Below looks at the Dow Jones Industrial average over the past 100 years. The long-term of the Dow remains up. The action of the past couple of weeks has NOT changed that fact.

We do find this interesting-The Dow Industrials finally moved into correction territory after one of its longest-ever stretches without one. Even more interesting, this ranks as the 4th-fastest correction ever from an all-time high

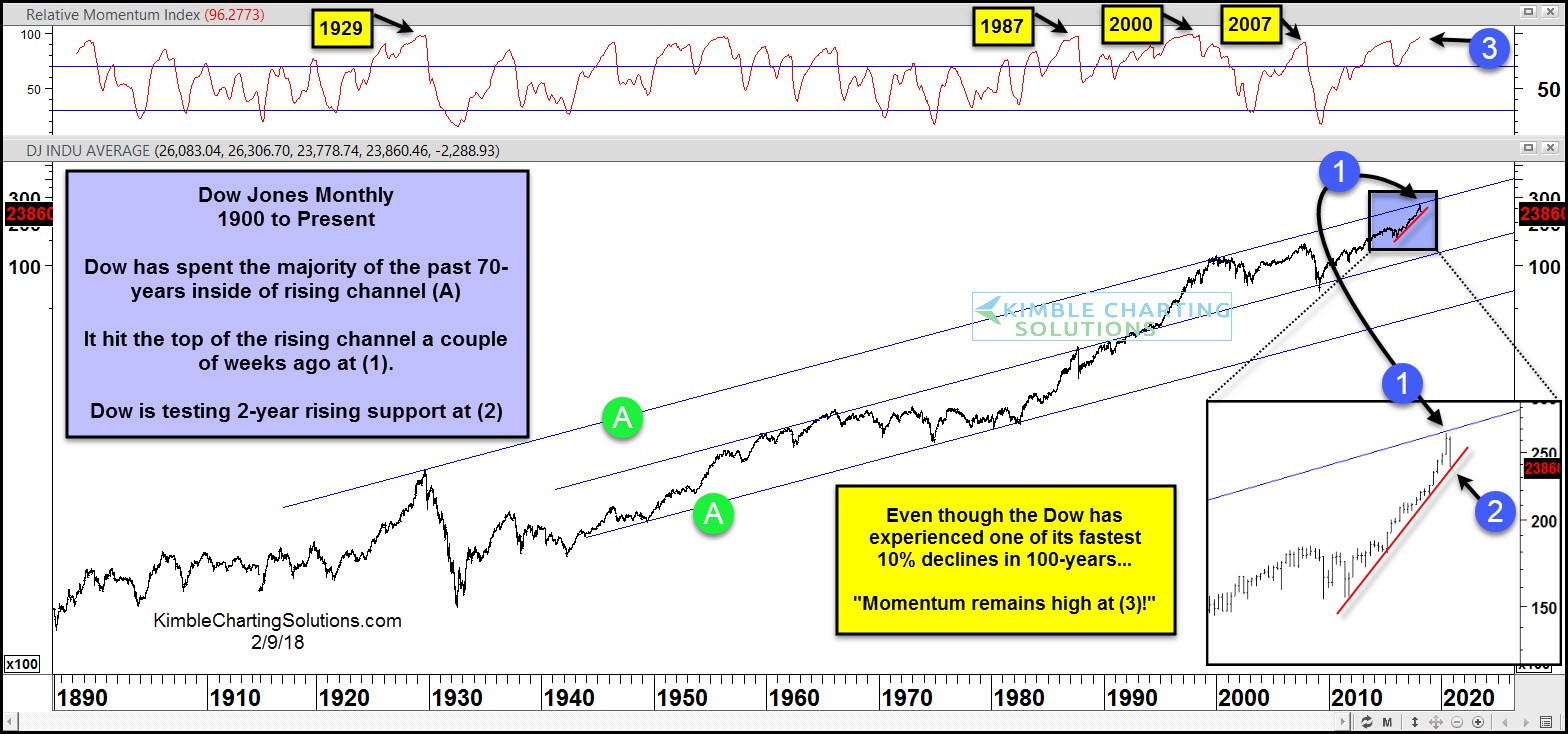

Has this decline and loss of Trillions of dollars caused the Dow’s momentum to become oversold? Below looks at the Dow over the past 100-years on a monthly basis with momentum applied.

The Dow has spent the majority of the past 70 years inside of rising channel (A). Long-term buy & holders/passive investors most often do best when buying near long-term support when momentum is oversold. Combinations like this in the the past 40-years took place in the early 1980’s, 2003 and 2009.

Historically buy & hold/passive investing has seen sub-par returns going forward when the Dow was near the top of the rising channel as momentum was hitting lofty levels.

Momentum remains near 1929, 1987, 2000 & 2007 levels at this time. From a long-term perspective it would appear that it is important that short-term support holds at (2) as the top of the 70-year channel remains just overhead.