There’s no sign of an imminent recession in the latest earnings reporting season. With more than 90% of the S&P 500 companies having already reported their earnings for Q2, here's the scorecard.

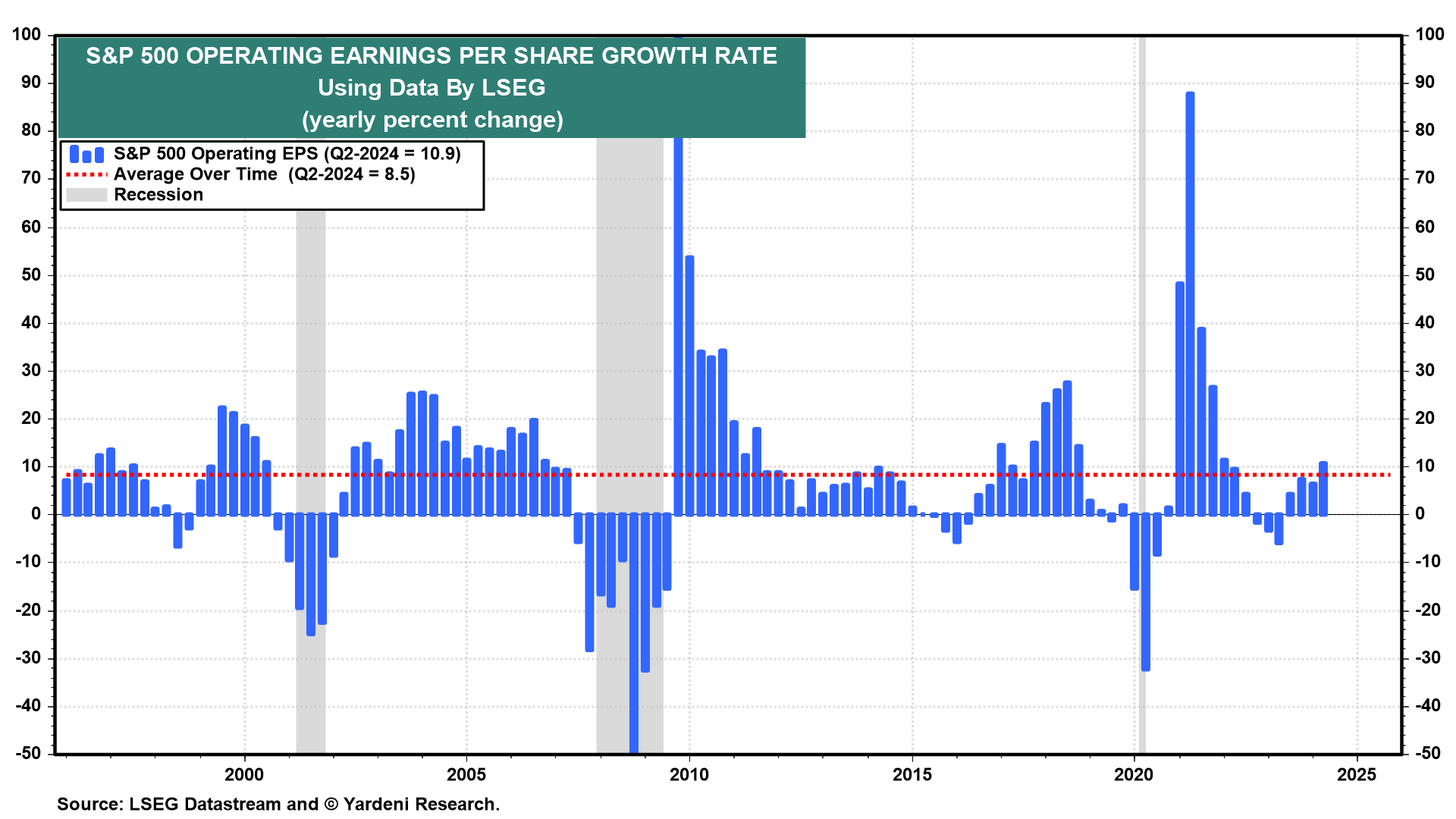

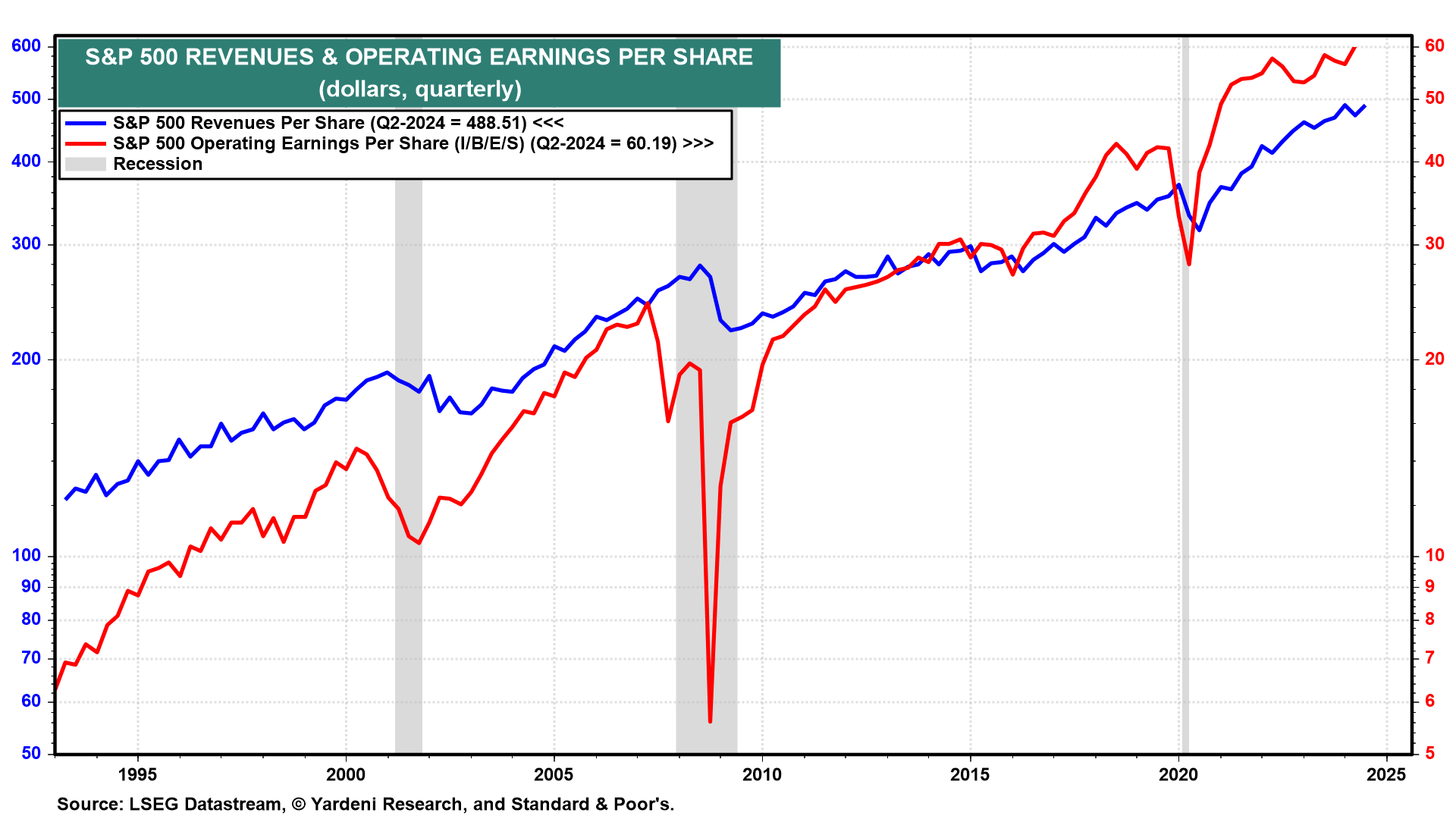

S&P 500 operating earnings per share (EPS) rose 10.9% y/y during the quarter to a record high of $60.19.

Now, here’s more related happy news:

1. Quarterly earnings

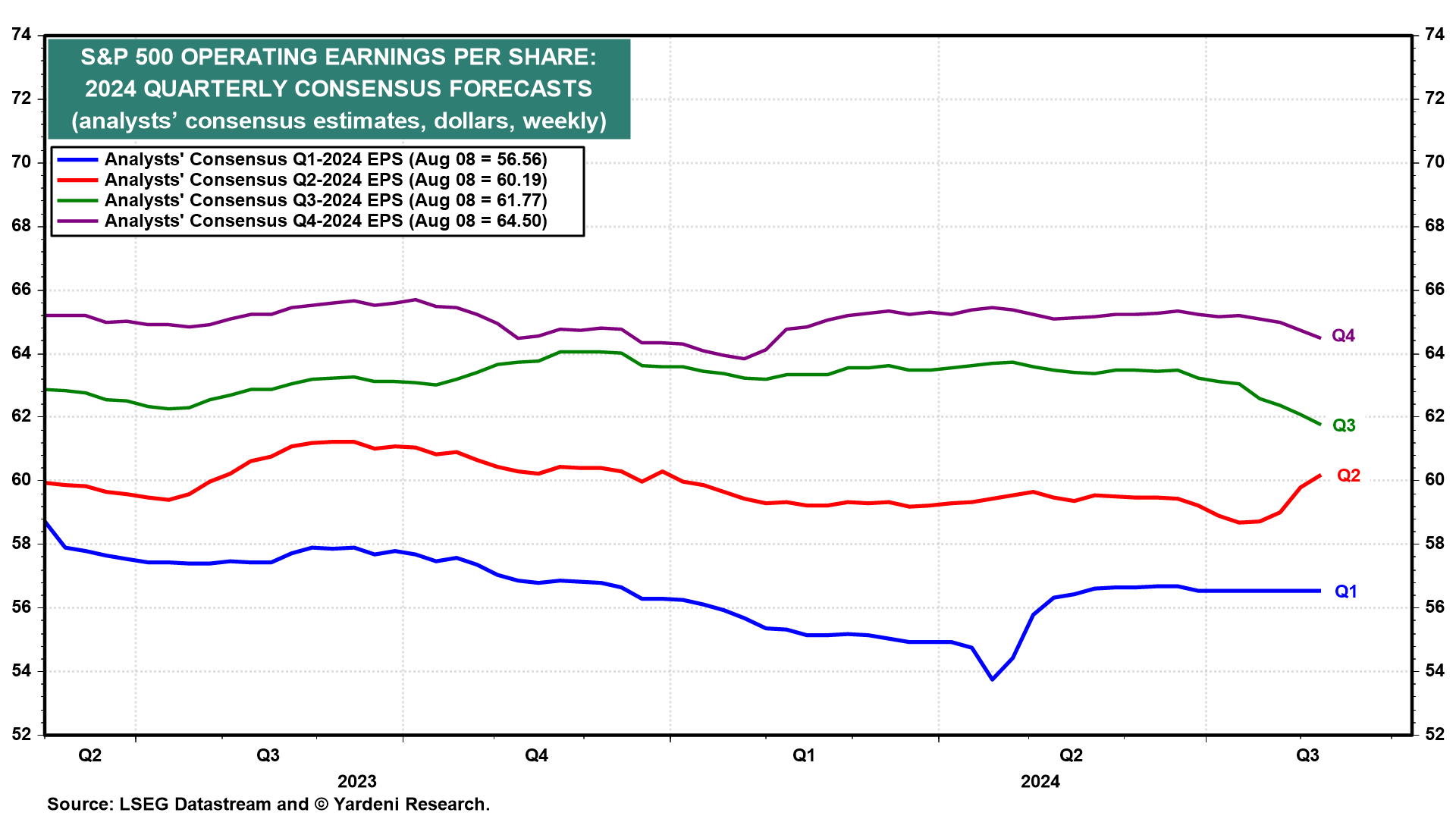

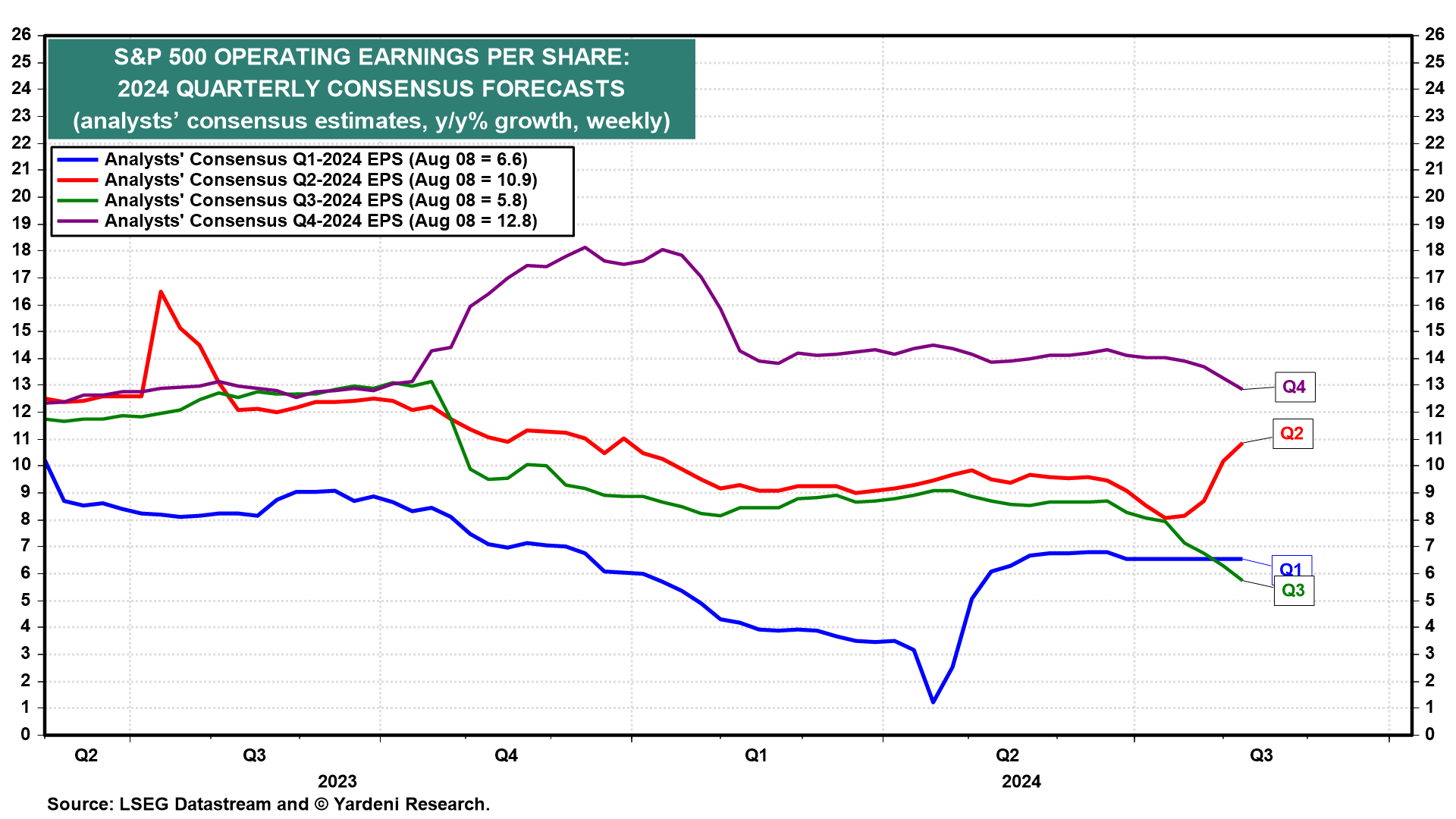

Just before the start of the Q2 earnings reporting season, during the week of June 28, the analysts’ consensus forecast had implied an 9.1% increase in Q2 EPS.

