Investing.com’s stocks of the week

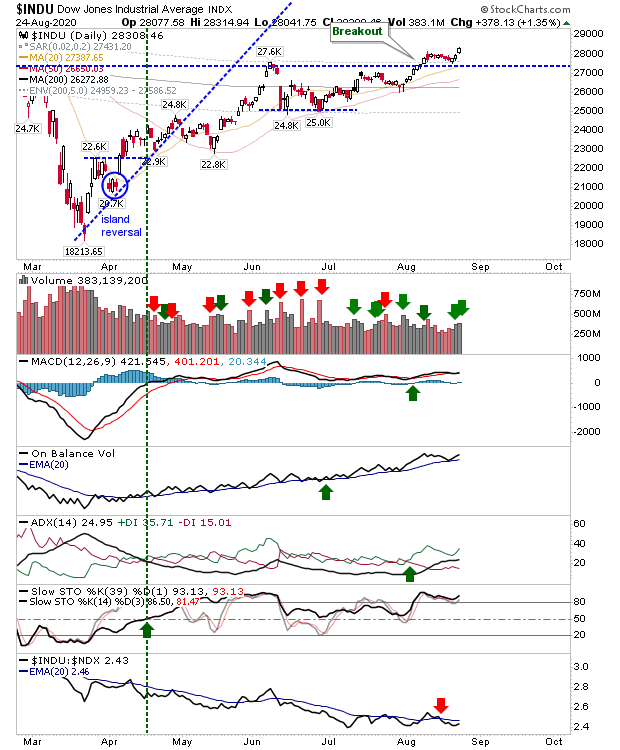

It was left to Large Caps to do the heavy lifting on Monday. The Dow Jones Index was yesterday's winner as it added over 1% on heavy volume accumulation. The index is still experiencing relative underperformance to Tech indices, but the gain marks a new swing high and an opportunity for momentum traders to get involved with some more defensive stocks.

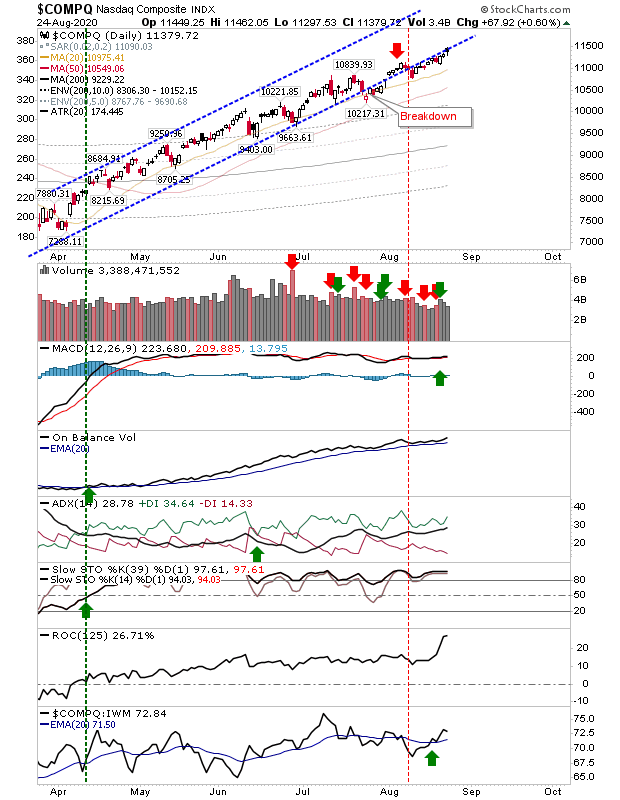

The NASDAQ finished the day with a black candlestick—often a reversal candlestick when it appears at the end of the rally, so we need to watch for a gap down today. Volume was lighter than Friday but technicals are bullish. A close above yesterday's highswould negate the bearishness of the individual candlestick.

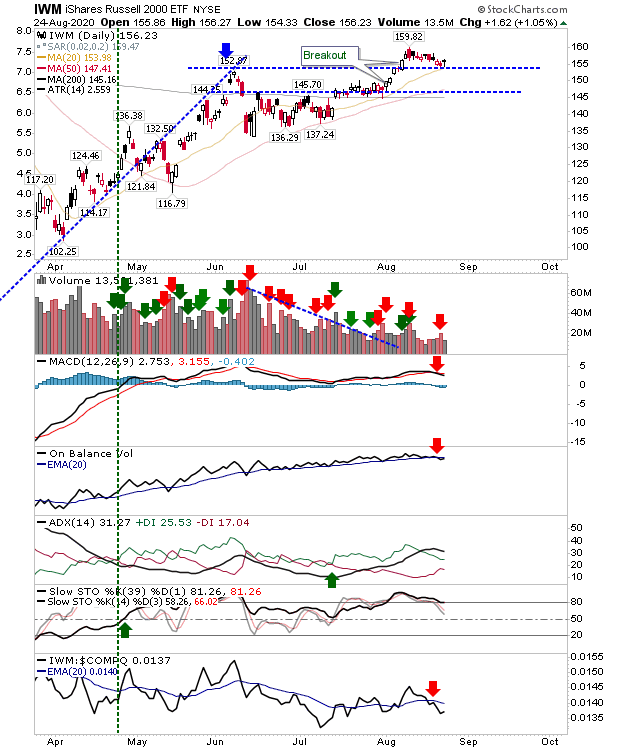

The Russell 2000 is back holding breakout support which is also its 20-day MA. Volume was well down on recent trading days but the action is probably enough to consider it a pullback 'buy.'

The day finished with momentum traders pushing money into Large Cap stocks as more speculative issues saw a pause in the buying. Too early to say if there is a more concerted effort to rotate money into more defensive stocks but yesterday was a start.