Let’s take a quick stroll as we approach the last week before the Election. I wanted to say a few words about each of the eight ETFs below.

First up is commodities, by way of the symbol DB Commodity Index Tracking Fund (NYSE:DBC). Everywhere I turn, the experts are saying commodities are going to be roaring higher for years to come. I disagree; I think the long-term trend is downward.

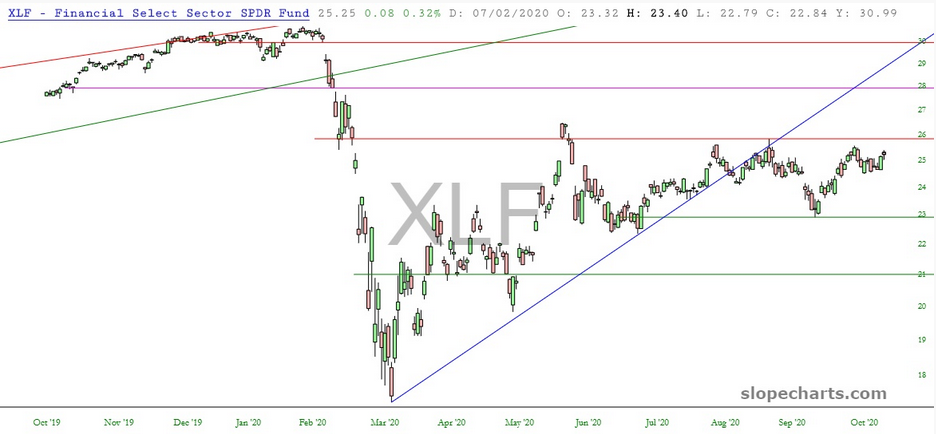

Equities continue to be annoyingly indecisive. On the one hand, there are far too many uncertainties in the weeks ahead to really let prices shoot higher, yet on the other, the Fed’s endless asset buying will keep the helium-filled in the balloons. The “Diamonds)” are bouncing along their long-term trendline, sputtering to a tight range.

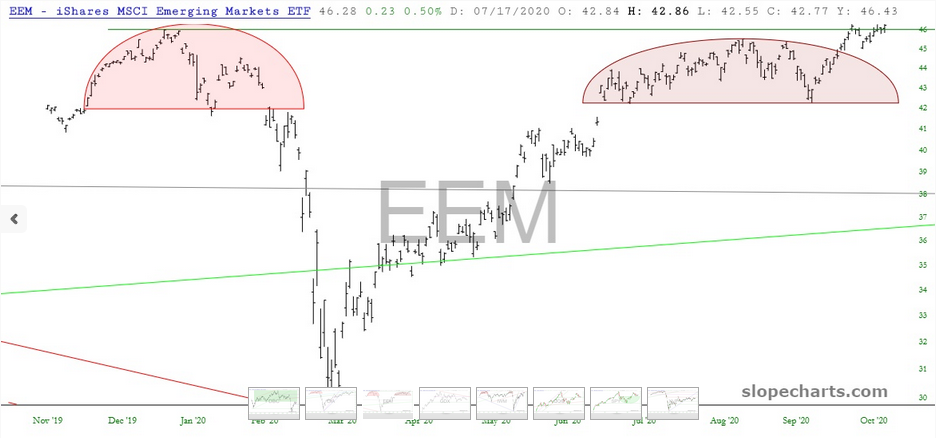

Emerging Markets ETF (NYSE:EEM), however, seem to have reached escape velocity. There had been (past tense) a lovely parallel between the two arched tops I’ve tinted, but that was busted a few weeks ago, and emerging markets are surprisingly strong.

Miners ETF (NYSE:GDX), however, looked poised for pain.

My principal obsession, the small caps, have an exceptionally well-formed chart that is rich with information. My belief is that the past couple of weeks have been nothing but the prices banging their head on the underside of the broken red trendline that I’ve drawn below. It can’t seem to “let go” for prices to descend as they did in the autumn of 2018 and spring of this year.

Looking closer, this time at the NASDAQ, we see the tiny basing pattern is being challenged. We are about to enter the meat of earnings season, with all the most important players reporting in the days ahead.

Cleaner than the QQQ, the SPY continues to respect its own basing pattern. If, for whatever reason, the results of the 11/3 election cause mass celebration, that saucer will probably be seen in retrospect as the launching-off mark for the next phase of this lovely bull market which delights me so.

Lastly, there is Consumer Staples (NYSE:XLP), which have been range-bound for months. If the above SPY chart were to rip higher (post-election), I daresay the red horizontal below would likewise be shunted aside.