However, company managements must have provided lots of negative guidance because the Q3 EPS consensus dropped 2.7% to $61.77 over this same period, and the y/y growth forecast fell from 8.3% to 5.8%.

2. Annual earnings

Nevertheless, the 2024 annual consensus earnings estimate remained flat during the latest earnings reporting season and is currently $243.51 per share.

The 2025 consensus estimate likewise remained flat; it’s currently $279.52, up 15% from the 2024 estimate. The 2026 estimate dipped during the August 8 week to $315.40, up 13% from the 2025 estimate.

3. No recession

Again, there’s no recession evident in either Q2’s record earnings or in analysts’ consensus earnings estimates through 2026. We’ve previously observed that industry analysts don’t have a good track record of calling recessions.

That’s our job as economists and strategists. We correctly pushed back against the consensus recession forecast in 2022 and 2023. We are doing so again this year. We might even do so over the next two years.

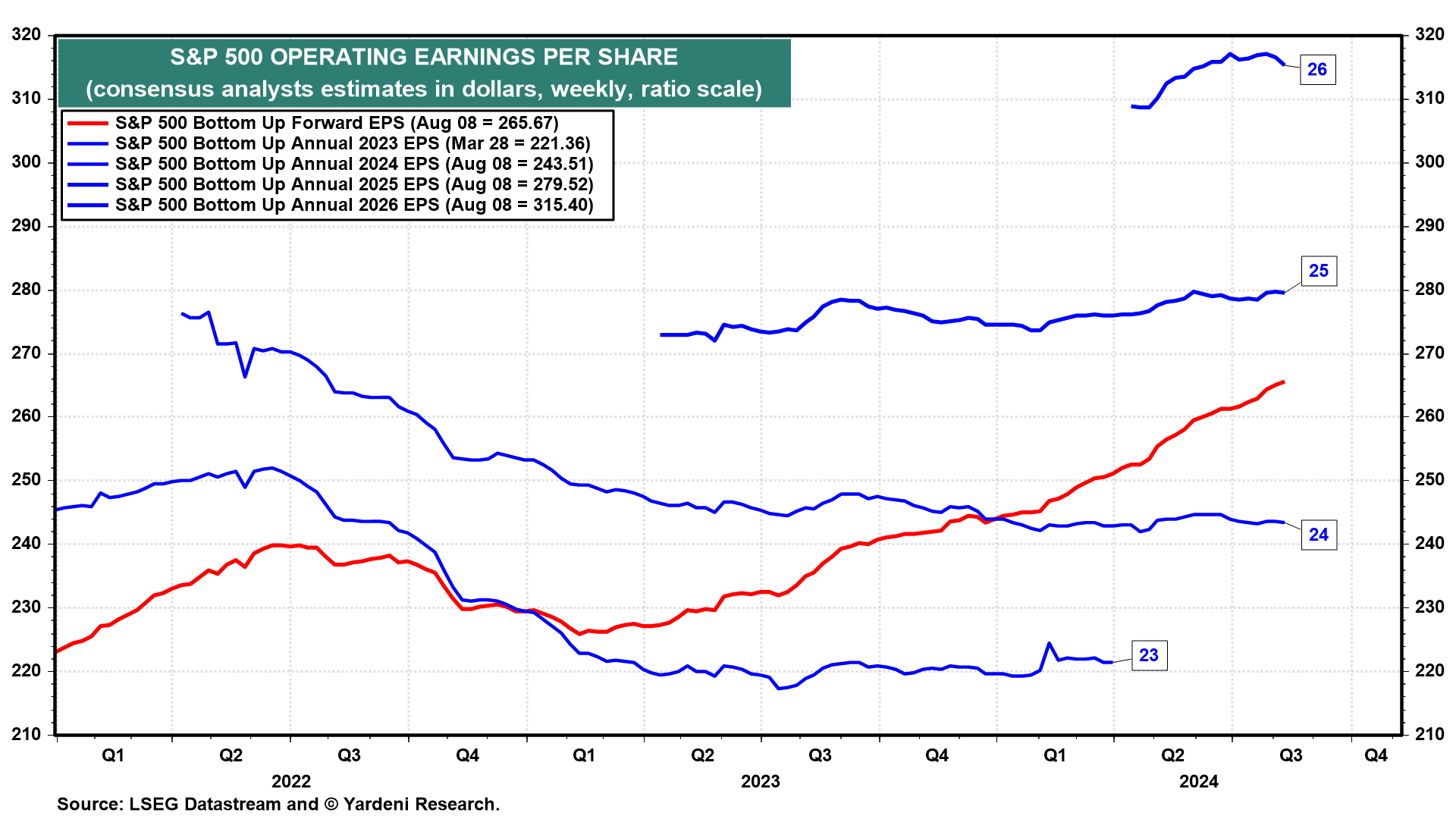

4. Forward earnings

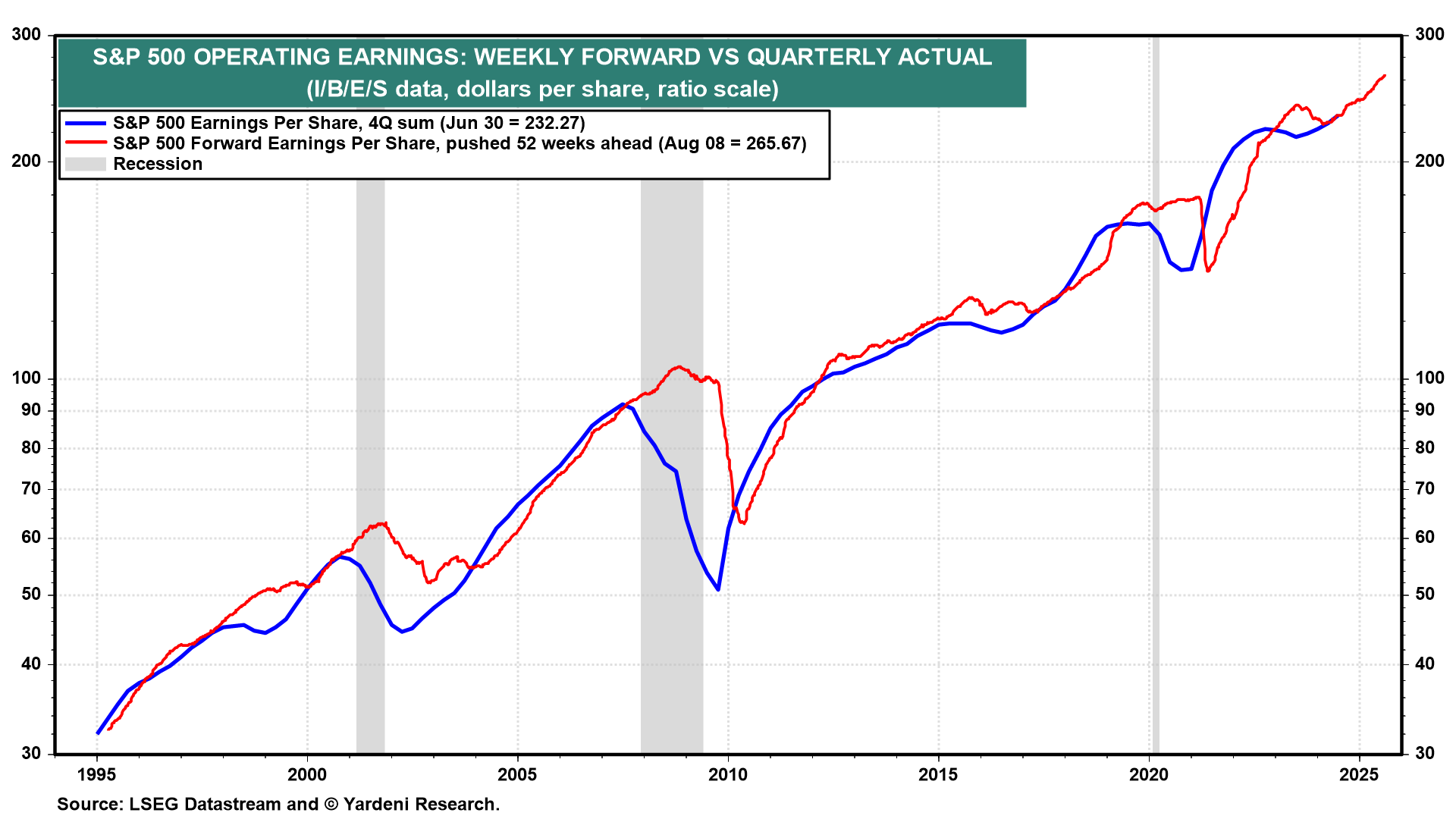

Meanwhile, if the no-show recession continues not to show up, S&P 500 forward EPS should continue to be a bullish leading indicator for actual EPS as well as for the economy. Forward earnings rose to yet another record-high $265.67 during the August 8 week.

It is a year-ahead leading indicator of four-quarter trailing earnings, which was $232.27 through Q2; we calculate forward earnings as a time-weighted average of analysts’ annual EPS consensus estimates for the current and coming year.

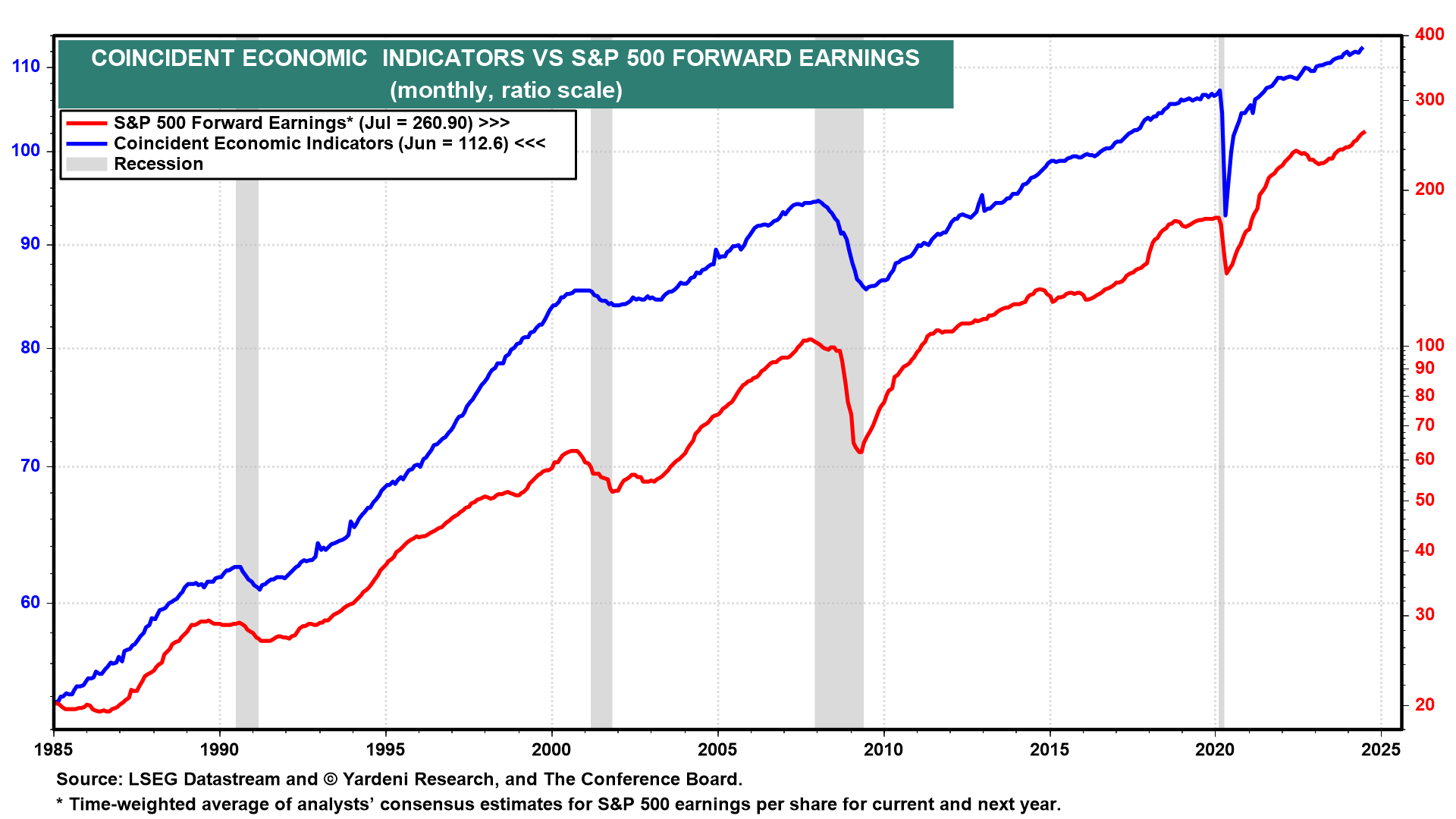

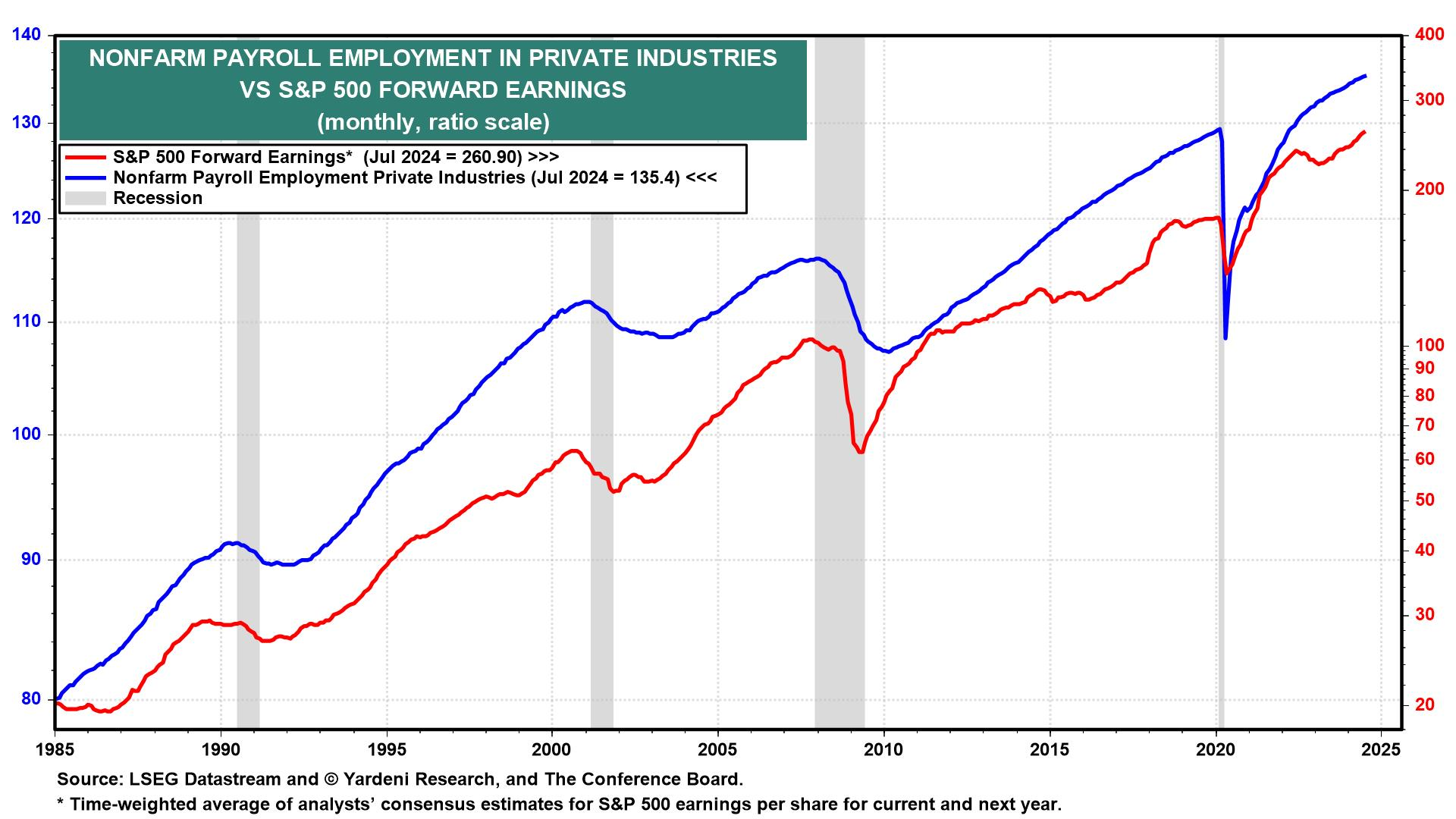

As we’ve previously observed, forward earnings is also highly correlated with both the Index of Coincident Indicators (CEI) and payroll employment, which is one of the CEI’s four components.

That makes sense since profitable companies tend to expand their payrolls, while unprofitable ones tend to cut their headcounts.

