One of the groups we’ve avoided for clients the last few years has been the “yield” or dividend trade.

Chasing yield seemed like the proverbial “overcrowded” trade whether it was in the fixed-income or equity space, as evidenced by the Utility sector, which rose 16.1% YTD as of 9/30/16, even though “Ute’s” were down 5.6% in the 3rd quarter alone. Retail investors continued to pour money into fixed-income funds, even into this summer, despite rock-bottom yields.

That won’t end well in my opinion.

Utilities and Telecom are symptomatic of the chase for yield.

This is a big week for banks, at least the big ones like JPM, C, WFC and PNC, all of which report 3rd-quarter earnings on Friday.

If we had been chasing yields, in terms of the dividend trade, I’d be swapping into the Financial sector today.

JP Morgan (JPM) remains our favorite financial for a number of reasons:

- Within JPM, investors get the benefit of a combination of the traditional commercial bank and brokerage aspects

- JPM is a good combo as well of retail and business/industrial lending

- Jamie Dimon – Dimon in my opinion is one of the best CEOs in Financial services today.

Pay attention to JPM revenue growth in the 3rd quarter of 2016 (which has seen upward revisions, and to 2016 and 2017 revenue estimates.)

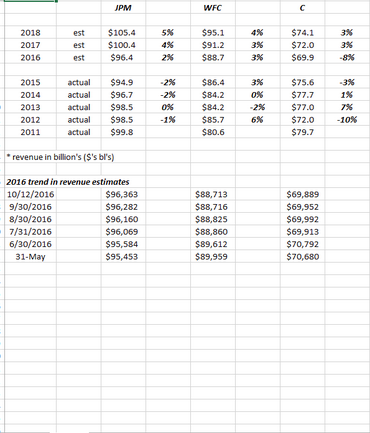

Rather than attach the Excel spreadsheet (estimates courtesy of Thomson Reuters as of 10/12/2016), the above shows the history of JPM’s, WFC’s and C’s revenue over last 5 years as well as the trend in expected full-year 2016 revenue.

JP Morgan is starting to see upward revisions to forward revenue, while slight downward pressure remains on Wells and Citi. (It was surprising to me, getting into the numbers after the Wells cross-selling fiasco, the revenue number hasnt been pressured to a greater degree.)

The banks – both regionals and the money-centers – had a strong 3rd quarter 2016 in terms of performance relative to the S&P 500.

Usually quarterly earnings reports and the subsequent revisions have been a time to shed the group.

If you have been in the “yield-chasing” sectors, you might want to look at banks and Financials as a defensive group.

A steepening yield curve (not necessarily higher short-term rates) should help the group from a sentiment perspective.

Ultimately, though, I think the election could help Financials more.

Our Top-4 Financial Holdings

Technology and Financials had a tough start to 2016, through June 30, but since Brexit, both sectors have performed well.

I do think some of the Dodd-Frank restrictions and some of the regulation must ebb for the Financial sector to generate some revenue growth.

(The opinions rendered here, are just that – opinions – and along with positions can change at any time. However the expectation currently is to hold these positions through Q3 ’16 earnings and through year-end ’16.)