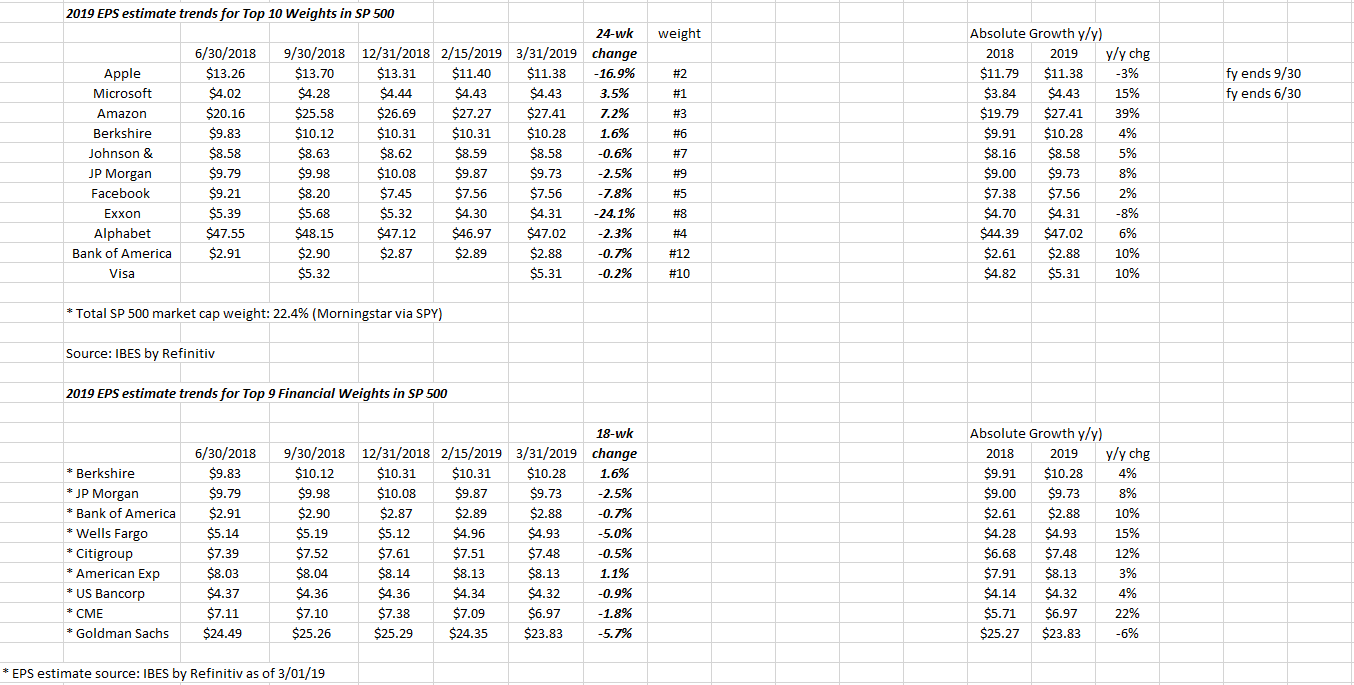

2019 EPS estimates for the top ten stocks in the S&P 500:

Visa (NYSE:V) has joined the top ten, while Bank of America (NYSE:BAC) fell to twelfth place in the S&P 500 and Procter & Gamble Company (NYSE:PG) climbed to eleventh place.

What’s interesting is that Tech as a sector – per the IBES Refinitiv data – is expecting -6.1% y/y earnings growth for Q1 ’19, a lot of which could be Apple (NASDAQ:AAPL) since with the reconfigured Tech sector, Apple is now 20% of the sector by market cap, and Apple is expecting -3% EPS growth for 2019, but Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN) and Facebook (NASDAQ:FB) are all expecting positive y/y earnings growth and in the case of Microsoft and Amazon, 15% and 39% y/y EPS growth respectively, i.e. well above “tech sector” growth.

Exxon (NYSE:XOM) currently has a larger market cap than JPMorgan Chase & Co (NYSE:JPM), not by much, but it tells you how far Financial’s have sunk the last 15 months.

The top 10 weightings in the S&P 500 now comprise 22.4% of the benchmark.