Today, investors are likely to lock their gaze on the ECB decision and the US CPIs for May. With regards to the ECB, we don’t expect any policy change neither any hints on QE tapering. However, in the US, inflation is anticipated to have accelerated again in both headline and core terms, something that could increase speculation for the Fed to start normalizing its policy sooner than previously thought.

Investors Await The ECB and US Inflation Data

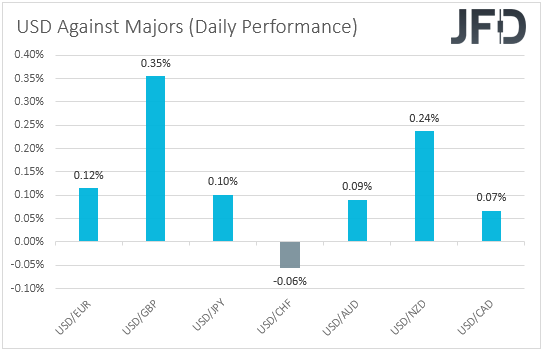

The US dollar traded higher against all but one of the other major currencies on Wednesday and during the Asian session Thursday. It gained the most versus GBP, NZD, and EUR, while it underperformed slightly against CHF.

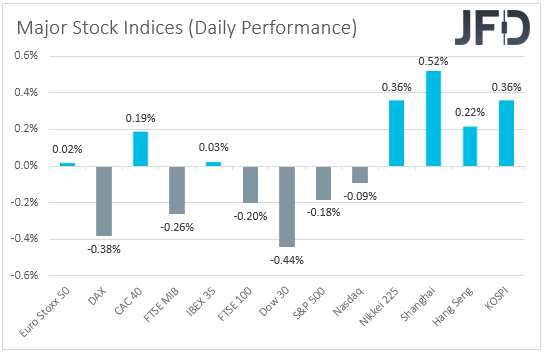

The relative strength of the US dollar and the Swiss franc suggests that market appetite remained weak yesterday and today in Asia. Looking at the performance in the equity world, we see that major EU bourses were mostly lower or unchanged, while in the US, all three of Wall Street’s main indices closed in the red. That said, sentiment improved during the Asian session today.

Despite the rebound in stocks today in Asia, the relatively cautious stance by investors in the last couple of days suggests that they are reluctant to significantly add to their risk exposure ahead of today’s ECB decision and the US CPIs for May.

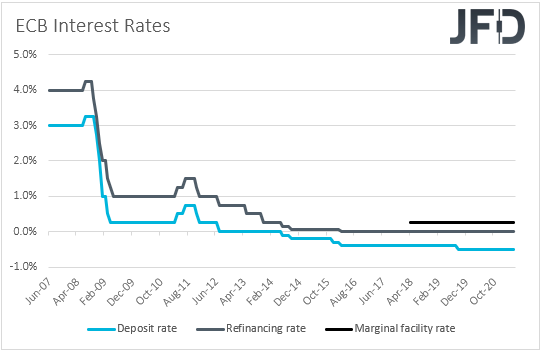

Getting the ball rolling with the ECB, when they last met, officials of this Bank kept their policy settings untouched, while there was not much new material information in the statement accompanying the decision. What’s more, according to sources, policymakers did not discuss plans with regards to their bond purchases at all.

Since that meeting though, a surge in inflation, especially in the US, has been the main theme for the financial markets, adding to speculation that the Fed may soon need to start scaling back its monetary policy support. In the Eurozone, headline inflation rose to +2.0% yoy, but the core rate increased only to +0.9% yoy from +0.7%, adding some credence to the view that the spike in headline inflation may be due to transitory factors. With that in mind, investors may be looking for hints as to what are the Bank’s future plans in terms of monetary policy.

Recently, ECB Chief Economist Philip Lane has pushed against the inflation-is-back narrative, adding that markets will take years to return to pre-crisis levels and that stimulus is still needed to secure the recovery. On top of that, ECB President Christine Lagarde said that it is “essential that monetary and fiscal support are not withdrawn too soon”.

Therefore, we expect the Governing Council to keep its policy extra loose and avoid any tapering talks. On the contrary, we see a small chance that there may be a debate on whether to prolong their support, a decision that will depend on how strong officials believe the economic recovery is, something we will get clues on from the updated economic projections.

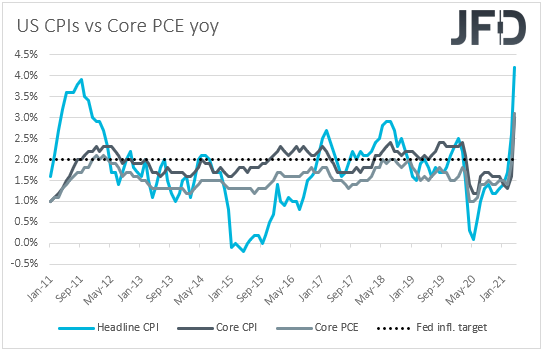

Now, passing the ball to the US and its CPIs for May, both the headline and core rates are expected to have climbed even higher, to +4.7% yoy and +3.4% yoy from +4.2% and +3.0% respectively. In contrast to the Eurozone, here, the surge in the core rate well above the Fed’s target of 2% suggests that the inflation spike may not be due to transitory factors. Even the core PCE rate, which is the Fed’s favorite inflation metric, jumped to +3.1% yoy in April from +1.9% yoy. With several Committee members already talking about the need to have a tapering discussion in the upcoming meetings, this may increase speculation that the Fed will have to start normalizing its monetary policy sooner than previously thought, and may result in a pullback in equity markets and other risk-linked assets. At the same time, the US dollar and other safe havens could come under some buying interest.

Speaking about central banks, yesterday, we had a BoC decision, with Canadian policymakers keeping their monetary policy settings unchanged as we have expected, but noting that any adjustments to the pace of their QE purchases will be guided by the ongoing assessment of the strength and durability of the economic recovery. In our view, the absence of strong hints with regards to further tapering in the upcoming months may have disappointed some Loonie traders, and that’s why the currency traded lower after the decision.

