Market Brief

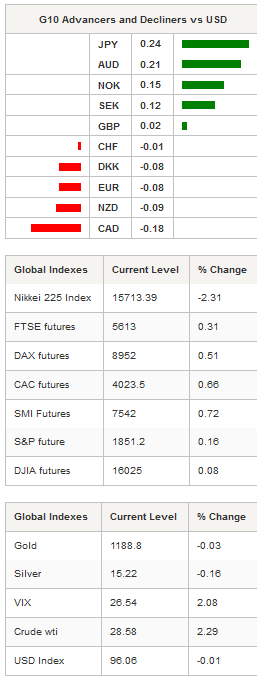

Yesterday was another rough day for global equities; especially European ones as Wall Street attempted a recovery rally in the late session but was only able to limit the losses as the same story of fears about China growth outlook, slowing global economy and persistently low crude oil prices continue to weigh heavily on the investors’ mood. In Japan, the Nikkei 225 fell 2.31%, while the broader Topix index slid 3.02%. In Singapore the STI slipped 2.14%, while in Australia and New Zealand equities were down 1.17% and 0.85% respectively. China's markets are still closed for the Lunar New Year holidays.

In the FX market, the Australian dollar was able to consolidate yesterday’s gains and is currently testing the next resistance, which lies at $0.71. AUD/USD up 0.21% in Sydney. The Japanese yen gained the most versus the dollar against the backdrop of renewed risk-off sentiment. USD/JPY broke the strong support at 115.57 (low from December 16, 2014) and is currently consolidating slightly below at around 114.90. The Japanese 10-Year treasury yield traded shortly in negative territory, and reached -0.08%, before stabilising above the neutral mark.

This week's economic calendar is a light one and traders will be focussed on today’s speech from Janet Yellen before the US congress. For now, the market is pricing in no rate hike for 2016. However, the market is known for having a short-sighted view and has the bad habit to overreact to short-term events. During her speech, Janet Yellen will likely put the emphasis on the continuous improvement in the job market and more specifically on the strong pick-up in wage growth. EUR/USD stabilised during the Asian session and is now trading above the 1.1250 threshold at around 1.1280. Given the arguments presented above, we believe that the risk remains on the upside for the greenback as Yellen will likely try to place emphasis on the few bright spots of the US economy (job market and slight improvement in wage inflation) rather than on the amount of slack in the rest of the economy.

Emerging market currencies are broadly trading higher this morning as yesterday’s strong risk-off sentiment eased. The South African rand rose 0.85% against the US dollar, with USD/ZAR back below the 16.0 mark at around 15.9350. The Russian ruble also took advantage of this respite and gained 0.65% versus the greenback, which helped USD/RUB to edge lower to 79.10. Asian pairs also benefited from this environment as the South Korean won rose 0.74%, the Taiwanese dollar edged up 0.60%, while the Indian rupiah climbed 1.05%.

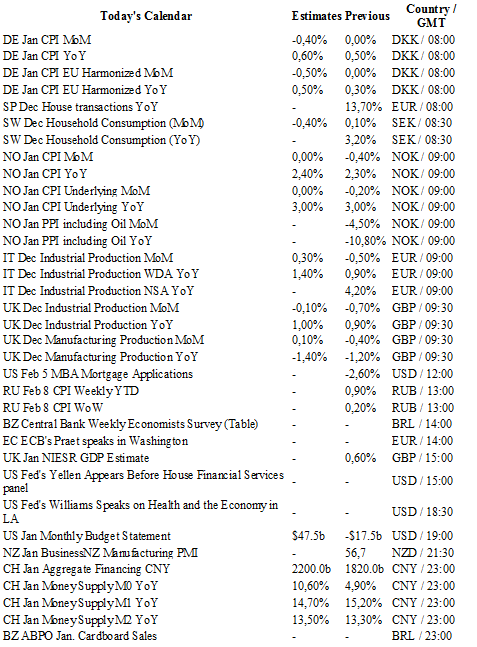

Today traders will be watching Janet Yellen’s testimony before the US congress, MBA mortgage application, budget statement; industrial and manufacturing production from France and the UK; CPI from Denmark and Norway; industrial production from Italy.

Currency Tech

EUR/USD

R 2: 1.1495

R 1: 1.1387

CURRENT: 1.1293

S 1: 1.0711

S 2: 1.0524

GBP/USD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4494

S 1: 1.4081

S 2: 1.3657

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 114.56

S 1: 105.23

S 2: 100.78

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9724

S 1: 0.9476

S 2: 0.9072