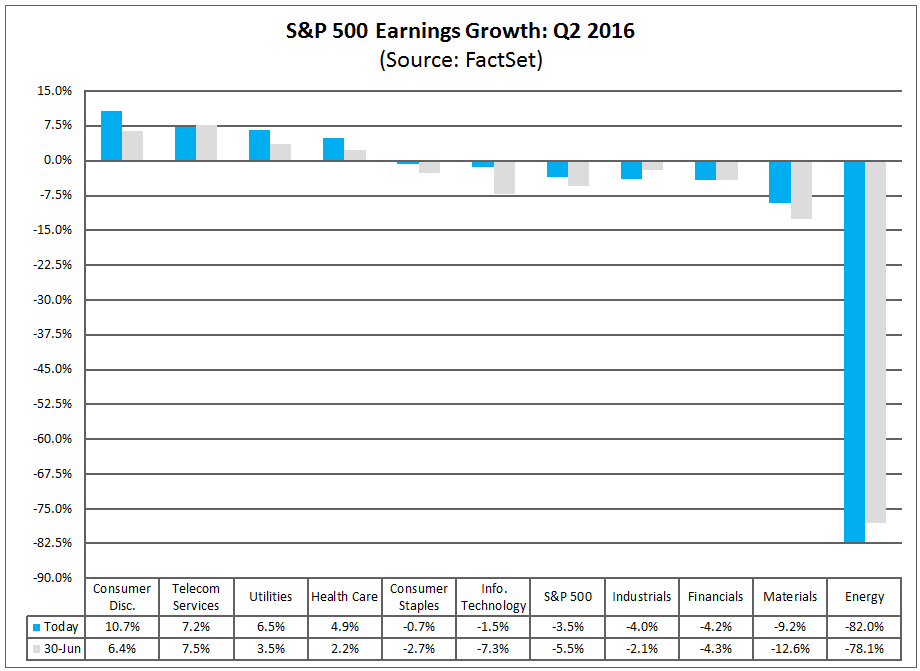

Surprise, surprise, the second quarter earnings season is again producing better than expected overall results. Analysts’ earnings growth estimates for the S&P 500 are now somewhere around -3.5%, an improvement from the previous 5.5% – the earnings contraction is decelerating.

It should be noted, however, that even with massive stock buy-backs and acquisitions, earnings per share continue to shrink. In July, a Wall Street Journal article reported that “companies in the S&P 500 bought back $161.39 billion of shares during the first three months of the year, the second-biggest quarter for repurchases ever”.

Howard Silverblatt, S&P Senior Index Analyst calculates that approximately 67% of the companies in the index have a lower share count than a year ago. Buybacks have played an important role in re-shaping earnings per share metrics and lifting stock prices but one can’t help but wonder how long this can last.

Although there are some companies yet to report, energy companies in the index have all announced and, as expected, had the largest negative impact on index earnings. S&P Global has energy sector earnings down by almost 87% while Factset is a tad more optimistic.

Not surprisingly, upstream companies (exploration and production) were the worst performers. Ex-energy, S&P Capital IQ calculates that earnings in the quarter would have been up approximately 3%. Earnings for Materials and Financials also fell.

It should be noted that beginning September 1st, Real Estate Investment Trusts (REITs) will be separated from the Financials group and moved to their own sector. The search for yield and strength in commercial and residential real estate have benefited REITs, the best performing industry in Financials (+14% for the past 52 weeks as of 8/11/16). In fact, with the exception of Diversified Financial companies (+4% for the same period), all other financial industry classifications have negative returns.

As we mentioned in last month’s piece, Industrials are an interesting sector because of the disparate industries. There are fourteen industries ranging from Aerospace & Defense, Construction-related, Professional Services and Transportation. Some of these, such as railroads, are experiencing headwinds, while others – defense companies come to mind – are seeing earnings and revenue growth.

With the majority of reports in, there seems to be a large discrepancy between calculations of year-over-year earnings growth for this sector in particular. FactSet (mix of GAAP and non-GAAP, but mostly non-GAAP submitted by analysts) has Industrials reporting declining earnings while S&P Capital IQ has a positive (Operating Earnings) EPS growth number, as does Thomson Reuters.