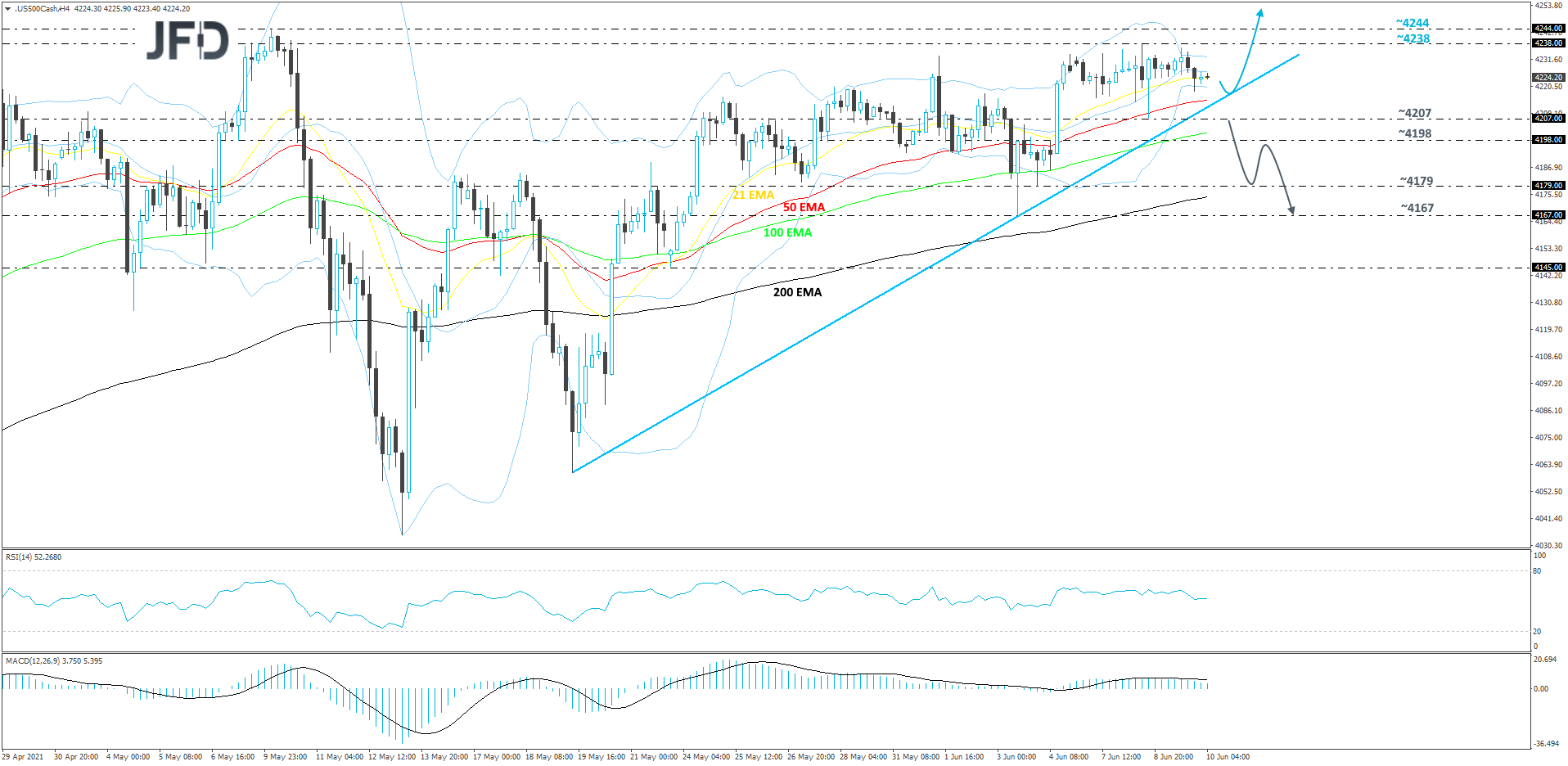

S&P 500 Technical Outlook

Although the S&P 500 tried to make its way higher yesterday, still, there wasn’t enough buying power to keep the index in positive territory. The price was very close to its all-time high, at 4244, but instead, we are now seeing the cash index moving lower. That said, we might still class this move as a temporary correction, before another leg of buying, if the price continues to trade somewhere above the short-term tentative upside support line taken from the low of May 19.

If the index moves a bit more to the downside, but stays somewhere above the aforementioned upside line, the bulls might take advantage of the lower price and push it higher. If so, the index could travel back to the current high of this week, at 4238, or even to the 4244 barrier, which is the current all-time high. If the bulls are capable to overcome that barrier, this would confirm a forthcoming higher high, placing the S&P 500 into the uncharted territory.

Alternatively, if the aforementioned upside line breaks and the price drops below the 4207 hurdle, marked by the current lowest point of June, that may open the door for a move towards slightly lower areas. The S&P 500 might drift to the 4198 obstacle, or to the 4179 zone, marked by the low of June 4. If the selling doesn’t stop there, the S&P 500 may slide to the current lowest point of June, at 4167.

