The European Central Bank (ECB) is struggling to achieve its inflation target of less than but close to 2%. It disappointed markets by only extending its “forward guidance” by 6 months, promising not to increase interest rates before the middle of 2020 at its meeting on the 6th of June. There was no change to the main refinancing rates, which remains at zero and the deposit rate, which remains at -0.4%.

The ECB is caught between the “rock” of low inflation and the “hard place” of the various complications and constraints that limit its ability to undertake further aggressive monetary easing.

Low euro area inflation is due to a combination of global headwinds hitting the economy and falling oil prices. Whereas, the ECB’s policy space is constrained by limits on its asset purchases and concerns about bank profitability.

The recent escalation of the trade war between the US and China has combined with softer US data to spook financial markets. By early June, the S&P 500 had fallen by 7% and the price of Brent crude oil by 18% from April 2019 peaks. In response to these global headwinds, markets have shifted to the price in at least two Fed interest rate cuts by the end of 2019.

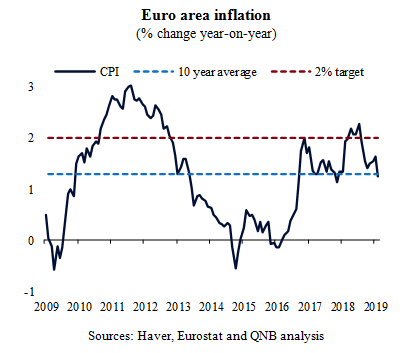

Global headwinds and lower oil prices have pushed euro area inflation down to 1.2% in May (see chart). Inflation has averaged less than 1.3% over the past 10 years. The ECB’s own projection is for inflation to reach just 1.6% by 2021.

Market expectations for euro area inflation over the next five to ten years have fallen below 1.3%. The last time expectations were this low in 2016 the ECB undertook aggressive monetary stimulus. However, the ECB faces a number of complications and political constraints that limit its ability to undertake further aggressive monetary easing.

The first political constraint on the ECB is divergent attitudes to fiscal policy in Europe, with Italy running excessively loose fiscal policy and Germany running excessively tight fiscal policy. The lack of significant fiscal stimulus in Europe has placed the responsibility for stimulating the euro area economy and therefore boosting inflation, onto the ECB. Indeed, Draghi played an interesting game, in his post-meeting statement, by trying to tie any further increase in the ECB’s EUR 2.6 Tn of asset purchases to the fiscal stimulus by euro area governments.

The second political constraint on the ECB comes via its asset purchase programme, which some fear will simply become a way to make fiscal transfers between countries. The ECB cannot buy more than 50% of any single bond or more than 50% of the bonds issued by any single government. Indeed, it is difficult for the ECB to buy more than 33% of any single bond as that would allow it to block decisions in debt restructuring negotiations. The ECB has also committed to try to purchase assets according to the share that each country has in the ECB’s capital. The end result is that the ECB is unable to stimulate the euro area economy and inflation via a significant expansion of its asset purchases.

One complication is that Mario Draghi is due to leave his job as ECB President at the end of October. Therefore, in some sense “forward guidance” involves Draghi setting policy for his successor. One candidate to replace Draghi includes the president of Germany’s Bundesbank Jens Weidmann, who is considered a monetary policy hawk.

Our expectation is that the ECB will wait and see if the Fed is forced into cutting US interest rates. If that happens, then the ECB may need to be aggressive using a variety of tools: lower interest rates; further asset purchases; and subsidized funding for bank lending.

The Fed may move as early as July, but Draghi has until the September meeting to hand over a legacy of monetary stimulus to his successor, whoever that may be.