East West Bancorp, Inc.’s (NASDAQ:EWBC) second-quarter 2017 earnings of 81 cents per share came in line with the Zacks Consensus Estimate. The reported figure was up 14% year over year.

Higher revenues primarily led to earnings growth. Growth in loans and deposit was a major support. However, a rise in expenses and increase in provisions were the undermining factors.

Net income came in at $118.3 million, up 14.5% year over year.

Performance in Detail

East West Bancorp’s total revenue grew 13.3% from the prior-year quarter to $337.5 million. Moreover, revenues surpassed the Zacks Consensus Estimate by 2.5%.

Net interest income came in at $290.1 million, up 14.4% year over year. Further, net interest margin (NIM) rose 10 basis points (bps) to 3.41%.

Non-interest income climbed 7.1% year over year to $47.4 million. The rise was primarily attributable to letters of credit fees and foreign exchange income, ancillary loan fees and derivative fees.

Non-interest expense was $169.1 million, 13.6% higher than the prior-year quarter. The substantial increase was mainly attributable to higher compensation and employee benefits, computer software expense and amortization of tax credit and other investments.

Efficiency ratio for East West Bancorp came in at 41.33%, down from 44.6% in the prior-year quarter. The decline indicates an increase in profitability.

East West Bancorp’s total loans receivable were $27.2 billion, up 2.8% from the prior quarter. The improvement was primarily driven by higher single-family residential mortgages and growth in commercial loans. Total deposits rose 2% quarter over quarter to $31.2 billion.

Asset Quality

East West Bancorp’s asset quality was mixed. As of Jun 30, 2017, Non-PCI (purchased credit impaired) loans to loans held-for-investment were 0.48%, down from 0.71% as of Jun 30, 2016.

Non-PCI nonperforming assets were $132.9 million, down 25% from the prior-year quarter. Moreover, provision for loan losses rose 75% year over year to $10.7 million.

Capital and Profitability Ratios

East West Bancorp’s capital ratios were strong and well above the minimum regulatory requirement. As of Jun 30, 2017, Tier 1 leverage capital ratio was 9.3%, Tier 1 risk-based capital ratio was 11.3% and total risk-based capital ratio came in at 12.8%.

Further, profitability ratios showed improvement. Return on average assets increased 9 bps year over year to 1.36%. Return on average common equity rose 34 bps year over year to 13.05%.

2017 Guidance

Management expects, NIM will be in the range of 3.35–3.45%. Further, management foresees end-of-period loans to increase at a low double-digit rate and provision for loan losses to remain in the range of $40 million to $50 million. Non-interest expense is projected to increase at a low single-digit rate and the effective tax rate will likely be 26%.

Our Take

East West Bancorp’s revenue growth is commendable. Also, the company’s strong capital position and rising profitability ratios are favorable. The efficiency ratio also dropped by 327 bps which is encouraging.

However, higher expenses and increased provision for loans losses remain major concerns.

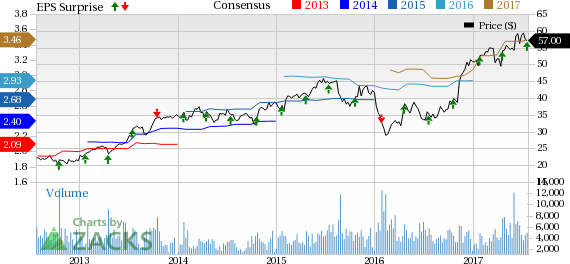

East West Bancorp, Inc. Price, Consensus and EPS Surprise

At present, East West Bancorp has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other firms in the finance space, First Interstate Bancsystem Inc. (NASDAQ:FIBK) and UMB Financial Corporation (NASDAQ:UMBF) are scheduled to report their second-quarter 2017 results on Jul 26, while Hope Bancorp, Inc. (NASDAQ:HOPE) is slated to release earnings results on Jul 25.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

UMB Financial Corporation (UMBF): Free Stock Analysis Report

First Interstate BancSystem, Inc. (FIBK): Free Stock Analysis Report

East West Bancorp, Inc. (EWBC): Free Stock Analysis Report

Hope Bancorp, Inc. (HOPE): Free Stock Analysis Report

Original post

Zacks Investment Research