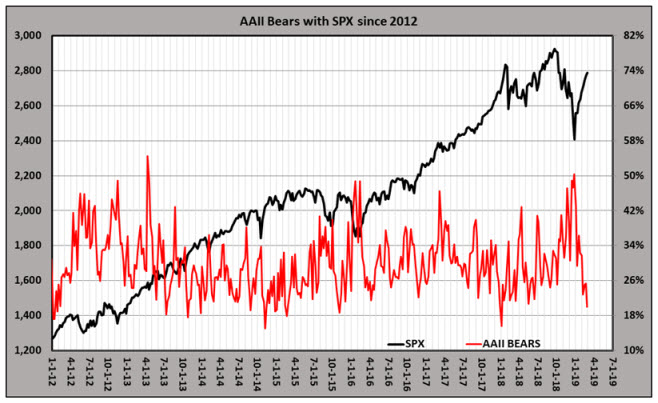

Just a few short weeks ago, the majority of American Association of Individual Investors (AAII) respondents considered themselves bearish on the stock market. However, in the wake of the epic 2019 rally thus far, AAII bears have gone into hibernation, now accounting for just 20% of respondents. That's a bearish exodus Wall Street hasn't seen since 2009, according to Schaeffer's Quantitative Analyst Chris Prybal. Here's what that could mean for the S&P 500 Index (SPX), if history is any indicator.

Specifically, in the week ended Feb. 28, AAII bearish respondents -- defined as individual investors who feel the stock market will move lower in the next six months -- dropped another 5.4 percentage points, to 20%. That marks the lowest reading since Jan. 3, 2018. Bullish respondents make up 41.6% of AAII investors, and the other 38.4% of respondents are neutral. The bulls-minus-bears line is at 21.6%, which is the highest since June 2018.

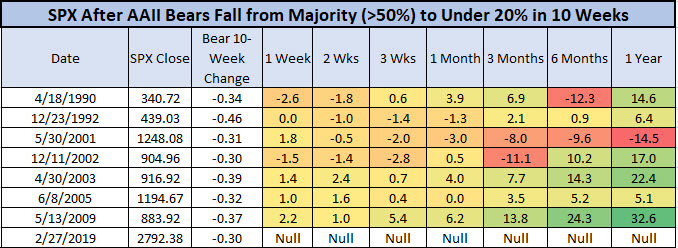

As alluded to earlier, the last time AAII bears went from at least 50% to 20% in a 10-week span was in May 2009, shortly after the March 2009 bottom. Prior to that, you'd have to go back to mid-2005 for such an exodus of bearish investors. Since 1990, there have been just eight of these sentiment signals (considering only one signal per month).

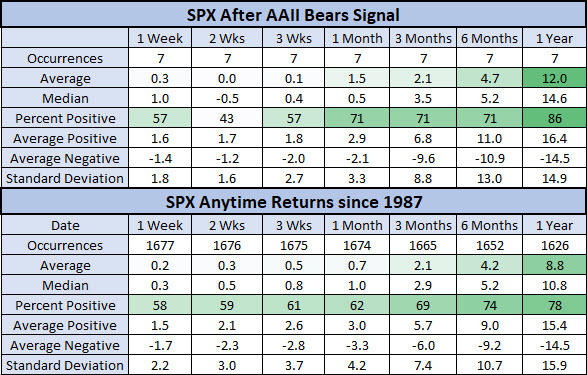

S&P 500 returns after these signals are in line with or slightly below the norm, until you get one month out. A month after AAII bears go into hiding, the SPX was up 1.5%, on average, and higher 71% of the time. That's nearly double the average anytime one-month return of 0.7%, with a win rate of 62%. Six months later, the index was up a slightly better-than-usual 4.7%, and one year later, the SPX was up a whopping 12%, on average, and higher 86% of the time. For comparison, since 1987, the SPX has averaged an annual gain of just 8.8%, with a 78% positive rate.

In conclusion, the sudden rush of optimism that's accompanied the 2019 rally in stocks might now unwind in the form of a slower, choppy few weeks -- particularly with the likes of S&P 2,800 nearby. However, while the sample size is relatively small, history indicates stocks could extend their journey higher in the second quarter and beyond.