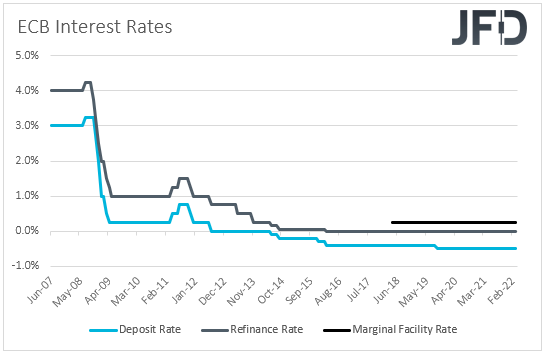

Following the BoC, today, the spotlight is likely to turn to the ECB. With peace hopes over the war in Ukraine diminishing lately, expectations around higher rates by this Bank have been scaled back as well.

The pessimism is also reflected in the wounded euro, and it remains to be seen whether the Bank will reaffirm willingness to battle accelerating inflation.

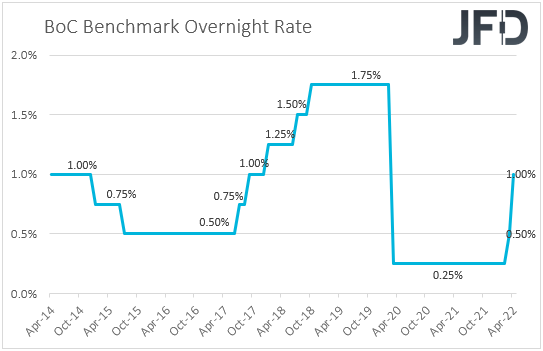

Yesterday, the BoC hiked by 50bps and maintained hawkish language, joining the central banks which are planning to tighten their policy more aggressively than previously thought.

Investors Lock Gaze On ECB, A Day After The BOC Hiked By 50BPS

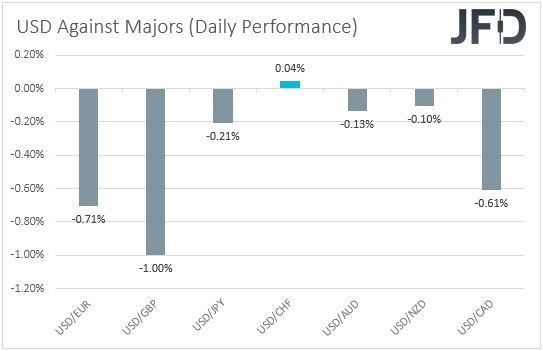

The US dollar traded lower against all but one of the other major currencies on Wednesday and during the Asian session Thursday. It underperformed the most versus GBP, EUR, and CAD in that order, while it was found virtually unchanged against CHF.

The weakening of the greenback and the safe-haven franc suggests that investors’ appetite may have improved yesterday and today in Asia.

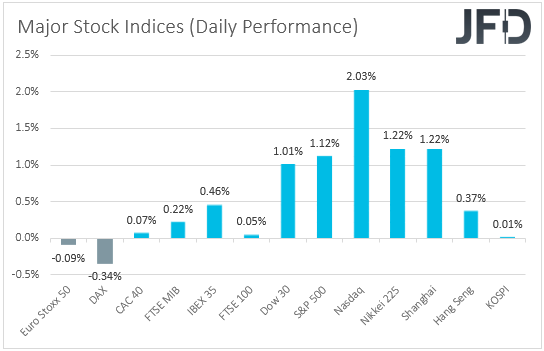

Indeed, turning our gaze to the equity world, we see that, although major EU indices traded mixed, Wall Street rebounded decently, with the optimism rolling into the Asian session today.

To be honest, with hopes over an imminent resolution to the conflict between Russia and Ukraine diminishing, and with most major central banks hiking—or preparing to hike—more aggressively than previously thought, we don’t see a clear and valid catalyst behind the rebound in equities.

Perhaps it was a short-covering bounce. We will hold the view that the path of least resistance remains to the downside.

European investors may have adopted a more cautious approach, perhaps because we have an ECB monetary policy meeting scheduled for today.

When they last met, policymakers of this Bank kept all three of their main interest rates untouched, as was widely anticipated, but decided to end their Asset Purchase Program in Q3, without hinting that any interest-rate hikes will be delayed due to the geopolitical tensions.

President Lagarde said that the risks to the economic outlook have increased substantially, but also that inflation could be considerably higher than forecast.

Combined with a large upside revision to the inflation forecast for this year, this suggested that most policymakers view the risk of high inflation outweighing concerns on how geopolitics could affect economic growth.

Back then, the outcome increased speculation for higher rates in the Eurozone later this year, with market participants pricing in 50bps by December. However, in the aftermath of that decision, President Lagarde warned that the Fed and the ECB may move out of sync in the foreseeable future, as the war in Ukraine has vastly different effect on their economies.

Her remarks raised questions as to whether officials will continue paying more attention to inflation and, thereby, decide to lift rates later this year. Now, with peace hopes also vanishing on the geopolitical front, investors are pricing in only one quarter-point increase in December, and not fully. They assign around a 70% chance for that to happen.

The latest pessimism is also reflected in the wounded euro, though we saw a decent recovery yesterday. That recovery could continue in case the Bank reaffirms willingness to battle accelerating inflation and downplays the economic consequences of the war, but even in such case, we cannot call for a bullish reversal in EUR/USD.

The Fed is expected to tighten much more aggressively than the ECB, and that monetary policy divergence, combined with the uncertainty surrounding the war, is likely to bring the pair under renewed selling interest.

Now, in case the narrative is more dovish than last time, the euro is likely to resume its prevailing downtrend instantly.

Besides the euro, the other two major winners of the day were the pound and the Loonie. The former may have received a boost after the UK CPIs accelerated more than expected, allowing participants to maintain bets that the BoE will also need to lift rates faster than previously thought.

As for the latter, its fuel was the outcome of the BoC decision.

BoC officials decided to hike rates by 50bps as was expected, noting that interest rates will need to rise further. Governor Macklem specifically said, “We need higher rates, and the economy can handle them,” adding that they are prepared to move as forcefully as needed to get inflation on target.

This puts the BoC into the group of the major central banks which are planning to move as aggressively as possible in order to control inflation, and thus, we expect the Loonie to outperform currencies of which the respective central banks are not that hawkish, like the BoJ, the ECB and the RBA.

Yes, market expectations with regards to the RBA are very hawkish, but the Bank itself has not officially confirmed whether that’s realistic—at least not yet.

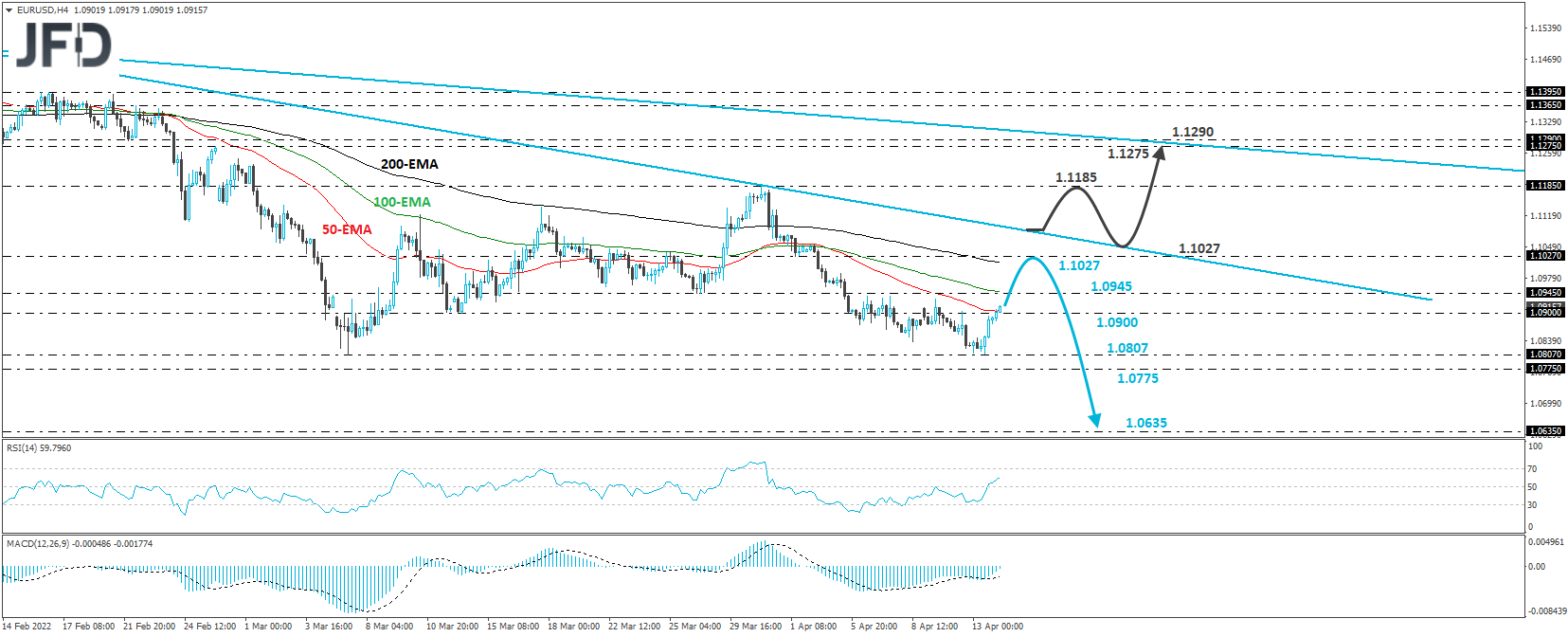

EUR/USD – Technical Outlook

EUR/USD traded higher yesterday, after hitting support once again at 1.0807, a zone marked by the low of Mar. 7. Overall though, the pair remains below the downside line taken from the high of Feb.10, as well as below a longer-term line, taken from the peak of June 1.

In our view, this suggests that even if the recovery continues for a while more, the bears can still jump in and take full charge.

This could happen near the 1.1027 zone, where a potential retreat could drag the action back down to the 1.0807 level. Slightly lower lies the 1.0775 hurdle, marked by the low of May 14, 2020, the break of which would confirm a forthcoming lower low and may see scope for declines towards the low of Mar. 22, at 1.0635.

On the upside, we would like to see a break above the downside line taken from the high of Feb. 10, before we start examining the case of a stronger positive correction. This could allow advances towards the 1.1185 barrier, marked by the high of Mar. 31, the break of which could lead the rate towards the crossroads of the 1.1275 zone and the downside resistance line taken from the high of June 1.

AUD/CAD – Technical Outlook

AUD/CAD traded lower yesterday following the hawkish outcome of the BoC decision. However, the slide remained limited near the key support zone of 0.9340, and thus, although the rate trades below the downside line taken from the high of Apr. 5, we prefer to wait for a dip below that zone before we get confident on larger bearish extensions.

In such a case we would expect the first slide to challenge the 0.9290 or 0.9265 zones, marked by the low of Mar. 22 and the inside swing high of Mar. 15, respectively. If the bears are not willing to stop there, then we may see the diving all the way down to the low of Mar. 15, at 0.9167.

The picture could brighten somewhat again upon a break above Tuesday’s peak, at around 0.9445. This will confirm a forthcoming higher high on the 4-hour chart, as well as the break above the aforementioned downside line.

The next stop may be the peak of Apr. 5, at around 0.9515, the break of which could open the path towards the 0.9620 zone, marked by the inside swing low of Apr. 22, 2021.

As For The Rest Of Today's Events

Besides the ECB decision, the only other releases worth mentioning are the US retail sales for March, the initial jobless claims for last week, and the preliminary University of Michigan consumer sentiment index for April.

Both the headline and core sales are expected to have accelerated, while the jobless claims are forecast to have increased somewhat. The UoM index is expected to have slid to 59.0 from 59.4.