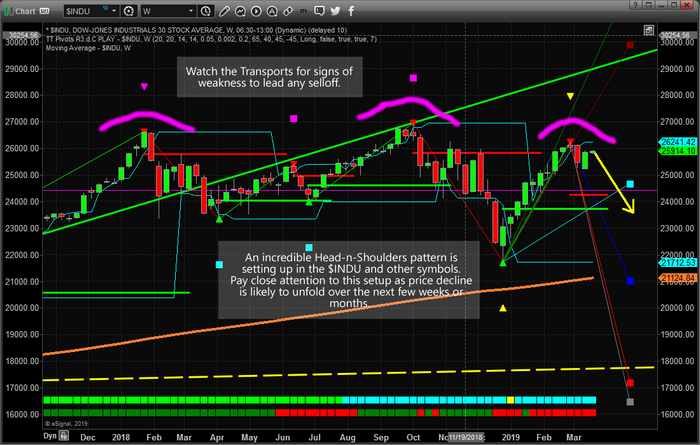

Our research team believes a moderately mild price rotation will unfold over the next 30 to 60 days where the U.S. stock market will rotate downward. Particularly, the Dow Jones Industrials should move lower towards the 23,000 to 24,000 range before finding support based on the longer term weekly chart. Keep in mind we are not saying the price is going to fall. We are stating price could correct in a big way if recent support levels are broken. If so, then 23,000-24,000 levels should be reviewed.

We have been warning about a specific price pattern that we believe is currently in the process of setting up in the U.S. stock market. This pattern is a “Falling Wedge” pattern. We’ve seen a few of these over the past 5+ years in downward retracing price swings. They typically act as a means for the price to explore a “momentum base” setup before breaking out to the upside. You can read our previous research here.

Price weakness could begin to drive market prices lower over the next few weeks as this right shoulder acts as critical resistance. If you have not already prepared for this move, please try to understand the importance of this long term price pattern. Head & Shoulders patterns are typically viewed as major resistance and a classic topping formation. Our belief that the downside price swing from the right shoulder is based on our predictive modeling systems results. We believe this move will drive prices lower before support is found and our downward sloping wedge pattern sets up. This wedge pattern will likely break to the upside during the summer months.

This Head & Shoulders pattern is something all traders need to pay attention to. This is a critical resistance/top formation that should drive prices lower over the next few weeks/months.

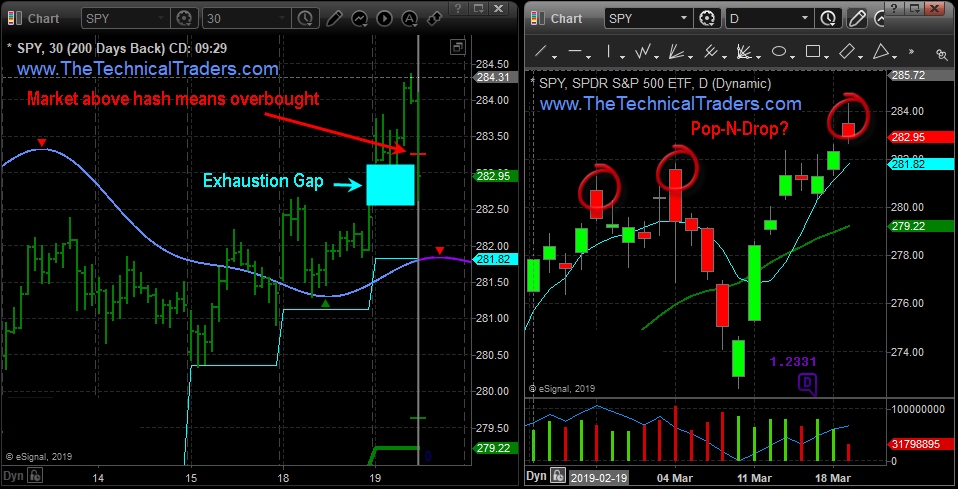

Just take a look at the daily SPDR S&P 500 (NYSE:SPY) chart and reversal type price action forming this week.

If you have not protected your long trades well enough or you have recently deployed a bunch of capital into the markets, we strongly suggest you develop a “Plan B” as we are likely to see a 5~10% correction before this downside swing is over.