DuPont (NYSE:DD) entered into a definitive agreement to purchase San Francisco-based Granular, Inc. The deal is expected to close in the third quarter of 2017, subjected to customary closing conditions. Terms of the agreement were not divulged.

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research

Founded in 2014, Granular helps farmers to operate more efficiently and thereby drive profits. The company caters many of the farms in the industry in the U.S., Canada and Australia. Granular is a leading provider of software and analytics tools that help farms improve efficiency, profitability and sustainability. The company generates tremendous value for growers, farming nearly 2 million acres of commodity and specialty crops.

DuPont is focused on developing innovative solutions to help farmers build strong, sustainable businesses. It is creating a digital agriculture ecosystem to support information sharing, services and commerce. The buyout of Granular will allow the business to connect farmers, analytics and public and private data to progress toward a digitally connected, more sustainable agriculture industry.

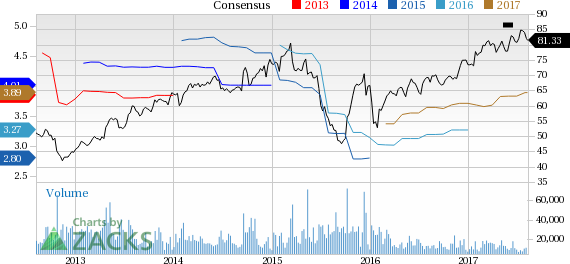

DuPont has underperformed the industry it belongs to over a year. The company’s shares have moved up 17.9% over this period, compared with the industry’s gain of around 18.4%.

DuPont is well placed to gain from its cost-cutting and productivity improvement measures and new product launches. The company has numerous new products in its pipeline that are expected to create value for its customers.

Moreover, the proposed mega-merger with Dow Chemical (NYSE:DOW) is expected to deliver cost synergies of around $3 billion and growth synergies of roughly $1 billion. The companies expect the closing of the merger to take place on Aug 31.

E.I. du Pont de Nemours and Company Price and Consensus

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research