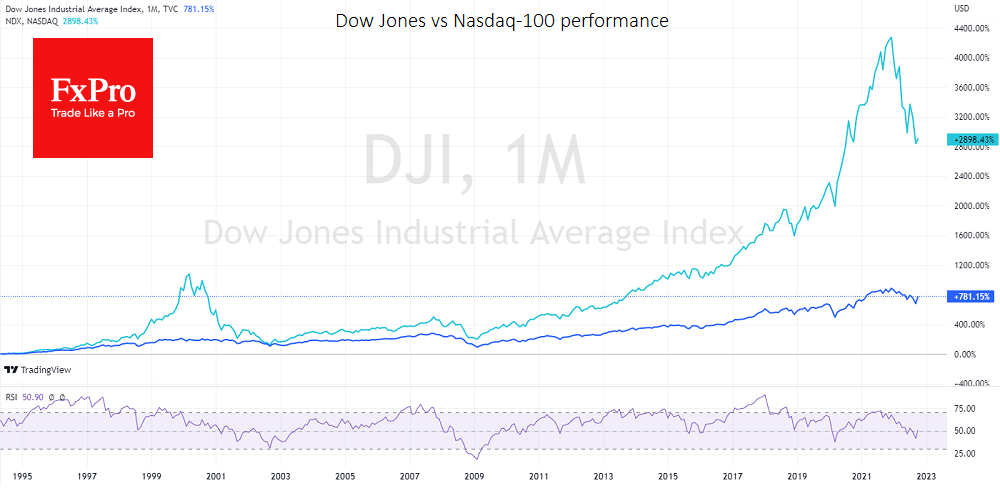

The Dow Jones is up 4.6% in the past five days versus 0.7% for the Nasdaq 100. And this divergence in momentum may continue as long as monetary authorities remain in the regime of containing inflation rather than pushing it up as they have been doing since 2009.

The behavior of the markets in February and May 2020 was the latest reminder that stocks could fall altogether, but recovery is closely dependent on changed circumstances. Then, thanks to monetary stimulus, the fate was on the side of “growth stocks,” widely represented in the Nasdaq-100, and now may shift to “value stocks,” which are more in the Dow Jones or the Russell 1000 Value.

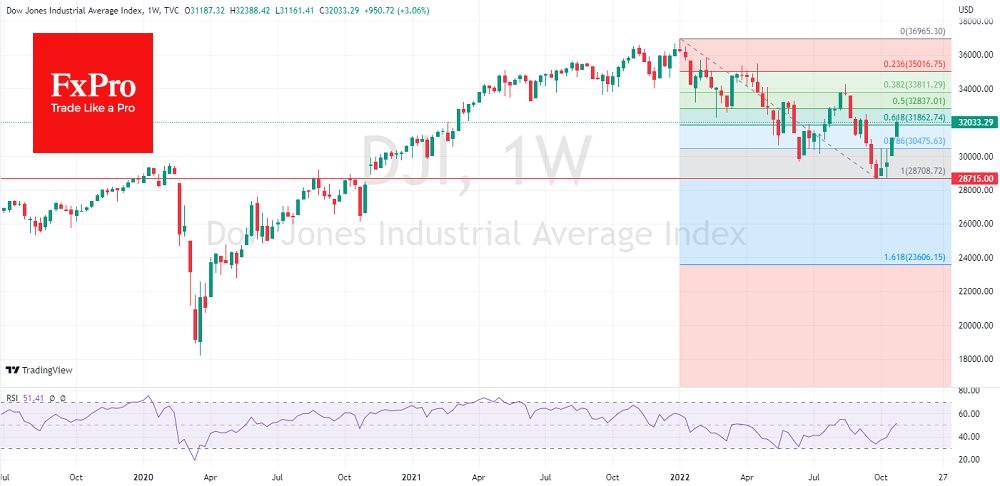

However, until October, there was not much sense in picking leaders as stock indices were declining and the most obvious way to preserve capital was to buy dollars. Nevertheless, at the end of September, it seems the markets entered a new cycle.

After adding about 12% to the lows of late September, the Dow Jones index moved beyond the corrective pullback, above 61.8% retracement of the amplitude from peak to trough of the first three quarters of this year.

The Nasdaq-100 started the retreat earlier (in November 2021) and has lost more (37.7% from the peak to the bottom and is now -34% below its all-time high), right now near its October start levels. The losing streak continues here, like the 2000-2002 episode.

In the stock indices momentum, it might look like the gap between the Dow Jones and the Nasdaq-100 is closing through a more substantial rise of the former and an apathy or even a further decline of the latter.

In the worst-case scenario for the Nasdaq-100, it would return to the 8000 area, mimicking the complete reversion to the mega-rally starting point as it did in 2002 and completing the "Head & Shoulders" pattern.

However, in our view, a more likely scenario is that the Nasdaq-100 will flat or "stumble" in the coming quarters on the back of a brisk march of the Dow Jones, which could return to all-time highs as early as the first quarter of next year.