Eastman Chemical Company (NYSE:EMN) completed the expansion of dimethylaminopropylamine (DMAPA) and alkyl alkanolamine capacity, which includes Diethylaminoethanol (DEAE/DEEA), at its manufacturing plant in St. Gabriel, LA. The latest move will allow the company to serve customers better, reaffirming Eastman Chemical’s commitment toward them.

While DMAPA is used to make surfactants found in personal care products such as shampoos, Alkyl alkanolamines are used in diverse markets such as water and gas treatment, coatings, and metalworking fluids.

Diethylaminoethanol is instrumental to minimize corrosion in boiler water treatment. Eastman Advantex and Eastman VantexT are multifunctional neutralizing amine additives with low odor used for architectural coatings while Synergex/SynergexT is known for improving the performance of metalworking fluids.

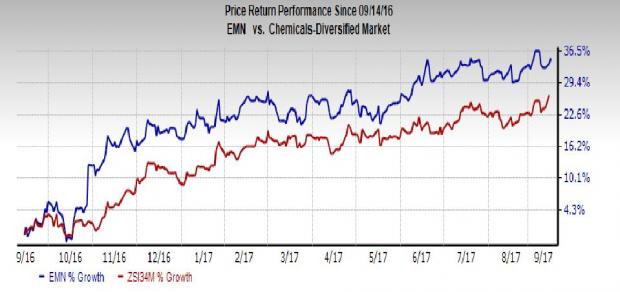

Eastman Chemical’s shares have moved up 34.8% over a year, outperforming the industry’s 26.8% gain.

Eastman Chemical expects to drive growth on the back of innovation and high-margin products amid an uncertain global business environment. Eastman Chemical believes that disciplined capital allocation and aggressive cost-management policies might contribute to earnings and offset challenges faced by the company in Fibers and ethylene pricing.

Factoring in strong first-half 2017 results, the company expects adjusted earnings per share for 2017 to grow 10-12% year over year, up from its earlier view of 8-12%.

Eastman Chemical remains focused on cost-cutting and productivity actions. The company aims to achieve $100 million of cost savings in 2017.

The company remains committed to reduce debt and boost shareholder returns. Eastman Chemical returned around $325 million to shareholders during first-half 2017. The company expects to record robust earnings and generate solid free cash flow (of around $1 billion) in 2017.

Eastman Chemical is also gaining from synergies of acquisitions, especially Taminco Corporation. The Taminco acquisition has provided attractive cost and revenue synergy opportunities.

However, Eastman Chemical continues to witness pricing pressure in some businesses. Lower prices of acetate tow are hurting its Fibers unit. Moreover, the company expects ethylene prices to be lower in second-half 2017 vis-à-vis the first half. As such, ethylene margins are expected to be under pressure in the second half. The company is also exposed to a volatile raw material pricing environment.

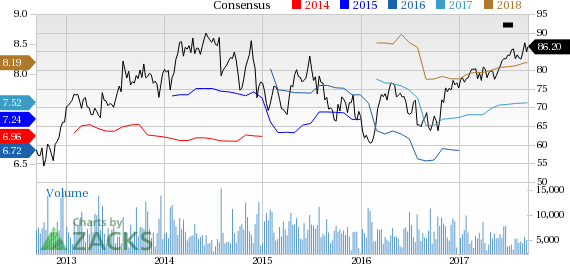

Eastman Chemical Company Price and Consensus

Eastman Chemical currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the chemical space are Kronos Worldwide (NYSE:KRO) , Air Liquide (OTC:AIQUY) and BASF SE (OTC:BASFY) .

Kronos Worldwide has expected long-term earnings growth of 5% and flaunts a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Air Liquide has expected long-term earnings growth of 8.1% and carries a Zacks Rank #2 (Buy).

BASF has expected long-term earnings growth of 8.6% and carries a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

BASF SE (BASFY): Free Stock Analysis Report

Eastman Chemical Company (EMN): Free Stock Analysis Report

Air Liquide (AIQUY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Original post

Zacks Investment Research