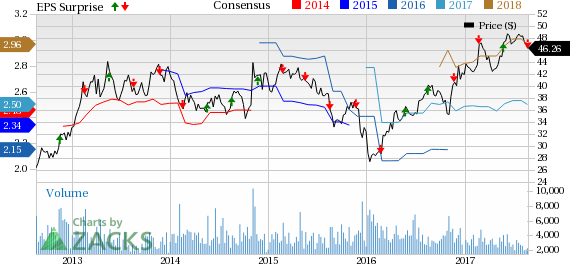

Shares of Eaton Vance Corp. (NYSE:EV) fell 1.9% following the release of its third-quarter fiscal 2017 (ended Jul 31) results. Adjusted earnings of 62 cents per share lagged the Zacks Consensus Estimate of 67 cents. However, earnings were 11% above the prior-year quarter.

Results were adversely impacted by a rise in operating expenses. However, higher revenues, growth in assets under management (AUM) and robust liquidity position supported earnings to some extent.

Net income attributable to shareholders was $72.8 million or 58 cents per share, up from $64.3 million or 55 cents per share in the year-ago quarter.

Revenues & Expenses Rise

Total revenues for the quarter amounted to $393.7 million, up 15% year over year. The rise was mainly driven by higher management fees, distribution and underwriting fees, as well as service fees. However, the figure missed the Zacks Consensus Estimate of $400 million.

Total expenses increased 16% from the prior-year quarter to $272.7 million. The rise was largely due to higher compensation and related costs, fund-related expenses, distribution expenses and service fee costs.

Total operating income rose 13% year over year to $121 million.

Strong Liquidity Position, AUM Improves

As of Jul 31, 2017, Eaton Vance had $550.2 million in cash and cash equivalents compared with $424.2 million as of Oct 31, 2016. Further, the company had no borrowings outstanding against its new $300 million credit facility.

Eaton Vance’s consolidated AUM grew 21% from the year-ago quarter to $405.6 billion, reflecting net inflows of $9.1 billion and market price appreciation of $9.4 billion.

Share Repurchase

During the first nine months of fiscal 2017, Eaton Vance repurchased nearly 2.3 million shares of its Non-Voting Common Stock for $100.2 million under its existing repurchase authorization.

Our Viewpoint

Eaton Vance’s improving AUM along with revenue rise is likely to support its growth in the quarters ahead. However, rising expenses remains a major headwind.

Eaton Vance currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

BlackRock, Inc.’s (NYSE:BLK) second-quarter 2017 adjusted earnings of $5.24 per share lagged the Zacks Consensus Estimate of $5.39. Results were adversely impacted primarily by a rise in operating expenses and lower investment advisory performance fees. However, increase in investment advisory, administration fees and securities lending revenues, along with growth in assets under management acted as tailwinds.

The Blackstone Group L.P. (NYSE:BX) reported second-quarter 2017 economic net income of 59 cents per share, which lagged the Zacks Consensus Estimate of 62 cents. An increase in expenses was the primary reason for the lower-than-expected results. However, the quarter witnessed a rise in revenues.

Ameriprise Financial Inc.’s (NYSE:AMP) second-quarter 2017 operating earnings per share of $2.80 comfortably surpassed the Zacks Consensus Estimate of $2.62. Results benefited from a rise in revenues along with lower expenses. Also, growth in AUM and assets under administration were on the positive side.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

AMERIPRISE FINANCIAL SERVICES, INC. (AMP): Free Stock Analysis Report

The Blackstone Group L.P. (BX): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

Eaton Vance Corporation (EV): Free Stock Analysis Report

Original post

Zacks Investment Research