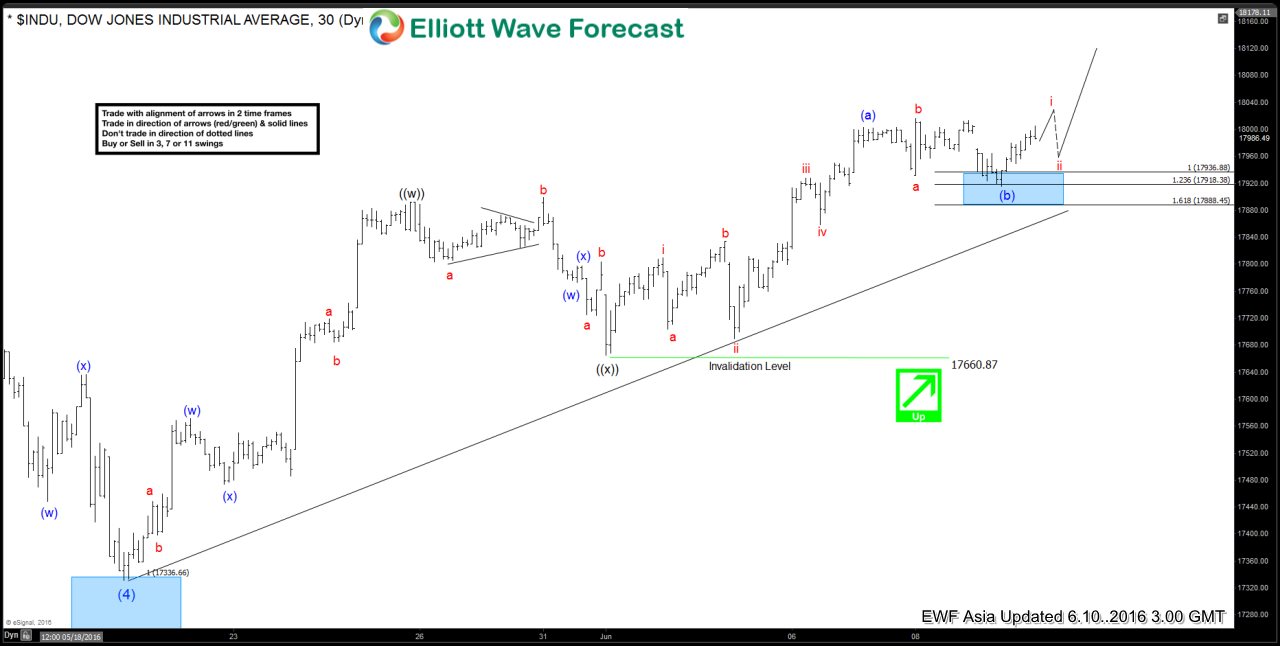

Short-term Elliottwave structure suggests that dip to 17331.07 ended wave (4). Rally from there is unfolding as a double three where wave ((w)) ended at 17891.6 and wave ((x)) ended at 17660.87. Internal of wave ((y)) is unfolding as a zigzag where wave (a) ended at 18003 and wave (b) is proposed complete at 17915. A break above irregular wave b at 18016 high now will give confirmation that index has resumed higher.

If the index breaks below ave (b) at 17915, then index is doing a double correction in wave (b). While the index stays above 17915, and more importantly above wave ((x)) at 17660.87, favor more upside in the index towards 18222 – 18354. Currently, we don’t like selling the index.