Morning Notes

US Futures are tracking lower this morning as European markets are trading sharply lower by over -2% as the future of economic growth concerns resurface after the recent Brexit decision. Asian stocks closed lower, led by the Nikkei closing lower by -290 points.

Technicals

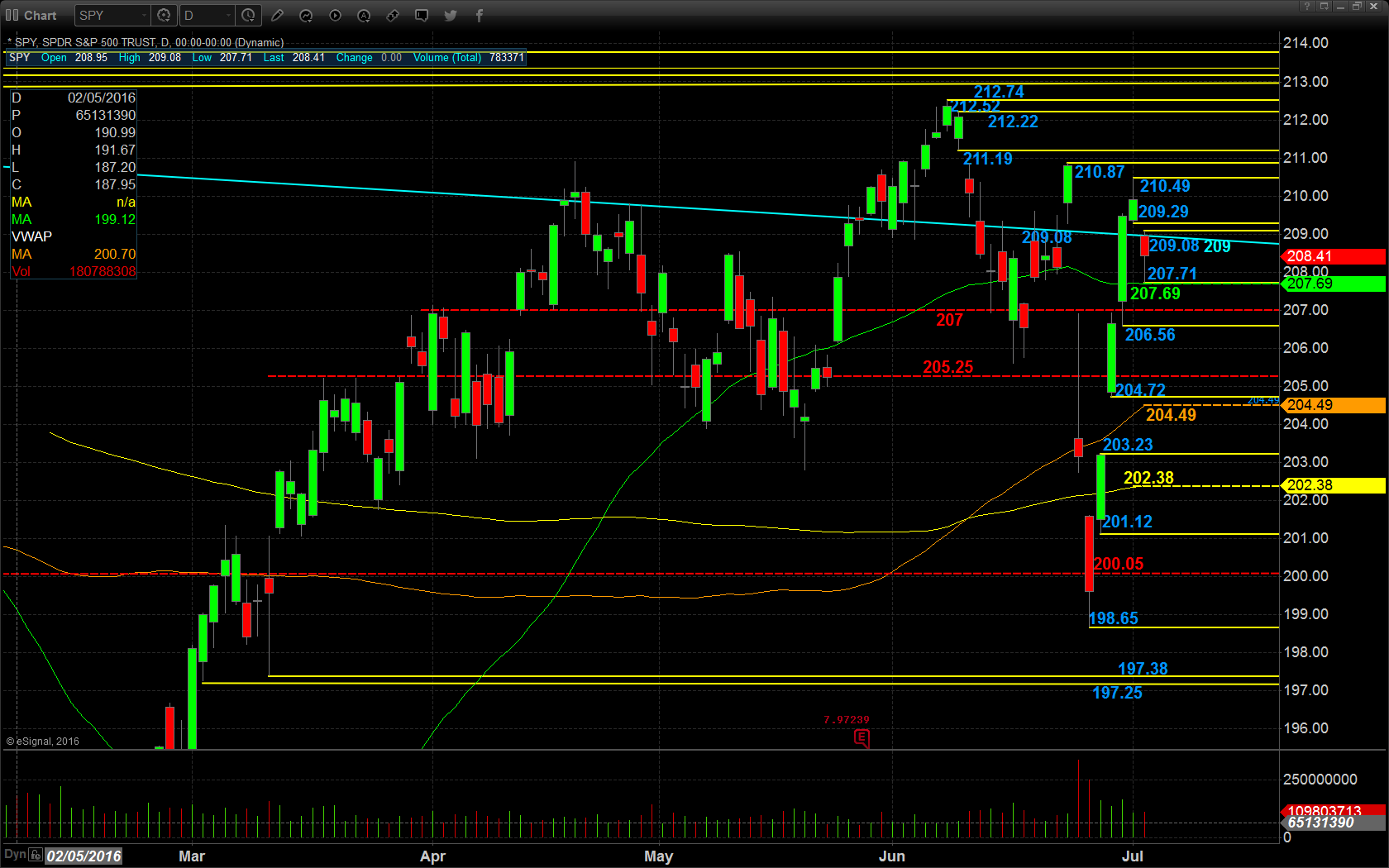

The SPY (NYSE:SPY) moved back below the macro descending resistance in yesterday’s session and ended closing below the critical level after intraday tests. Support will lie at the upper support pivot at $207, followed by $206.56, the mid range support pivot at $205.25, $204.72, and the 100 day moving average at $204.49. Resistance will lie at the 50 day moving average at $207.69, followed by the low of yesterday’s range at $207.71, the high of yesterday’s range at $209.08 which also coincides with the macro descending resistance.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

Netflix Inc (NASDAQ:NFLX)

Royal Gold Inc (NASDAQ:RGLD)

Economic Calendar

8:30 May trade balance expected -$40.0B

9:00 Fed Governor Daniel Tarullo speaks

9:45 Revised Jun Markit U.S. services PMI expected unchanged at 51.3

10:00 Jun ISM non-manufacturing PMI expected +0.4 to 53.3

2:00 FOMC Minutes

Notable Earnings Before Open

WBA: Walgreens Boots Alliance (NASDAQ:WBA) – EPS Est. $1.14, Rev Est. $29.80B

Notable Earnings After Close

NONE

July 6th Swing Watch List

Intellia Therapeutics Inc (NASDAQ:NTLA) – On reversal watch after getting pummeled following its IPO. Looking for a bottom bounce entry around $20.50 Stop will be 19.50. Down nearly 30% in a week, this has nice bounce/recovery potential.

Eli Lilly and Company (NYSE:LLY) – On reversal watch for a short after a nice 11% run. This one trades liquid with options and has a low IV rank. Will look for the Aug16 80/75 put spread for a debit of 2.50.