What an incredible and shorter week in the world of high finance.

Doomsday news appeared EVERYWHERE yet did not impact the market per se.

Gold however, like our recycled, solid gold art installation, held its ground.

Only, the metal looks like it is about to go into orbit.

Yields rose, the dollar remains flat, grains caught a boost and of course, Nasdaq 100 soared to yet another new all-time high.

The start of stagflation (also recycled from the 1970s) might finally be upon us.

Regardless of the latest COVID flare-up, many stocks ran to new 52-week highs.

Nevertheless, millions remain unemployed and the new surge threatens the full reopening of the economy.

But also recycled, is the human amazing superpower-hope!

The Economic Modern Family already owns gold, but also hopes to soar away with NASDAQ in the recycled gold capsule.

Can they?

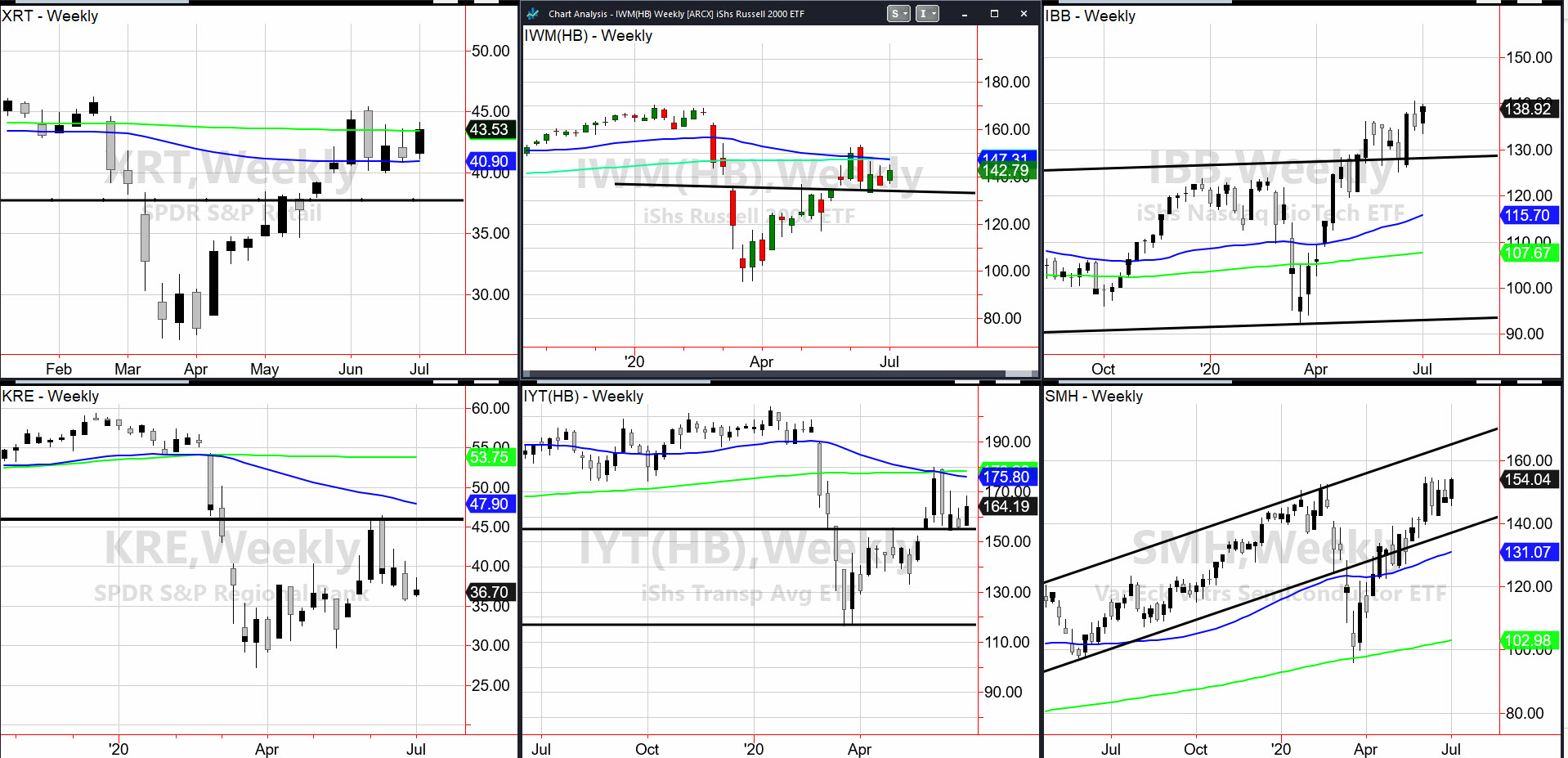

If you are thinking to yourself looking at these weekly charts, man, that is where all of them were trading weeks ago, you would be right.

The trading ranges are wide, given the volatility, but persistent.

The Retail ETF (NYSE:XRT) for example, sits between the 50 and 200-week moving averages. I am particularly interested in whether Granny can enter the gold capsule and do something she has not done for years-LEAD!

As a consumer-based economy, that would be compelling. Even more compelling to me than strong FAANG stocks as far as the hope for the economy in the future.

Granddad Russell 2000 (NYSE:IWM), is below both the weekly moving averages and in a bear phase. Concerning? Yes. However, should his wife get wings, he will follow as a happy consumer is a happy manufacturer.

Biotechnology ETF (NASDAQ:IBB), unless we have a full-blown crash, over 140 also gives us hope for the whole family.

Regional Banks ETF (NYSE:KRE) is an issue for sure. Still lagging. Still bearish. Still though, showing a positive divergence on momentum. Plus, we had an inside week, so all is not lost yet.

If Granny is not enough, it will be partly because Transportation ETF (NYSE:IYT), is another one in a bearish phase. IYT is like rocket fuel for the gold space capsule.

And talk about trading ranges, Sister Semiconductors ETF (NYSE:SMH) has pushed against the 155 area for weeks.

It is also the same area SMH was just before the crash in February.

We would all love to hear some good news, such as the number of new cases is falling, the death rate remains very low, and the US government continues to want to help its people.

Nonetheless, the Economic Modern Family looks poised to go either way to take out the top of the ranges for a wonderful start to next week…

Or,

Abandon hope of entering a golden space capsule, and instead, just be grateful that they own gold instead.

S&P 500 (SPY) Rangebound 316-300

Russell 2000 (IWM) 141 support 146.50 resistance

Dow (DIA) 250 support 258.50 pivotal 262.90 resistance

Nasdaq (QQQ) You might want to make a bearish case, but not seeing it yet

KRE (Regional Banks) Confirmed bear phase but inside week

SMH (Semiconductors) 155 resistance 150 support

IYT (Transportation) Inside day. 160.60 pivotal support 170 resistance

IBB (Biotechnology) 136-140 range now

XRT (Retail) Could not close over 43.50 so watch carefully

Volatility Index (VXX) 31.00 support and over 32.70 troubling

Junk Bonds (JNK) 100 big support

LQD (iShs iBoxx High yield Bonds) New highs-watch 134.90