Ecolab Inc. (NYSE:ECL) recently announced that it will acquire Holchem Group Limited to enhance food safety standards, and boost the Food & Beverage and Nalco Water units in Europe.

However, the buyout is yet to be cleared by the Competition and Markets Authority, which is expected to take place by early 2019. Ecolab and Holchem Group will operate separately until the acquisition is approved. The financial terms of the deal have been kept under wraps.

On completion of the acquisition, management at Ecolab is looking forward to better serve the customers of the food and beverage and foodservice industry in Ireland, the United Kingdom and entire Europe.

About Holchem Group

Holchem Group operates in the United Kingdom and Ireland. It is a leading supplier of hygiene and cleaning products and services for the food and beverage, foodservice and hospitality industries.

The company recorded sales of £43 million or $56 million in 2017.

Ecolab’s Food & Beverage Offerings

At the Food & Beverage unit, Ecolab serves the Beverage processing, Cheese processing, Meat, Poultry & Seafood, Biofuels & Ethanol, Dairy Processing, Brewery & Winery and Food Processing markets.

Notably, Ecolab’s Food & Beverage offerings come under the Global Institutional revenue segment. In the third quarter of 2018, revenues improved 6% to $1.34 billion at this segment, courtesy of robust growth in the Specialty business. North America and Asia Pacific also witnessed solid growth in the same period.

The latest development highlights Ecolab’s special emphasis on Europe.

Market Prospects Bright

Per statista, the global Food & Beverage market has a net worth of $93,582 million in 2018. Markedly, the market value is expected to multiply at a CAGR of 10.3% to $152,677 million by 2023.

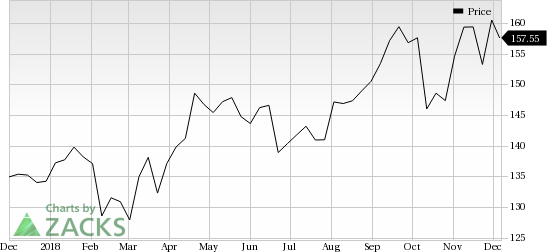

Impressive Stock Performance

Ecolab’s stock has outperformed its industry in a year’s time. This Zacks Rank #4 (Sell) company has gained almost 15.9% against the industry’s 5% decline. The current level is also higher than the S&P 500 index’s 2.3% growth.

Ecolab Inc. Price

Other Acquisitions in Focus

In a bid to gain market traction and boost profits, Ecolab continues to focus on investment in key growth businesses and bolt-on acquisitions besides collaborations and agreements with other companies.

Earlier this month, Ecolab announced that it will acquire Bioquell PLC to enhance offerings for life sciences and healthcare environments. The transaction is expected to close by the first quarter of 2019.

In October, Nalco Champion, an Ecolab company, collaborated with Accenture (NYSE:ACN) and Microsoft (NASDAQ:MSFT) to launch a new unified, digital platform – Refined Knowledge – powered by ECOLAB3D.

In August, Nalco Champion and XOS entered into an exclusive distribution agreement to provide a chlorine monitoring solution for the global refining industry.

In January, Ecolab acquired Cascade Water Services Inc. — a privately-held company, based in New York. Cascade Water Services provides water treatment programs and services to the U.S. institutional market.

Stocks to Consider

A few better-ranked stocks in the broader medical space are Quidel Corporation (NASDAQ:QDEL) , STAAR Surgical Company (NASDAQ:STAA) and Illumina, Inc. (NASDAQ:ILMN) .

Quidel Corporation has long-term expected earnings growth rate of 25% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

With a Zacks Rank #1, STAAR Surgical delivered average four-quarter positive earnings surprise of 400%.

Illumina’s long-term earnings growth rate is projected at 23.4%. The stock carries a Zacks Rank #2 (Buy).

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Ecolab Inc. (ECL): Free Stock Analysis Report

Quidel Corporation (QDEL): Free Stock Analysis Report

Illumina, Inc. (ILMN): Free Stock Analysis Report

STAAR Surgical Company (STAA): Free Stock Analysis Report

Original post

Zacks Investment Research