- SPX Monitoring purposes; Sold 4/5/17 at 2352.95= .4% gain; Long SPX on 3/24/17 at 2343.98.

- Monitoring purposes Gold: Sold GDX at 24.33 on 2/22/07 = gain 20.15%; Long GDX on 12/28/16 at 20.25.

- Long-term Trend monitor purposes: Neutral.

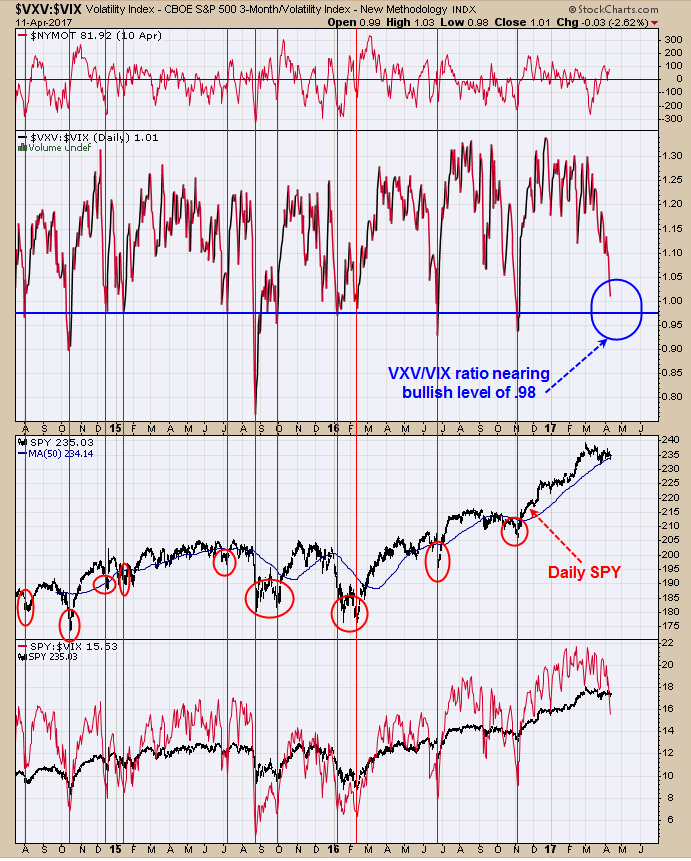

Yesterday we said, “It common for a pull back the week before option expiration week. Option expiration week is next week.” Well there was a pull back today, though not much. Today the VIX hit and closed at a four month high. The previous times the VIX hit 14 range (today’s high was 15.88) the market was near a low and we expect that the market is near a low again. If the market did not rally back to the close the TRIN and Ticks may have produced a bullish combination. We did notice that volume did expand today and suggests today’s low may be tested again shortly. The test could produce the bullish TRIN and Ticks setup. Current statistics are producing a bullish picture.

The VXV—VIX ratio seldom says anything, but now its approaching a level that suggests the SPY is nearing a low. The chart above goes back nearly three years. When this ratio hits .98 or lower the market is near a worthwhile low. Ideally to help this ratio hit the bullish levels, a decline in the SPY would be helpful. Signs for a approaching bottom are present. Neutral for now. Sold Long SPX on 4/5/17 = gain .4%.

Today SPDR Gold Shares (NYSE:GLD) hit above its previous high of late February and GDX is far below it February high; showing GLD is outperforming GDX. This comes to light in the performance of the GDX:GLD ratio. GDX:GLD ratio is having trouble breaking above its March highs. It has been a bullish condition for both gold and gold stocks where GDX:GLD ratio is rising which showing gold stocks are performing gold and the current situation is the other way around. However not all indicators work all the time and that may be the case here. It common for holiday’s to mark turns in the market and Good Friday is April 14 and markets are closed, leaving tomorrow and Thursday the last two trading days this week. Normally volume lightens going into holidays and light volume rallies are bearish. With GDX/GLD ratio not showing strength and volume may drop tomorrow and Thursday, we will keep our powder dry for now. Still looking for buy signal that could develop near the 21.00 range. Sold GDX at 24.33 on 2/22/17 = gain 20.15%; Long GDX on 12/28/16 at 20.25.