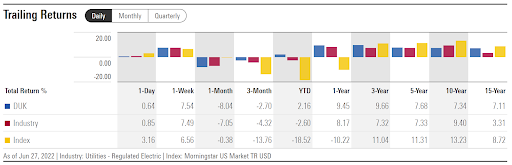

- DUK has outperformed peers over the past year.

- The company is well-positioned for long-term growth.

- Consensus outlook is bullish, with expected total return of 13% over next 12 months.

- The market-implied outlook continues to be bullish.

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

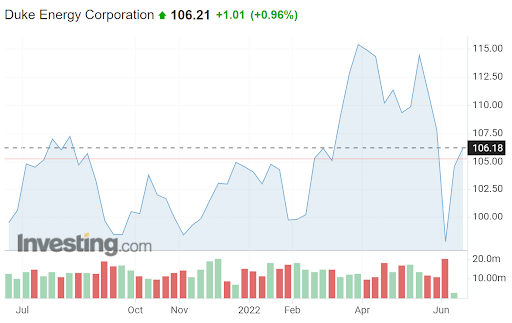

Duke Energy (NYSE:DUK) is the second-largest U.S. utility by market capitalization and serves 8.2 million electricity customers and 1.6 million natural gas customers. After reaching a 12-month high closing price of $115.43 on April 20, DUK fell 15.3% to close at $97.82 on June 17. The decline was largely due to growing fears that rising interest rates would continue. The 10-year Treasury yield has risen from 1.7% at the start of March to 2.9% on April 19th, an increase of 70% in less than two months.

Source: Investing.com

Utility stocks are expected to perform poorly in rising rate environments for two reasons. First, utilities tend to carry considerable debt and higher rates, making refinancing more expensive. Second, higher bond yields make bond income more attractive relative to utility dividends, so income-seeking investors are more likely to move assets from utility stocks to bonds. While DUK has sold off in recent months on investor concerns about the Fed response to high inflation, the shares have performed very well over the past 12 months, a period when the 10-year Treasury yield has risen 96%. DUK has returned a total of 9.5% over this period, as compared with 8.2% for the electric utility industry as a whole (as defined by Morningstar) and -11.2% for the U.S. equity market.

Source: Morningstar

DUK’s outperformance is attributable to several factors. First, net migration during COVID has expanded Duke’s customer base. Second, the company is moving aggressively to increase generation capacity that does not emit carbon. Solar, wind and hydro energy are increasingly attractive as fossil fuel prices soar. Third, rising oil prices have increased interest in, and demand for, electric vehicles and electrification in general. While clean energy may have limited impact on earnings for the time being, the market assigns a higher valuation to utilities that emphasize non-carbon generation. DUK has a forward P/E of 19.3, but NextEra Energy (NYSE:NEE), the U.S. utility with the world’s largest wind and solar generation capacity, has a forward P/E of 27.4.

Source: E-Trade

Green (red) values are amounts by which quarterly EPS beat (missed) the consensus expected value.

I last wrote about DUK on January 27, 2022, when I maintained a bullish/buy rating on the stock. At that time, the Wall Street consensus rating for DUK was neutral/hold, and the consensus 12-month price target implied low price appreciation potential. By contrast, the consensus view implied by options prices (the market-implied outlook) was slightly bullish to early 2023. In the period since this post, DUK has substantially outperformed the S&P 500, with a total return of 5.7%, as compared to -10.5% for the S&P 500 (SPDR® S&P 500) (NYSE:SPY), including dividends.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

I have calculated an updated market-implied outlook for DUK and compared this with the current Wall Street consensus outlook in revisiting my rating on the stock.

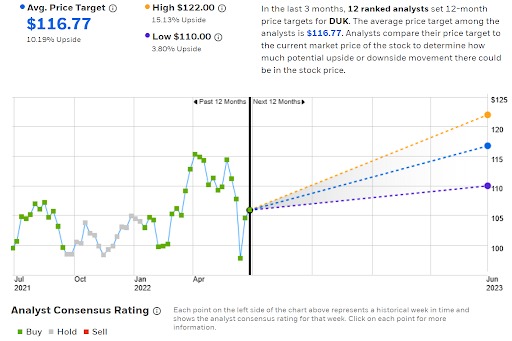

Wall Street Consensus Outlook For DUK

E-Trade calculates the Wall Street consensus outlook for DUK using ratings and price targets from 12 ranked analysts who have updated their views over the past three months. The consensus rating is bullish and the consensus 12-month price target is 10.2% above the current share price. The lowest of the individual price targets is 3.8% above the current share price. The spread among the individual price targets is low, indicating that there is little disagreement on the fair value of the shares. The consensus 12-month price target is only slightly above the YTD highs in April.

Source: E-Trade

Wall Street Consensus Rating And 12-Month Price Target For DUK

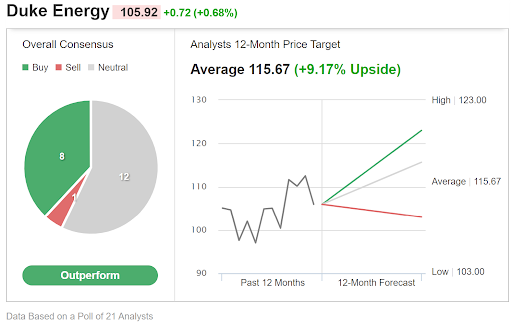

Investing.com’s version of the Wall Street consensus outlook is calculated using ratings and price targets from 21 analysts. The consensus rating is bullish and the consensus 12-month price target is 9.2% above the current share price.

Source: Investing.com

The Wall Street consensus rating for DUK was neutral/hold in late January. The consensus price targets have risen since then, along with the shift to a bullish rating. The consensus price target (taking the average of the values from E-Trade and Investing.com) implies an expected 12-month total return of 13.2% (including the 3.75% dividend yield). This is substantially higher than the consensus expected 12-month total return of 7.6% in January.

Market-Implied Outlook For DUK

I have calculated the market-implied outlook for DUK for the 6.7-month period between now and Jan. 20, 2023, using the prices of call and put options that expire on this date. I chose this specific expiration date to provide a view through the end of 2022.

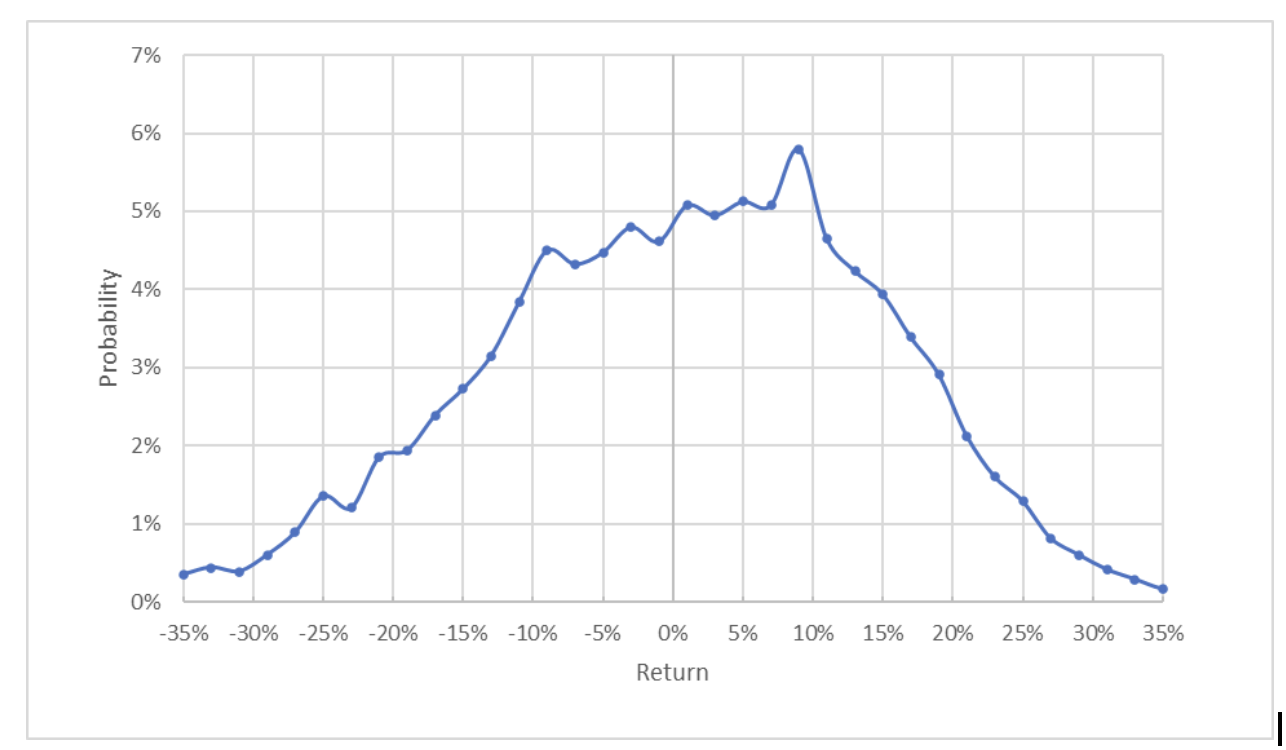

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook for DUK exhibits a peak that is significantly tilted to favor positive returns. The maximum probability corresponds to a price return of 9% over this 6.7-month period. The expected volatility calculated from this distribution is 23.8% (annualized). This is slightly higher than the expected volatility of 22.8% calculated back in January.

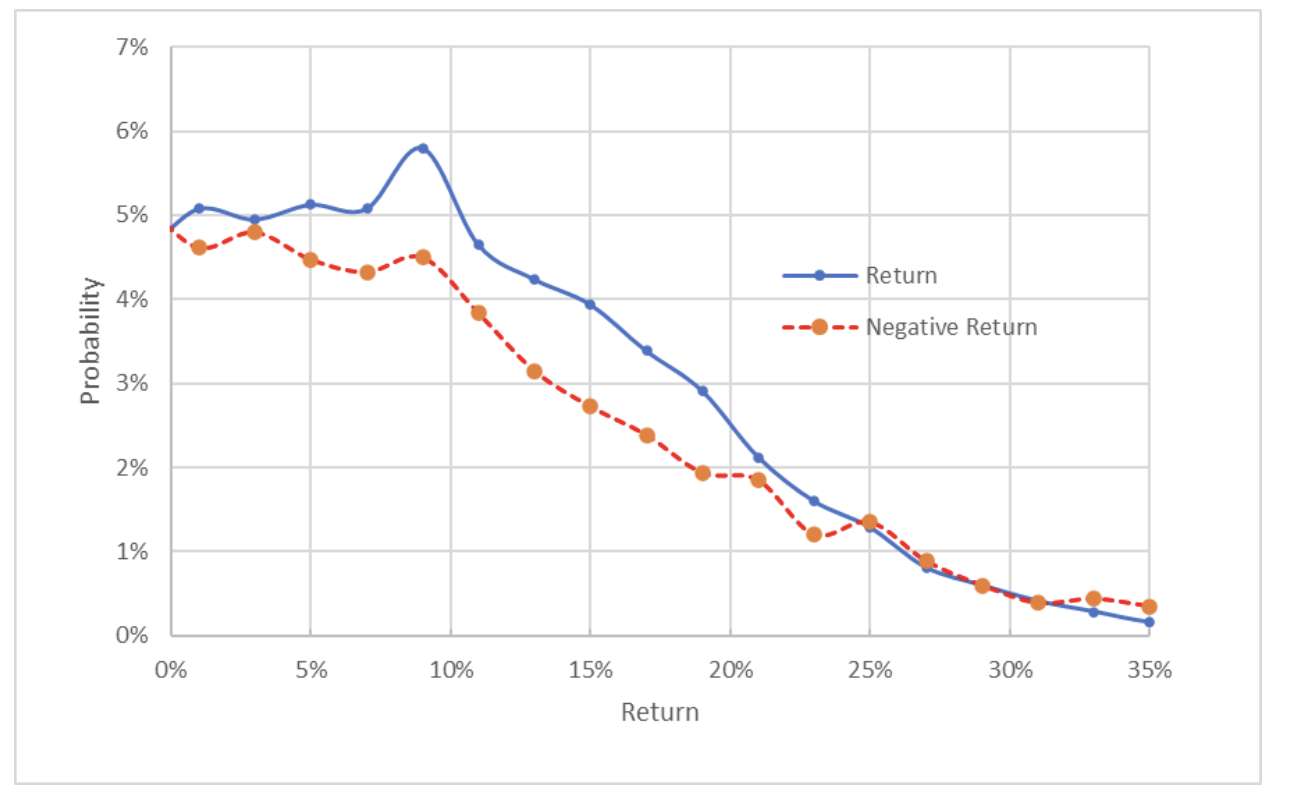

To make it easier to directly compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

This view shows that the probabilities of positive returns are consistently higher than the probabilities of negative returns of the same magnitude, across a wide range of the most probable outcomes (the solid blue line is consistently above the dashed red line over the left two-thirds of the chart above). This is a bullish outlook for the next 6.7 months.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation for a negative bias strengthens the bullish interpretation of this outlook.

The market-implied outlook has gotten more bullish since my analysis in January.

Summary

While DUK is expensive relative to earnings, as compared with historical values, the company is well-positioned to continue to provide steady performance. Even though utilities are expected to lag when interest rates rise, DUK provides a defensive refuge in volatile conditions and has maintained surprisingly stable earnings in recent years. Migration patterns and the growing interest in electric vehicles, along with increased focus on renewable energy, favor DUK. Solar, wind and hydro are increasingly cost effective, given high fossil fuel prices. The Wall Street consensus rating for DUK is bullish, with an expected 12-month total return of 13.2%. As a rule of thumb for a buy rating, I want to see an expected 12-month return that is at least half the expected annualized volatility (23.8% in this case). DUK meets this criterion. In addition, the market-implied outlook into early 2023 continues to be bullish and has gotten more bullish since early 2022. I am maintaining my overall bullish/buy rating on DUK.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »