Yesterday, the ECB kept its rates unchanged, with the deposit facility rate for March staying at -0.50%, the marginal lending rate remaining at +0.25% and the main interest rate sticking to 0.00%. European indices sold off heavily yesterday, closing in the negative double digits. US markets followed the same path, but just managing to stay fractionally below a 10-percent loss.

ECB KEEPS RATES UNCHANGED

Yesterday, the ECB kept its rates unchanged, with the deposit facility rate for March staying at -0.50%, the marginal lending rate remaining at +0.25% and the main interest rate sticking to 0.00%. However, the central bank had decided to announce new LTRO’s and expand Quantitative Easing by 120 bn euros. The long-term refinancing operations will be performed temporarily, as a measure to provide liquidity support for the whole euro area.

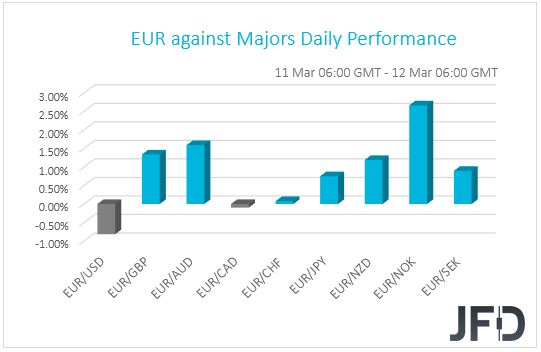

Until the end of this year, the ECB is planning to add additional net asset purchases of 120 billion euros that should support favourable financing conditions. After the release, the euro spiked higher against its major counterparts, but was quick to lose its immediate gains a few minutes after. A

fter Christine Lagarde’s press conference, the euro started moving heavily to the downside. Although the ECB did not cut its rates, Christine Lagarde sounded quite dovish during her speech, which may have led to a steep decline in EUR/USD. But as the head of the ECB explained, the decision was unanimous and the current tools that are in place from the ECB, those are enough to maintain stability in the eurozone.

EUR/USD – TECHNICAL OUTLOOK

EUR/USD took a strong dive yesterday, falling all the way to its short-term upside support line taken from the low of February 20th. That upside line held the rate perfectly and helped it rebound. However on the other end, the pair is getting held by its short-term downside resistance line taken from the high of March 9th. For now, there could still be some more downside in the near term, that said, if EUR/USD stays above that upside line, we take a bullish approach once again.

As mentioned above, there is a possibility to see a bit more downside up until the aforementioned upside line, especially if the rate falls below the 1.1132 zone, marked by yesterday’s intraday swing low. If that upside line stays intact, the bulls could re-enter the field and drive EUR/USD towards the above-discussed downside line, which if fails to withstand the bull pressure and breaks, this may clear the path to some higher areas. We will then aim for the 1.1222 hurdle, or the 1.1250 barrier, marked by the low of March 11th. If the buying doesn’t stop there, the next potential resistance area to consider might be at 1.1333, which is yesterday’s high.

Alternatively, if the aforementioned upside line breaks and the rate falls below the 1.1055 hurdle, marked by yesterday’s low, this would confirm a forthcoming lower low and could open the door to further declines. That’s when the pair might drift to the 1.0979 zone, a break of which may lead to a push to the 1.0950 level, marked by the low of February 28th.

MARKETS CONTINUED TO SLIDE

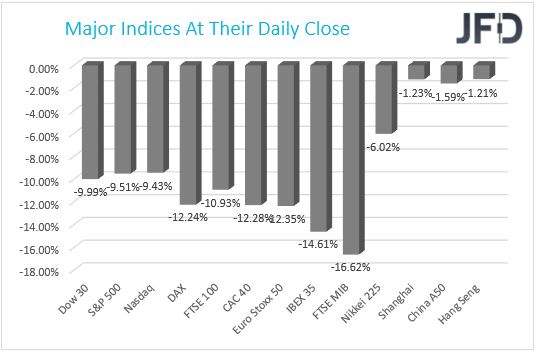

European indices sold off heavily yesterday, closing in the negative double digits. The FTSE 100 chopped off around 11%, DAX lost a bit more than 12%, the Spanish IBEX dropped around 14 and a half percent and the Italian FTSE MIB ended the session with about 16 and half percent loss. The Italian index made a new own record, with a biggest one-day loss in history. The FTSE 100 had its worst trading session since October 1987. The US indices followed in the same direction, but with a slightly lower loss. The DJIA wrote off 10% of its value, the S&P500 and Nasdaq Composite – about 9 and half percent each. This morning we are seeing a small rebound in the European and US futures, despite the fact that Asian indices continue to drift lower, at the time of writing this report.

