Options Traders Have Been Call-Skewed Towards CAT

Heavy machinery concern Caterpillar (NYSE:CAT) is up 0.1% at $143.15, as the company prepares to release earnings next week. Specifically, Caterpillar is slated to report second-quarter earnings before the open on Monday, July 30. Below, we will take a look at how CAT stock has been faring on the charts ahead of the release.

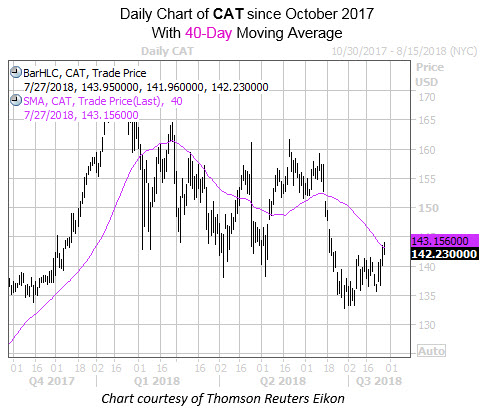

Caterpillar has been moving lower since its mid-January highs near $173, seeing its most recent breakout attempt capped by the resistance of the 40-day moving average. However, the $135 level has acted as a floor of support for the shares of late and at last check, CAT is up 24% year-over-year.

Digging into its earnings history, CAT stock has closed higher the day after five of the company's last eight earnings reports, but fell 6.2% back in April. On average, the shares have moved 4% in the post-earnings session over this two-year time frame, regardless of direction. This time around, the options market is pricing in a slightly larger-than-usual 5.4% next-day move for Monday's trading.

In the options pits, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows a 10-day call/put volume ratio of 1.79, ranking in the 92nd percentile of its annual range. This suggests calls have been bought over puts at a faster-than-usual clip during the past two weeks.

Echoing this, Caterpillar stock's short-term traders are more call-skewed than usual, with its Schaeffer's put/call open interest ratio (SOIR) of 0.77 ranking in the 3rd percentile of its annual range. This indicates that near-term call open interest outweighs put open interest by a wider-than-usual margin right now.

Lastly, CAT's Schaeffer's Volatility Scorecard (SVS) comes in at an 85 out of a possible 100. This indicates that the stock has tended to make outsized moves relative to what the options market has priced in over the past year. This could be a boon to those buying premium on the Dow name.