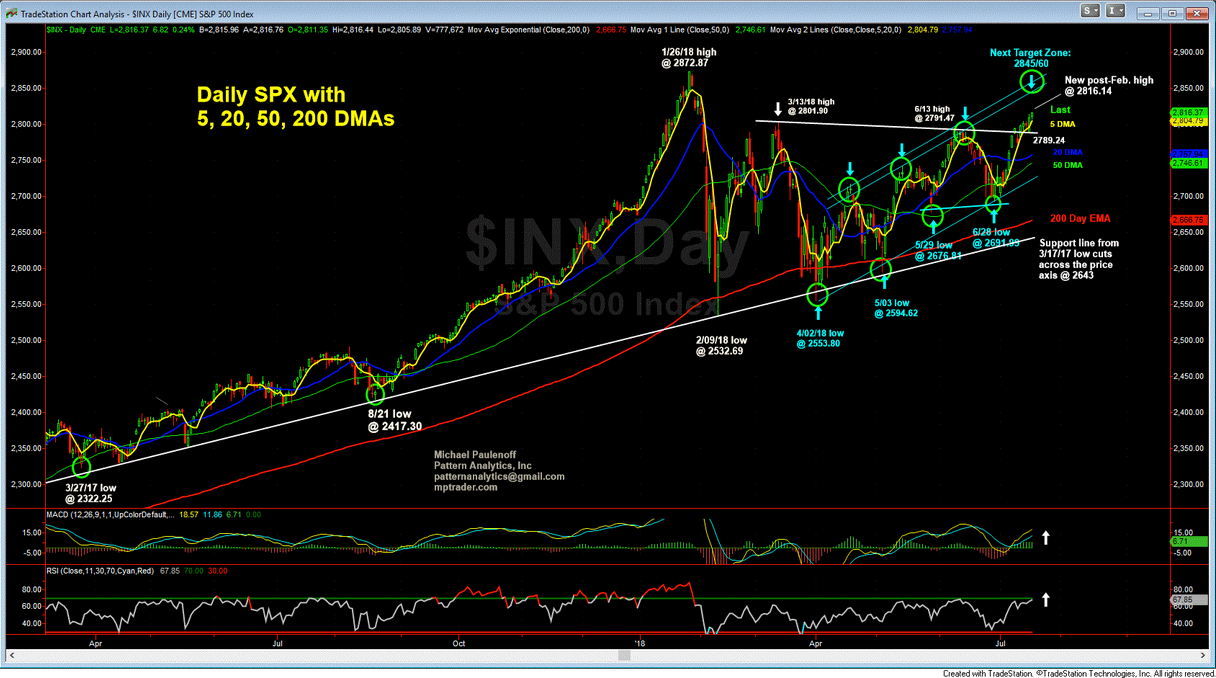

A big-picture perspective of the S&P 500 (SPX) shows that the most recent up-leg off of the June 28 low at 2691.99 has climbed to a new high at 2816.25, or +4.6%. In so doing, the SPX has hurdled its prior two significant rally peaks at June 13 (2791.47) and at March 13 (2801.90), positioning the index for upside continuation to my next optimal target zone of 2845-2860.

Should such a scenario unfold, the SPX, in effect, will be climbing toward a test of its all-time high at 2872.87 from January 26 of this year. Only a break below 2789 will trigger initial signals that the June-July up-leg needs a breather.

What if all of the action since the January high turns out to morph into a seven-month accumulation period? As Larry Kudlow intimated this morning in his Delivering Alpha interview, he remains open minded to the idea that after eight years of subdued business activity and growth, just maybe the US economy is only starting to shift into a faster gear precipitated by the unleashing of regulations, tax benefits and pent-up demand from shelved capex from the Obama years.

His suggestion dovetails with a potentially very bullish scenario that we see on our second SPX chart that views the past seven months as an accumulation/corrective base formation that is putting increasing upward pressure on the price structure and is just beginning to "squeeze" SPX to the upside.

Such a scenario projects to targets at 2930/60 and at 3040/70 to reflect the economic "combustion." Again, if SPX weakens, breaks and sustains beneath 2789, then all bets are off about a forthcoming squeeze.

Mike Paulenoff is a veteran technical strategist and financial author, and host of MPTrader.com, a live trading room of his market analysis and stock trading alerts.