Trump’s Wednesday announcement of banning European travellers from entering the United States, as of midnight on Friday, had pushed the oil market lower as well. Despite increasing oil production from the top two oil-producing countries, the travel ban could also lower the demand for oil and oil products. WTI oil and Brent oil, both lost around 10% each.

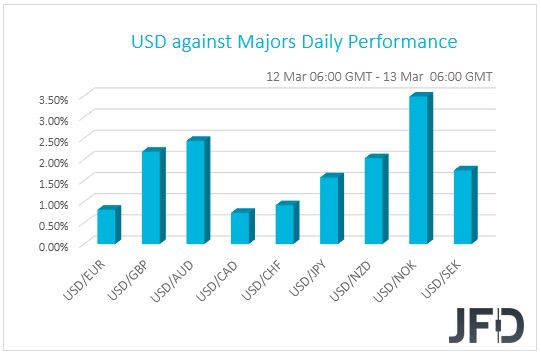

One of the few gainers yesterday was the US dollar, where at one point the DXY managed to gain around 2 and half percent. At the end of the day the index had to let go some of those gains, ending with not a full percent rise. The US dollar even started gaining against its Japanese counterpart, which tends to be seen as a safe-haven during turbulent times. But this time, the yen is moving slightly lower against some of its major counterparts, despite markets selling off. This might be explained by the fact that the BoJ had introduced some additional stimulus, in order to safeguard the Japanese economy. JPY might feel a bit of heat in the near term, however we will continue monitoring the developments in the stock market, which could force the yen to put its safe-haven suit again.

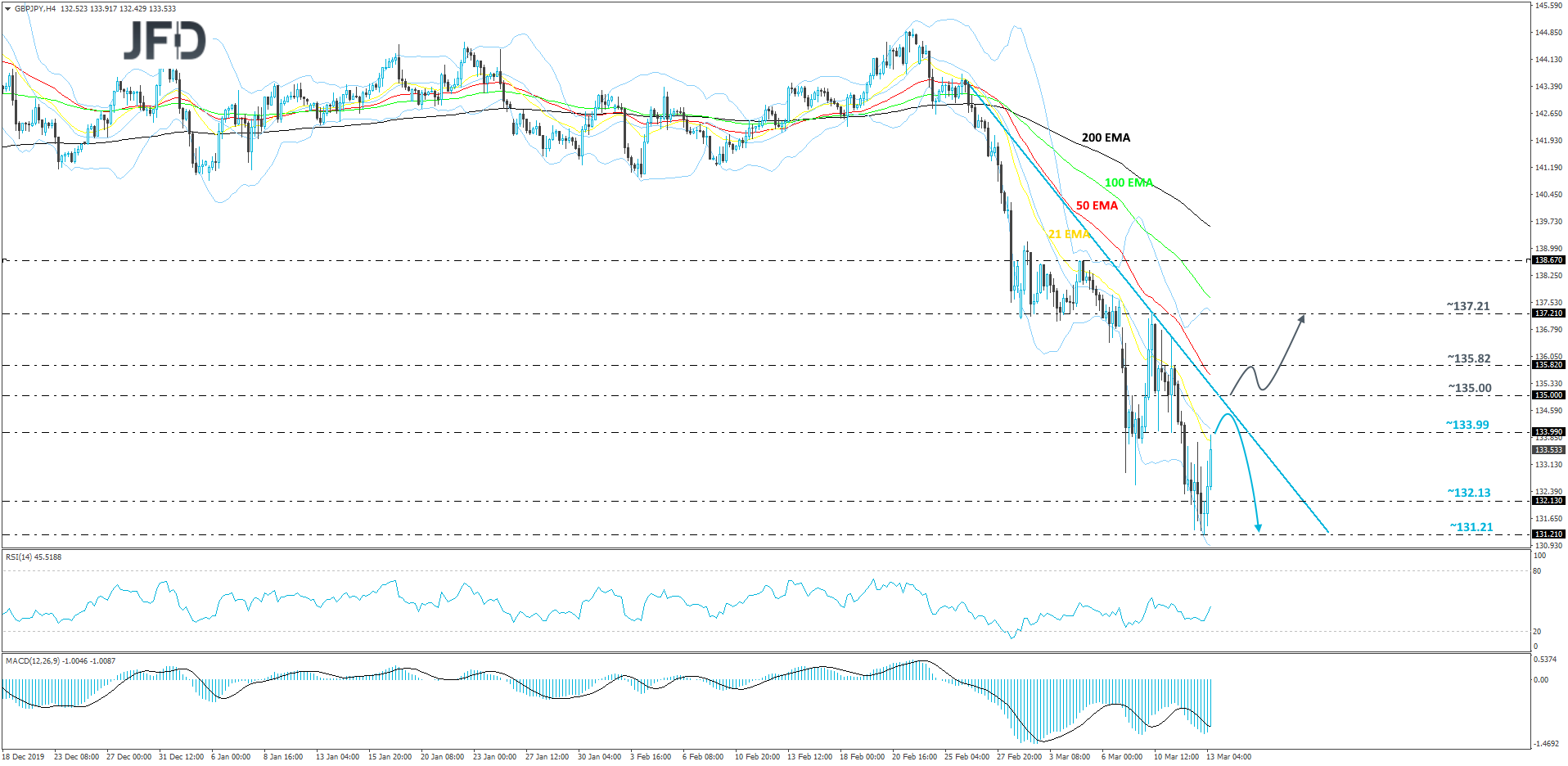

GBP/JPY – TECHNICAL OUTLOOK

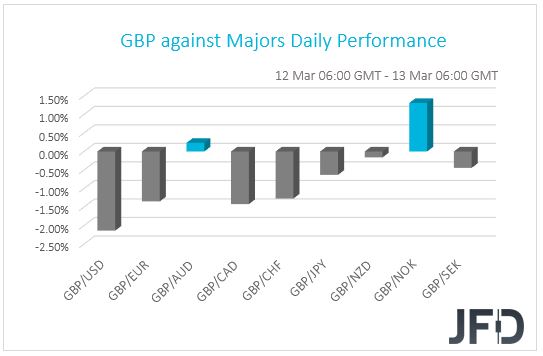

After finding support near the 131.21 hurdle yesterday, GBP/JPY got held around there and today the pair started grinding upwards. However, the move up could be a temporary occasion, as the rate remains below its short-term downside resistance line taken from the high of February 26th. If that line stays intact, this could result in another round of selling, hence why we will remain cautiously bearish, at least for now.

A push higher and a break above the 1.3399 barrier, marked by an intraday swing low of March 11th, would place the rate above the 21 EMA on the 4-hour chart. But as mentioned above, if the downside line holds, this may lead to another round of selling. If so, we will then examine a possible slide to the 132.13 hurdle, a break of which could clear the path to the 131.21 level, marked by the current low of this week.

On the other hand, if the pair breaks above that downside line and pushes above the 135.00 zone, marked by an intraday swing low of March 11th, this may spook the bears from the field in favour of the bulls. GBP/JPY might then drift towards the 135.82 obstacle, a break of which could set the stage for a move to the 137.21 level, marked by the high of March 10th.

CORONAVIRUS REMAINS AN ISSUE

In regards to the coronavirus, the official total number of infected people has surpassed the 130000 mark. Although China is seeing a real slowdown in the amount of infected and total deaths, Europe continues to suffer with new cases arising. The main leader on the old continent is Italy with more than 12000 registered infected people. The country is also the second in the world ranking of total deaths caused by the virus, with the number currently sitting slightly above 825 people. The second country in Europe, which has the most infected people is France, followed by Spain, Germany and Norway. Although the world has divided into two fronts, where one side believes that there is nothing to worry about and the other side believes that this could be the biggest plague of our modern day lives, one thing for sure is that the market is the one that is feeling the heat. It just proves how vulnerable our economy, which totally depends in what mood the society is in at that particular time.

AS FOR THE REST OF TODAY’S EVENTS

Today is a relatively quiet day in terms of economic data releases. This morning we already received the German inflation numbers for the month of February on MoM and YoY basis. Both numbers came out as expected, at +0.4% and +1.7% respectively. France also released its own CPI numbers on the same basis, where no surprises were seen. The MoM headline CPI came out 0.0% and the YoY figure was the same as expected, at +1.7%.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ECB Surprises With A No-Cut; Markets In Turmoil

Published 03/13/2020, 07:43 AM

ECB Surprises With A No-Cut; Markets In Turmoil

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.