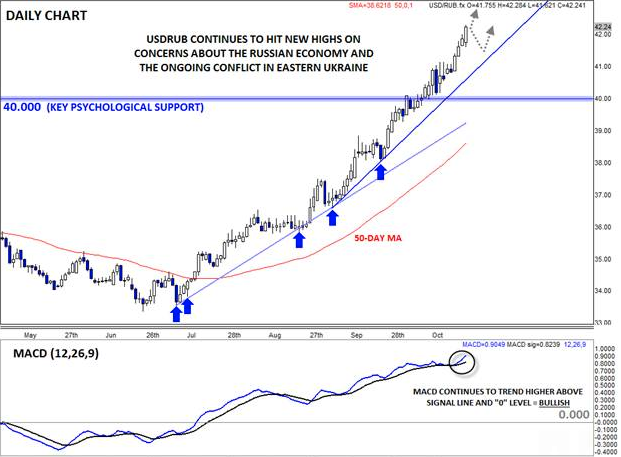

Ruble traders are taking a dour outlook on the election, with Russia’s currency falling to a new (you guessed it) all-time low against the US dollar today at 42.00. As we noted last week, as long as the pair remains above its accelerated bullish trend line and key psychological support at 40.00, higher prices will be favored in the near term.

Source: FOREX.com

Beyond the fallout from these elections, the biggest event for EM FX as a whole will be Wednesday’s Federal Reserve meeting. The Fed appears likely to taper the last $15B in monthly asset purchases in its meeting, though some analysts are suggesting they might hold off after a series of weak economic reports. Many emerging market currencies, prominently including the so-called “Fragile Five” economies with high current account deficits, are reliant on continued money printing from the Fed, so a decision to taper the last of QE could increase selling pressure on popular EM currencies like the Turkish lira and South African rand.

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom).