Today we will consider several trading chances this week by using the Dow Theory.

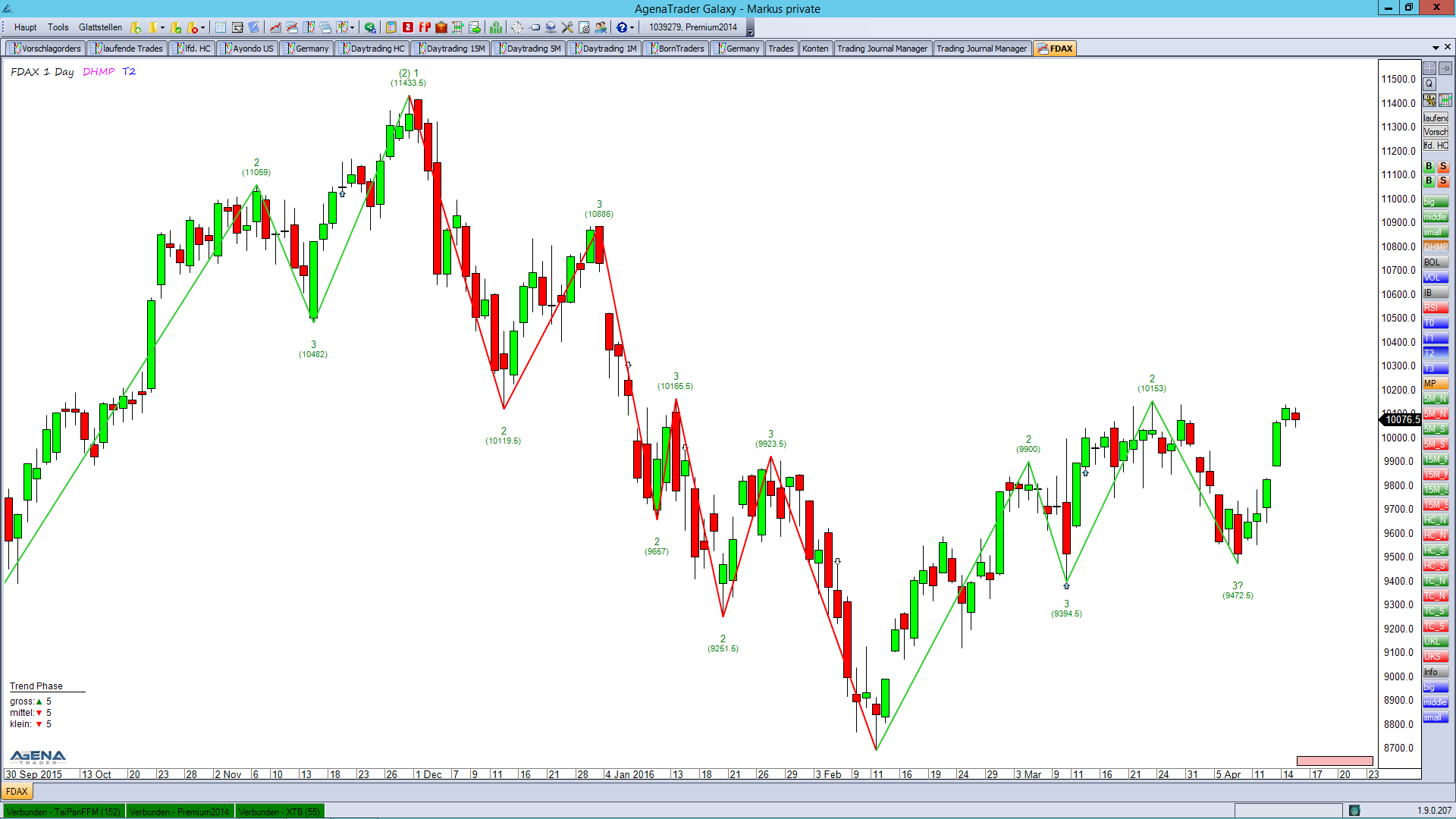

In the daily chart we can see a relatively young uptrend with a correction zone between 9900 points and 9394 points on the lower side. The last correction stopped at 9472 points and has been increasing up until now. The price is currently very close to the last point two – 10153 points – and as soon as the price creates a new point two above 10153 points, we can expect a high probability of a trend continuation.

In the tech index we see a dangerous situation. Why? Because the trend is very, very mature. As you can see in the chart, we are in the eighth correction arm and were just in the seventh movement. The current correction zone goes from 4543.17 points down to 4426.35 points, making this zone very large. The expectations, therefore, are headed more towards the lower side next week.

Light Sweet Oil

The so-called “black gold” was able to rebound since the first of April. The current high lies at $43.33 and the correction zone runs from $42.25 to $41.24. The last decrease led the price precisely to the lower edge of this green zone, where it then turned around. With a stop slightly below the correction zone, we can speculate on a trend continuation.

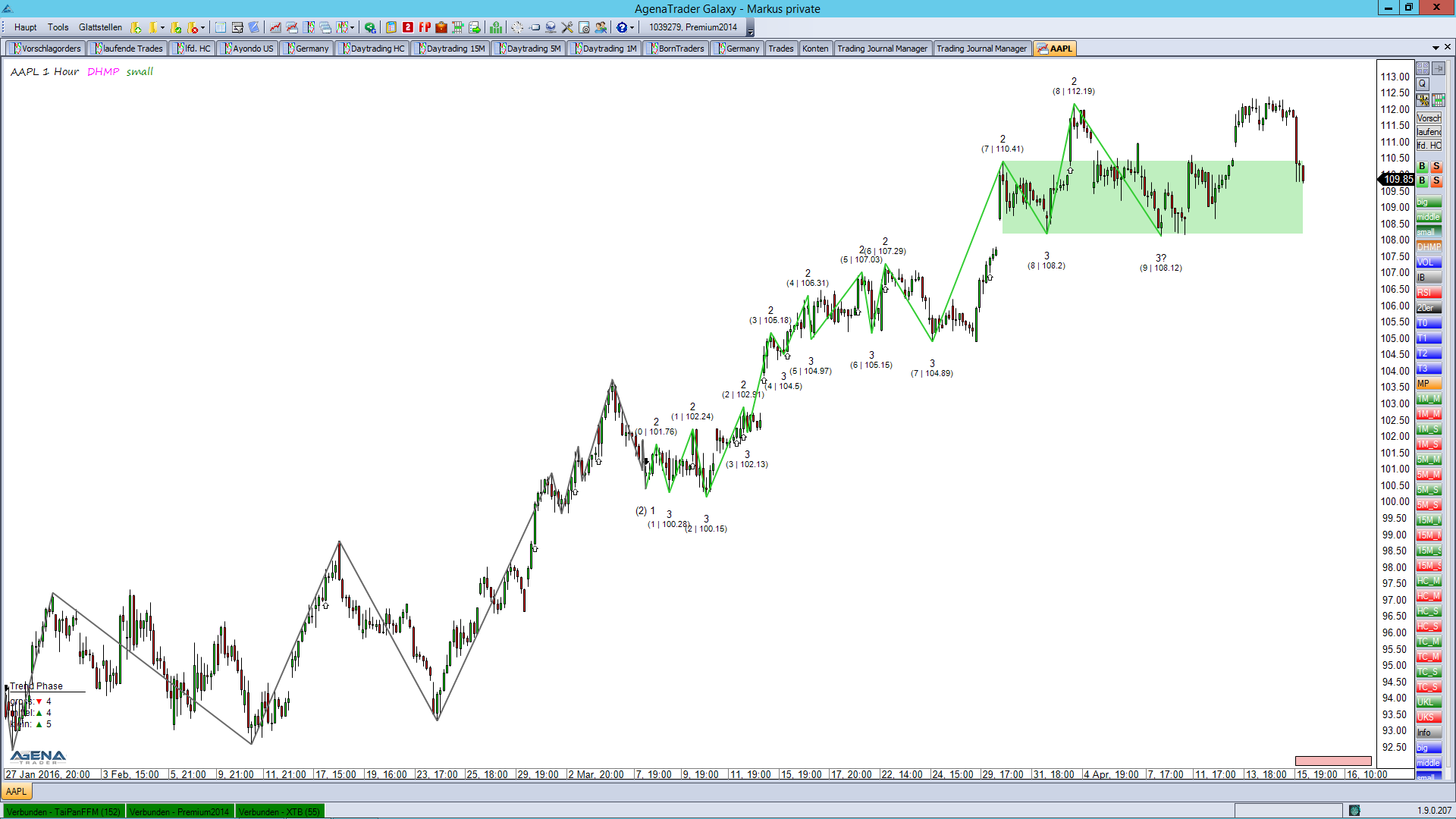

Apple Inc (NASDAQ:AAPL)

In the medium trend size in the hourly chart, we see a price that is in its fifth correction arm. We can also see that the price was unable to overcome the last point two at $112.19 with a close. This is a very strong indication that more sellers are in the market than buyers. The probabilities for next week are more on the lower side, but as long as the price does not undercut the green correction zone with a close, the trend will be able to continue each time.

For presentation purposes the trading software "AgenaTrader" has been used.

Disclaimer: Exchange transactions are associated with significant risks. Those who trade on the financial and commodity markets must familiarize themselves with these risks. Possible analyses, techniques and methods presented here are not an invitation to trade on the financial and commodity markets. They serve only for illustration, further education, and information purposes, and do not constitute investment advice or personal recommendations in any way. They are intended only to facilitate the customer's investment decision, and do not replace the advice of an investor or specific investment advice. The customer trades completely at his or her own risk. Please refer to the current version of the Terms and Conditions.