As we approach the earnings season, investor sentiment is cautiously optimistic, particularly within the financial sector. Market dynamics have shifted significantly over the past year, leading to subdued expectations among analysts and investors alike.

Bank of America Earnings Preview

Bank of America (NYSE:BAC) is set to release its third-quarter 2024 earnings on Tuesday morning, October 16, 2024. Consensus estimates project earnings per share (EPS) of $0.77 on net revenues of $28.3 billion, reflecting a year-over-year decline of 14% with flat revenue growth.

To say the sell-side has subdued expectations for Bank of America is an understatement, although this preview of the financial sector numbers were also subdued, given the challenging comparisons with 2023. However, low expectations can often work in favor of stocks, particularly in a bullish equity market.

One encouraging sign for BAC, in my opinion, is its resilience following Berkshire Hathaway’s decision to reduce its stake in the bank. As per the mainstream financial media, Mr. Buffett has reduced their BAC position to under 10% of outstanding shares.

Two primary concerns have impacted Bank of America over recent years: a liability-sensitive balance sheet and issues surrounding expense management. A liability-sensitive balance sheet means that BAC’s liabilities have re-priced faster than its assets, which poses challenges amid rising Fed funds rates and a yield curve that saw higher yields from early 2022 through late 2023. Additionally, there has been a consistent demand from sell-side for improved expense control (let’s put it that way).

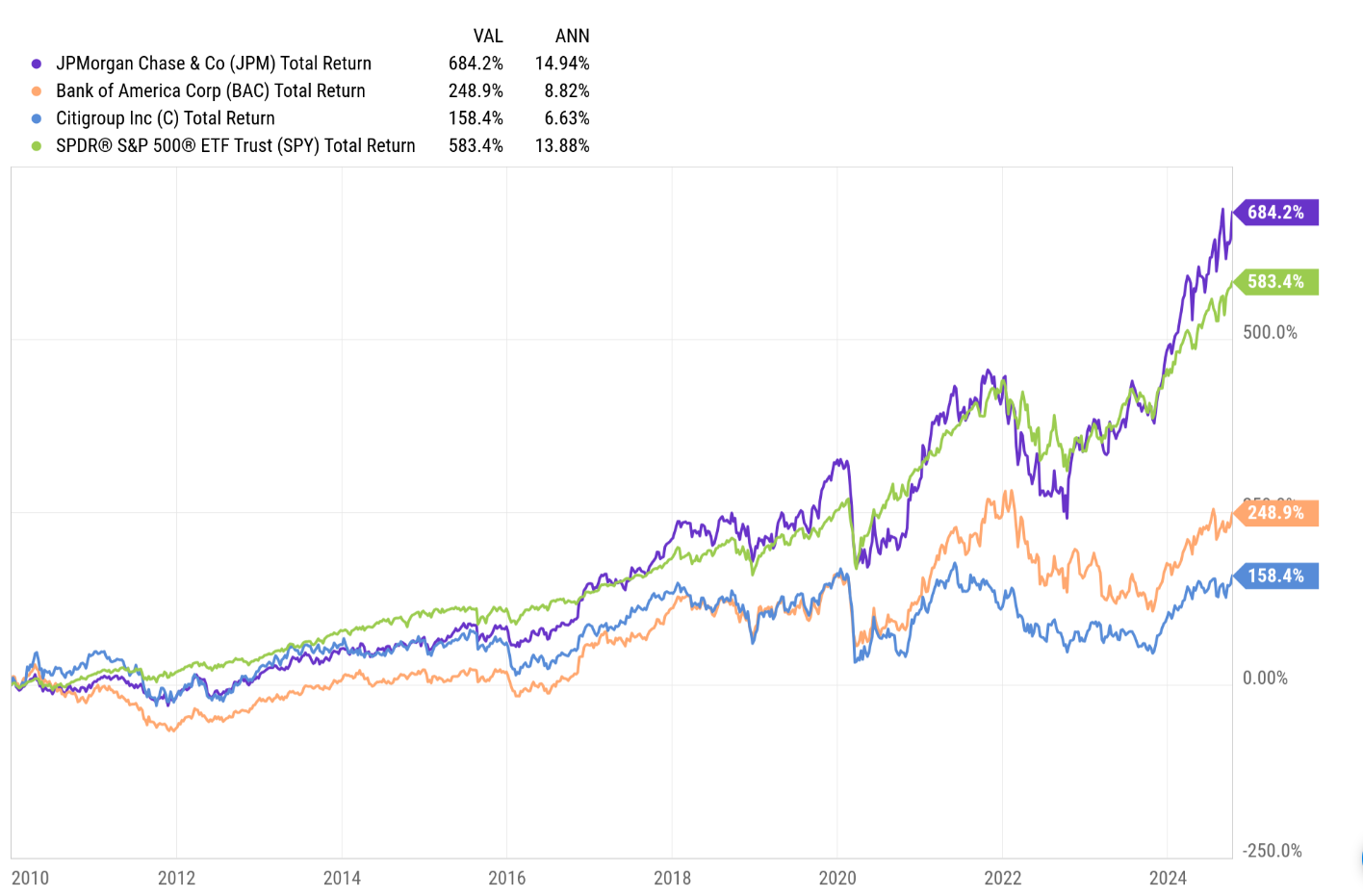

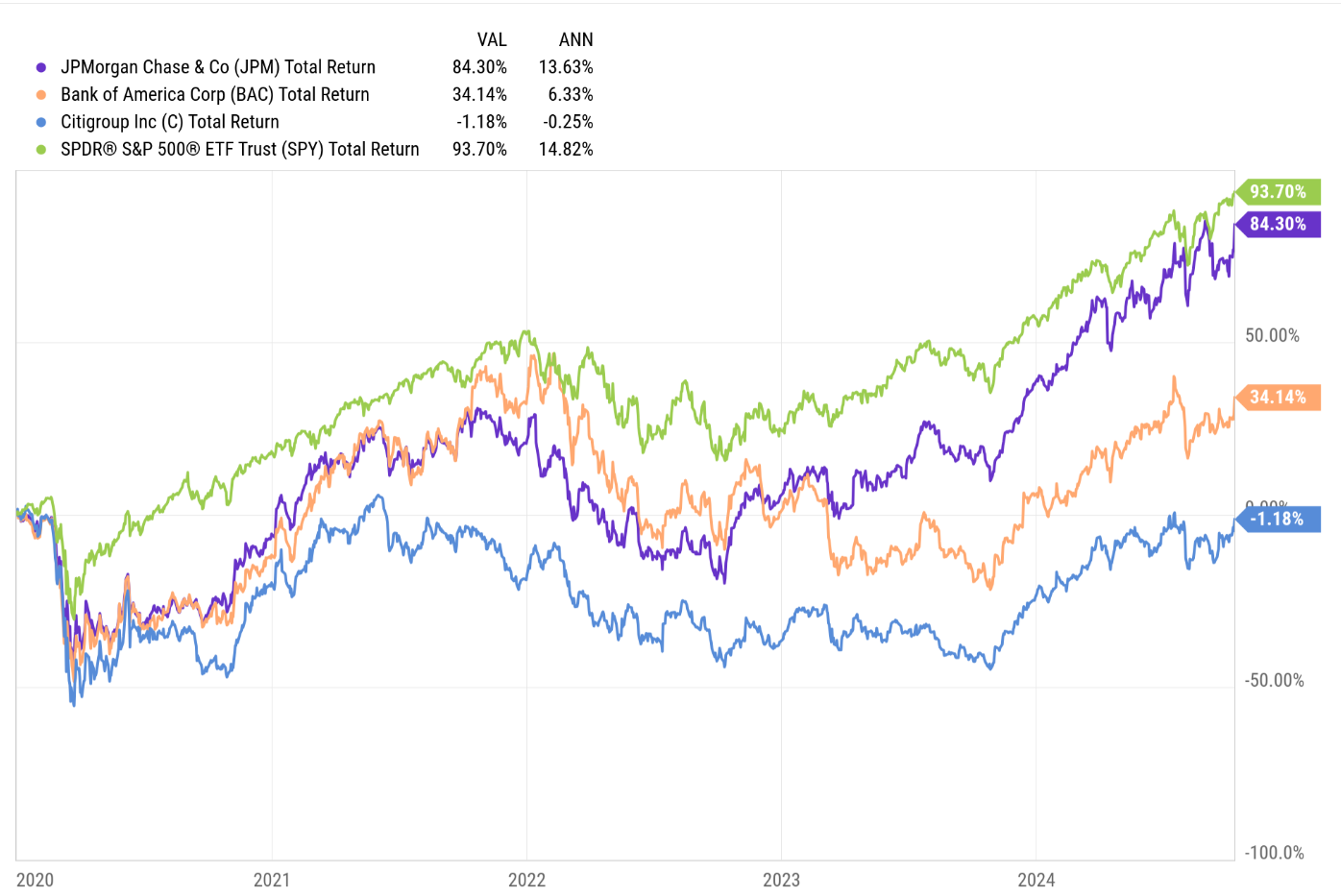

Here are the longer term performance charts of our favorite banks:

Looking back to 1/1/2010, only JPMorgan (NYSE:JPM) is beating the S&P 500 (SPY).

Since 1/1/2020, none of the above bank stocks have managed to beat the S&P 500 (SPY).

As you’d expect, JP Morgan’s total return is pretty close to the S&P 500’s this decade, as of 10/11/24.

Valuation Insights

For the full year of 2024, Bank of America anticipates 1% revenue growth and a 6% decline in EPS, suggesting a relatively contained performance for the banking giant. However, consensus forecasts for 2025 to 2027 project a more optimistic outlook, with expected revenue growth of 5% and EPS growth between 13% and 15%.

Currently, at $42 per share, BAC is trading at 13x the expected 2024 EPS of $3.21. With a three-year average PE of 12x, EPS growth is anticipated to average 7%

Trading at 1.2x book value and 1.7x tangible book value (TBV), Bank of America is valued more modestly on a book basis than JPMorgan, yet not as cheaply as Citigroup (NYSE:C), which will follow this earnings preview.

BAC also boasts a lower teens ROTCE (return on tangible common equity), significantly lower than JPMorgan's, but higher than Citigroup's.

BAC’s stock price peaked in early 2022 at $50 per share in January and again in February. A favorable market for financial stocks could allow it to reach those levels again.

Citigroup Earnings Preview

When Citigroup reports its third quarter 2024 financial results on Tuesday morning, October 16th, analyst consensus anticipates $1.31 in EPS on $19.8 billion in net revenue, reflecting year-over-year declines of -14% and -1%, respectively.

In the second quarter of 2024, Citigroup achieved net revenue growth of +3% and EPS growth of +14%. CEO Jane Fraser is working to reduce headcount, with Citigroup's total headcount at 229,000 in the second quarter, down from a peak of 240,000 but higher than 220,000 in December 2020. There are conflicting reports regarding future headcount changes, with some suggesting reductions are complete while others indicate more may come.

Regarding relative sector performance, Citigroup has been a significant laggard over both the 14-year and 4-year total return periods, although Jane Fraser has begun operational improvements. Citigroup’s ROTCE is lower than BAC’s and well below JPMorgan’s, but its book value positions it as the cheapest among the larger banks.

As of the June 2024 quarter, Citigroup’s book value (BV) was $99.70 per share, while its tangible book value (TBV) stood at $87.50 per share, resulting in Citigroup trading at 0.66x BV and 0.76x TBV at that time.

The expected ROTCE for Citigroup (per Morningstar) is projected to be 10% to 12%, showing improvement from Citigroup’s historical 7%.

Conclusion

Many major banks (including regionals) have not reached new all-time highs since 2021 due to the impact of fed funds rate hikes on their balance sheets. If BAC can surpass $55 (the 2006 high), it will establish a new all-time high; similarly, if Citi can trade above $80 (the mid-2021 high), it too will have made a post-2008 new high.

While JPMorgan remains the standout performer, from a portfolio construction perspective, BAC and Citi can provide a defensive element within financial services allocations. Both banks have emphasized the need for better expense control in their 2024 and 2025 expectations, which is an area under management’s control for incremental EPS growth.

Expected EPS growth for both banks is anticipated to be stronger in 2025 and 2026 compared to 2024, but we will need to await further guidance in January 2025.

The fact is both BAC and Citi are less-momentumy (not a great word) than JPM, making them potentially more resilient during a market correction of 15% to 20%. Both stocks recently increased their dividends, with Citigroup now offering a 3.25% yield.

The current environment is nearly ideal for larger banks, which faced significant challenges during the 2008 crisis. With solid consumer credit activity, corporate loan growth in the 3% to 4% range, net interest income benefiting from rate hikes, higher net interest margins, and robust capital market activity—especially in the bond sector as credit spreads remain tight—banks are positioned well. The only concern on the capital market front is the lack of an IPO market, which has been smaller than anticipated given the strength in U.S. equity markets.

Disclaimer: None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. Investing can and does involve the loss of principal, even for short periods of time. All EPS and revenue estimates are sourced from LSEG.