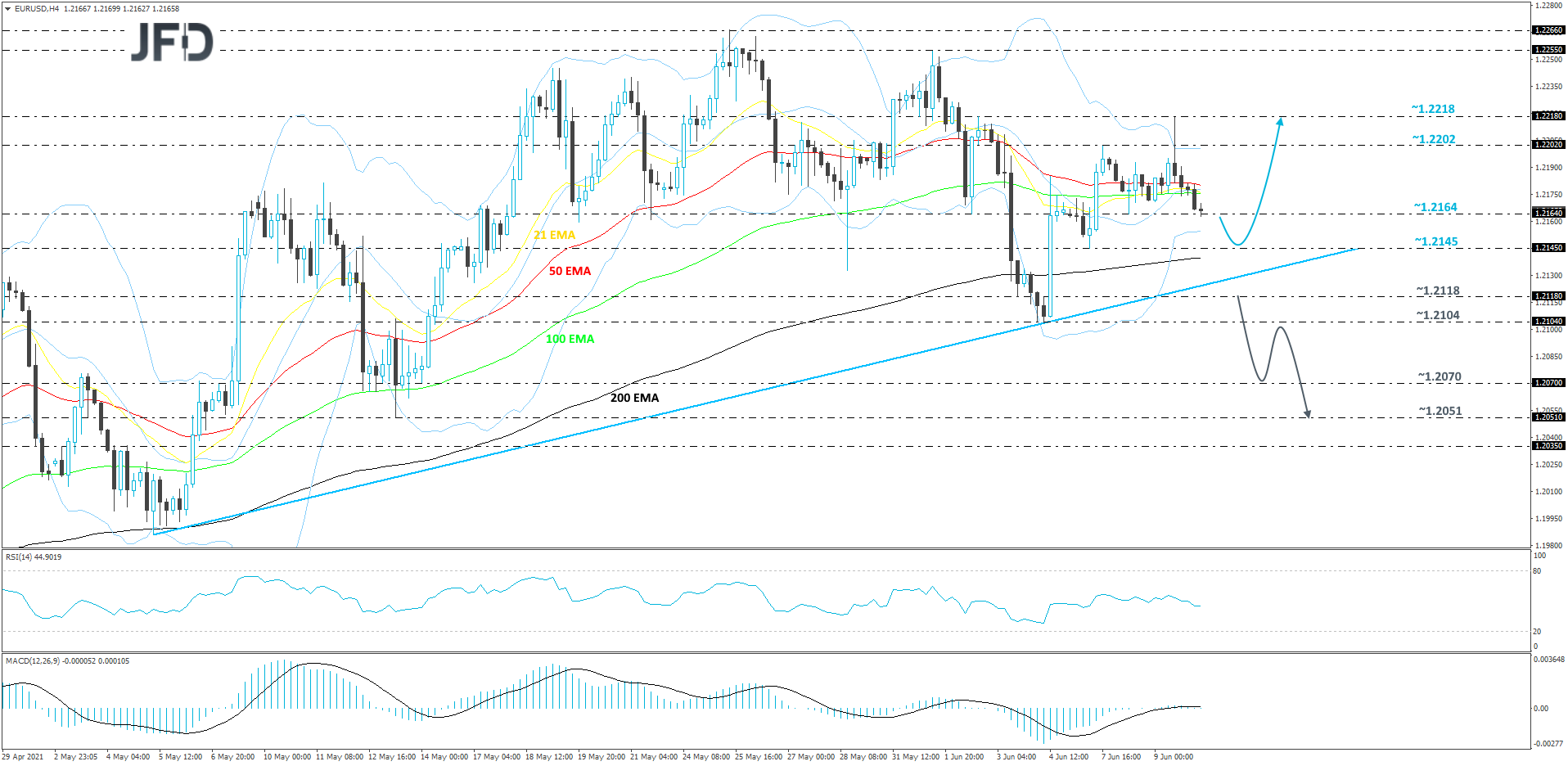

EUR/USD Technical Outlook

Yesterday, EUR/USD tried to make its way higher, but after finding resistance near the 1.2218 hurdle, the pair reversed its course and fell back below most of its EMAs on our 4-hour chart. The rate may drift a bit further south, however, we could still class this move as a corrective one, if EUR/USD continues to trade somewhere above the 200 EMA or the short-term tentative upside support line taken from the low of May 5.

A further drop could send the rate towards the 1.2145 hurdle, marked by the low of June 7. The pair might get a hold-up around there, as it may also test the 200 EMA, which could provide additional support. If so, EUR/USD might rise again, possibly bypassing the 1.2164 obstacle and aiming for the 1.2202 zone, marked by the high of June 7. If the buying continues, the next potential target could be at 1.2218, marked by yesterday’s high.

Alternatively, if the pair moves lower, breaks the aforementioned upside line and falls below the 1.2118 hurdle, marked by an intraday swing high of June 4, that may attract more bears into the field. EUR/USD may then travel to the current lowest point of June, at 1.2104, a break of which would confirm a forthcoming lower low, possibly sending the pair further south and aiming for the 1.2070 zone, marked by the low of May 14. If the bears are still feeling confident, they may stay behind the steering wheel and push the rate towards the 1.2051 area, marked by the low of May 13.

As For The Rest Of Today's Events

Apart from the ECB decision and the US CPIs, we also get the US initial jobless claims for last week, with expectations pointing to a small decline to 370k from 385k.

As for the speakers, apart from ECB President Christine Lagarde, who will speak at the press conference following her Bank’s decision, we will also get to hear from ECB Chief Economist Philip Lane.