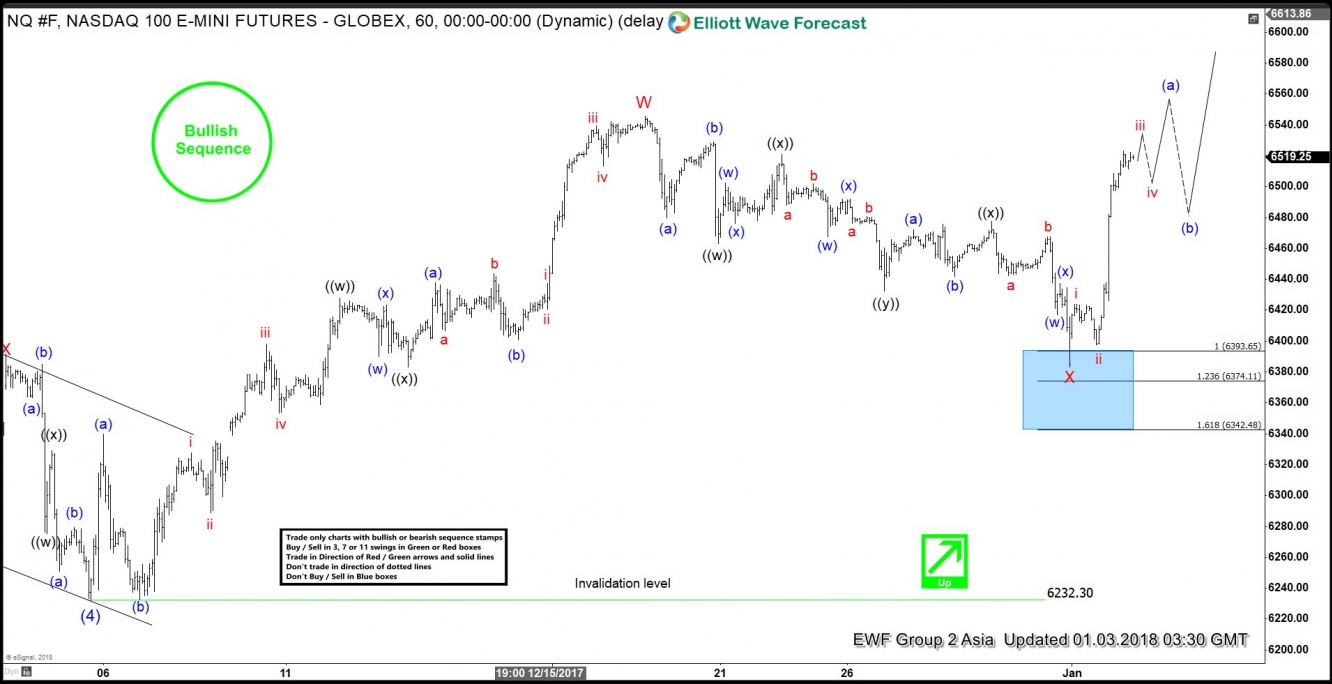

Elliott Wave view for Nasdaq suggests that the Index has ended the correction to the cycle from 12/5 low at 6383.25 and from there it it has started the next leg higher. Up from Intermediate wave (4) low on 12/5, the rally unfolded as a double three Elliott Wave structure where Minor wave W ended at 6545.75 and Minor wave X is proposed complete at 6383.25. However, for this view to gain validity, the Index needs to break above Minor wave W at 6545.75.

Internal of Minor wave W unfolded as a double three Elliott Wave structure where Minute wave ((w)) ended at 6427.75, Minute wave ((x)) ended at 6383, and Minute wave ((y)) of W ended at 6545.75. The Index then pullback in Minor wave X which unfolded as a a triple three Elliott Wave structure where Minute wave ((w)) ended at 6463.25, Minute wave ((x)) ended at 6520.75, Minute wave ((y)) ended at 6432.25, and second Minute wave ((x)) of X ended at 6383.25.

Short term, rally from 12/30 low (6383.25)( looks impulsive and could see more upside to end 5 waves up in Minutte wave (a). Afterwards, the Index should pullback in Minutte wave (b) in 3, 7, or 11 swing to correct cycle from 12/30 low (6383.25) before turning higher again. We don’t like selling the Index and while dips stay above 6383.25, and more importantly above 6232.30, expect Index to extend higher.

Nasdaq 1 Hour Elliott Wave Chart