5. Revenues and profit margins

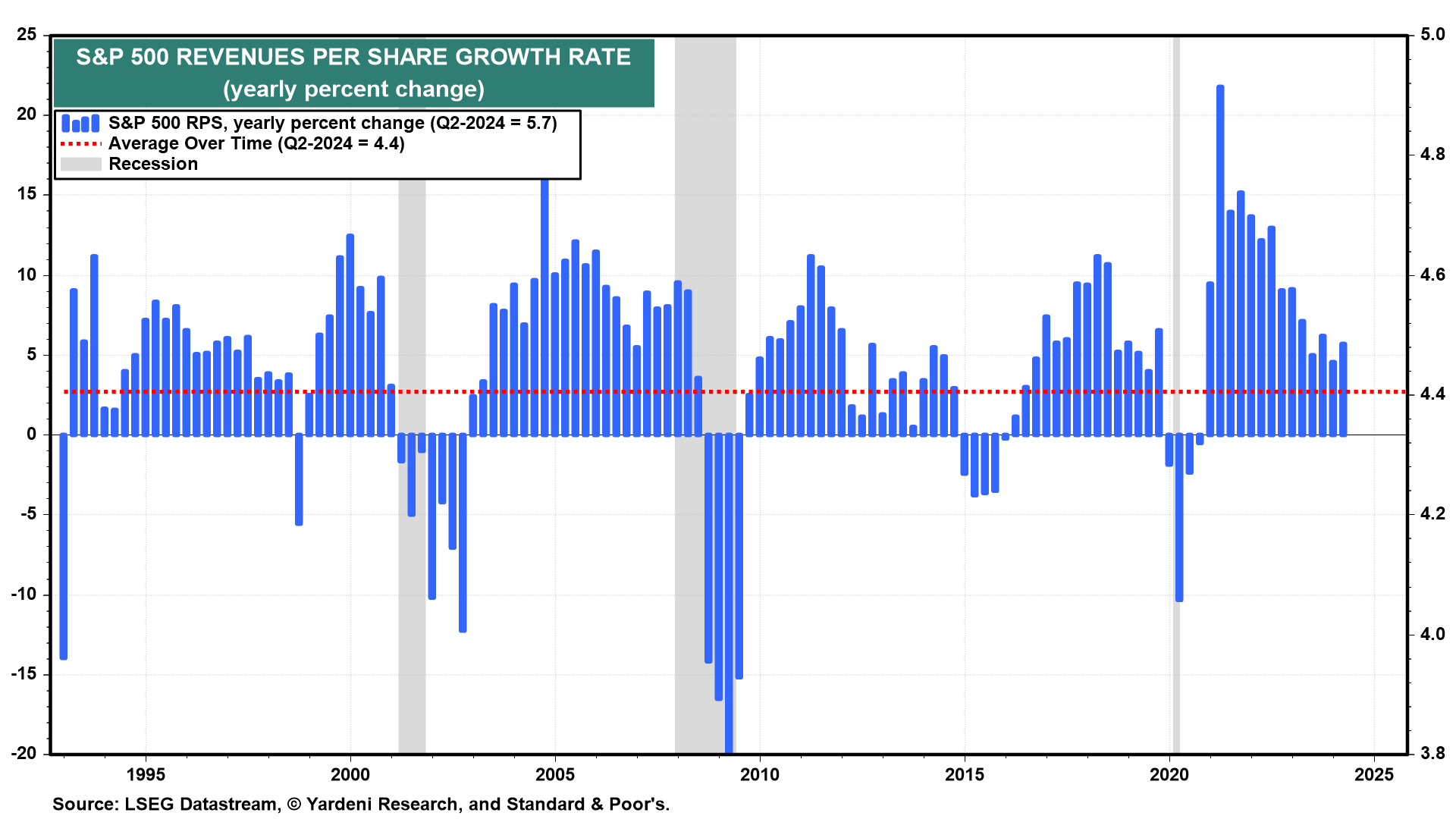

During Q2, S&P 500 revenues per share (RPS) rose 5.7% y/y.

That pace is likely to slow as inflation continues to moderate. In any event, RPS nearly matched its record high during Q4-2023.

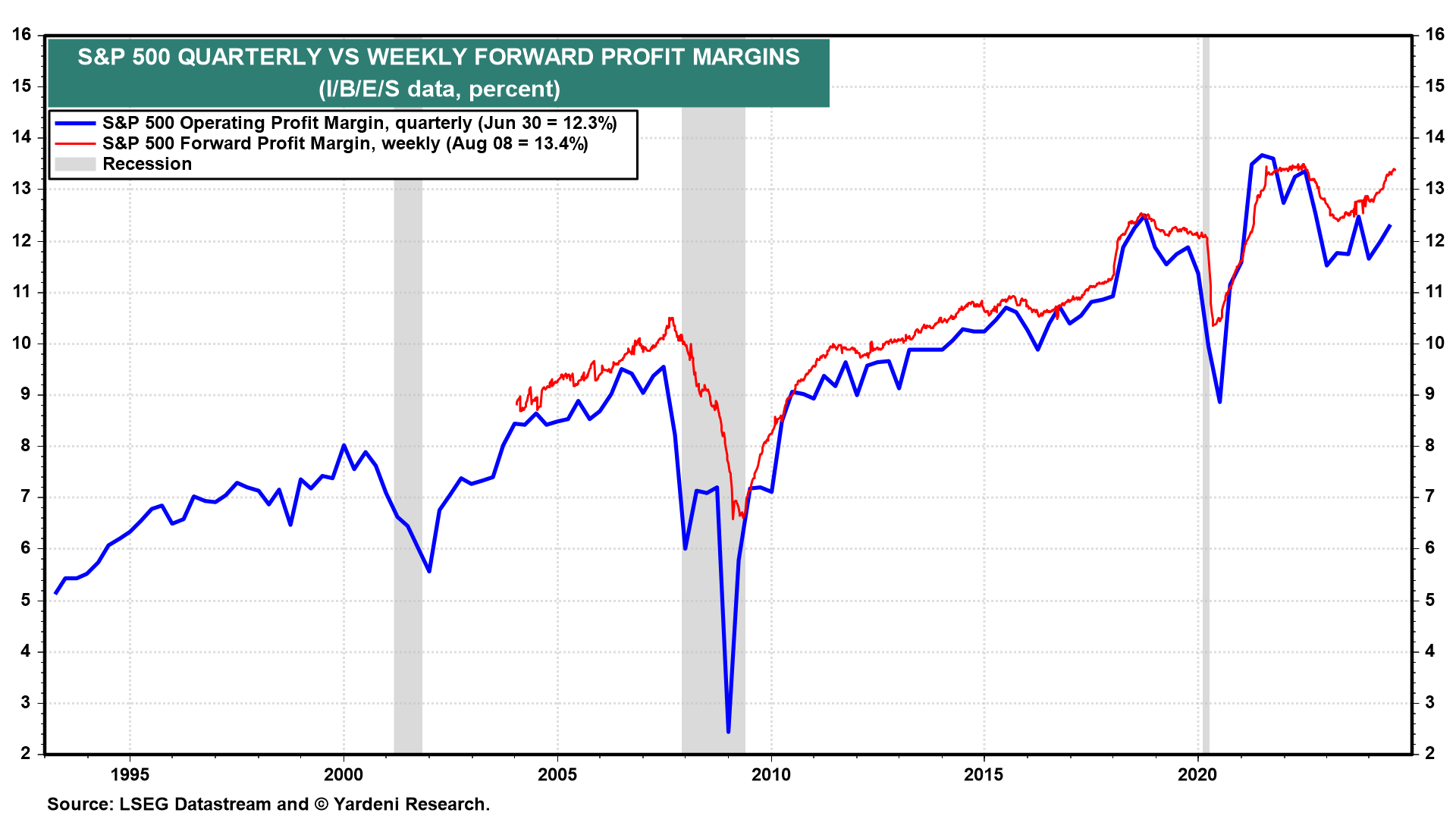

The S&P 500 profit margin rose to 12.3% during Q2. That’s still below its record high of 13.7% during Q2-2021.

The weekly S&P 500 forward profit margin rose to 13.4% during the August 8 week, matching its record high of 13.4% during the June 9 week of 2022.

That augurs well for the actual profit margin, which we expect will be rising to new record highs over the next few years in our Roaring 2020s scenario, which hinges on a technology-led productivity growth boom.