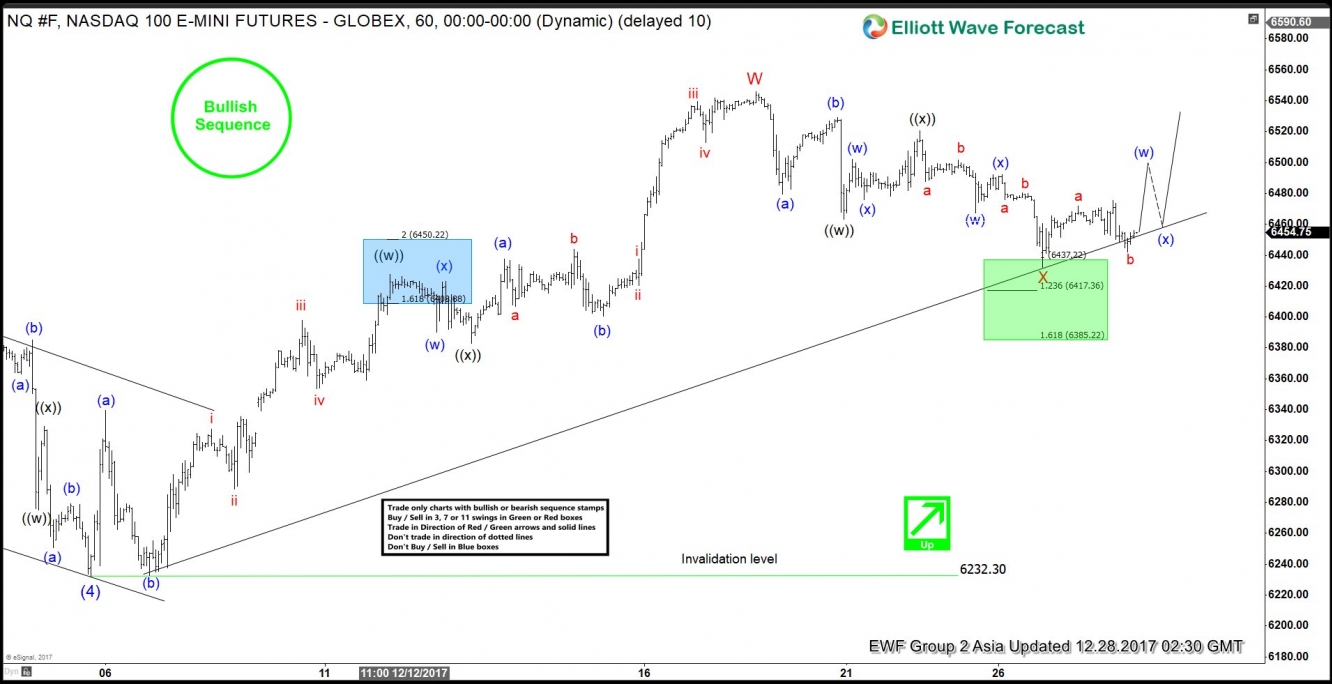

NASDAQ Short Term Elliott Wave view suggests that Intermediate wave (4) ended at 6232.3. Since then, Nasdaq has resumed the rally higher as a double three Elliott Wave structure. The subdivision of the first leg Intermediate wave W unfolded as a double three Elliott Wave structure where Minute wave ((w)) ended at 6427.75, Minute wave ((x)) ended at 6383, and Minute wave ((y)) of W ended at 6545.75.

Down from there, Minor wave X is proposed complete at 6432.25 in the green box. Subdivision of Minor wave X unfolded as a double three Elliott Wave structure where Minute wave ((w)) ended at 6463.25, Minute wave ((x)) ended at 6520.75, and Minute wave ((y)) of X ended at 6432.25. Near term, while dips stay above 6432.25, but more importantly as far as pivot at 12/5 low (6232.3) stays intact, expect Index to extend higher. We don't like selling the Index.

Unless already long in a risk free trade from the green box area, we prefer to wait for the Index to break above Minor wave W at 6545.75 before buying the dips again. At this stage, until the Index breaks above Minor wave W at 6545.75, a double correction in Minor wave X still can't be ruled out. If the Index breaks below 12/26 low (6432.25) from here, then it could open extension lower to 6234 - 6361 area next to end Minor wave X before buyers appear for at least 3 waves bounce.

NASDAQ 1 Hour Elliott Wave Chart