Market Brief

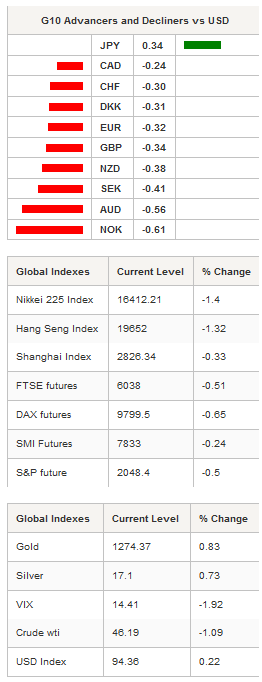

Risk appetite disappeared in the Asian session as traders moved into safe haven positioning. Regional Asian equity indices were red across the board. The Nikkei lead the decliners, falling -1.34% as the JPY was stronger in the G10. The yen rallied, despite BoJ Governor Kuroda's reiteration that the central bank will not hesitate to ease more if needed and that economic risks were tilted to the downside. US short-end yields shifted higher providing the USD with an interest-rate advantage. Gold found solid demand rising $10 to $1274. Asian FX was weaker with the USD/CNY fixing rising to 6.5219, while the KRW fell despite the BoK holding monetary policy steady at 1.50%.

We advise to avoid chasing the CNY lower as fixing has become steadily unpredictable. In the Philippines, following the historic presidential elections, Bangko Sentral ng Pilipinas held its policy rate unchanged at 4.00% as the bank remains comfortable with growth momentum and unlikely risk, unsettling the market during the tentative political cycle. India’s macro data disappointed as CPI surged to 5.4% in April from 4.83%, key factor coming from food inflation. India’s industrial production collapsed to 0.1% in March from 2.0%. Elsewhere in EM, Brazil’s senate voted 55-22 to start impeachment procedures against President Dilma Rousseff. BRL was slightly weaker on the news, with USD/BRL rallying 1.00% to 3.4830. Overall, there is limited evidence that the current pullback in risk taking is anything more than short-term volatility caused by the broad spectrum of events over the last 24hrs.

Yesterday's BoE trifecta provided plenty of information to digest. BoE outlook was decidedly less dovish then the market had anticipated. However, that did not translate into GBP buying as incoming economic data has been weak and political uncertainty looms large. There were no votes for additional policy easing and inflation forecast were not revised lower. Carney could slightly move anti-Brexit than we initially thought, keeping the central assumption that the UK stays within the EU and not bothering with axillary forecasts. Across the water, Germany’s Schaeuble stated that should the UK vote to leave the EU there would be no renegotiation, adding that there was a future for the EU without the UK. We remain bearish on the GBP, expecting any positive short term developments to run quickly into supply. GBP/USD short-term target remains 100d MA at 1.4355.

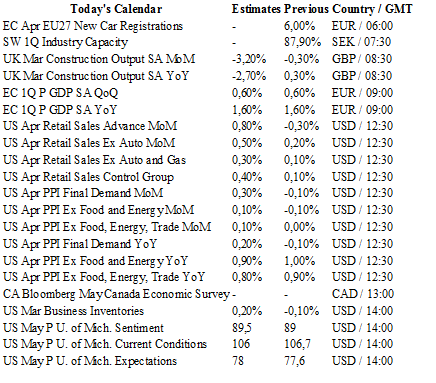

On Thursday, Boston Fed President Rosengren, generally viewed as dovish, stated that the probability of a rate hike this year is greater than markets expect. We agree with his outlook and expect a single rate hike in November or December. Markets will be focused on retail sales as a barometer for how the consumer is holding up as other economic indications have disappointed and have implications for GDP. San Francisco Fed President Williams is scheduled to speak later and the University of Michigan index of consumer sentiment will be released to close the week.

In the European session traders will be focused on EU GDP.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1396

S 1: 1.1217

S 2: 1.1144

GBP/USD

R 2: 1.4959

R 1: 1.4668

CURRENT: 1.4643

S 1: 1.4300

S 2: 1.4132

USD/JPY

R 2: 112.68

R 1: 111.91

CURRENT: 106.94

S 1: 105.23

S 2: 100.78

USD/CHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9621

S 1: 0.9476

S 2: 0.9259