Those that view the message of the market on a daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

Previous comments posted on 4/22 still stand,

While the Dow Industrials entered TRIPLE UPSIDE ALIGNMENT on 4/12, it wasn't an all out buy signal for investors. Bullish or bearish alignment is still relatively meaningless as long as price trades within a box of bullish (resistance) and bearish (support) reversals. The cycle of accumulation and distribution suggests stocks are building CAUSE, a neutral phase (trend) of underlying accumulation or distribution until the market jumps the creek or breaks the ice. Price jumps the creek and breaks the ice at 25,100 and 23,100, respectively (see Matrix). Breakout of CAUSE will be confirmed by the sentiment and the term structure of the VIX, two important stock market timing tools.

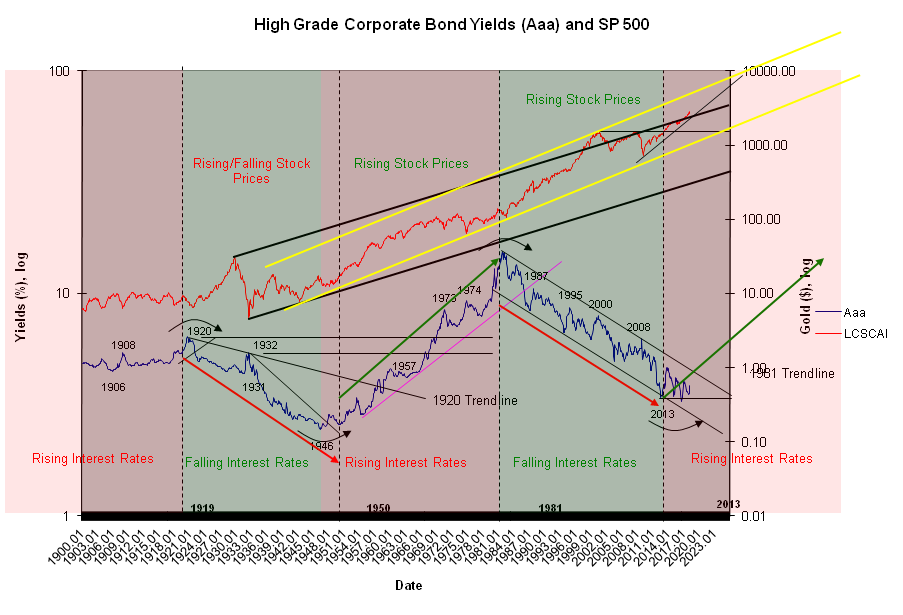

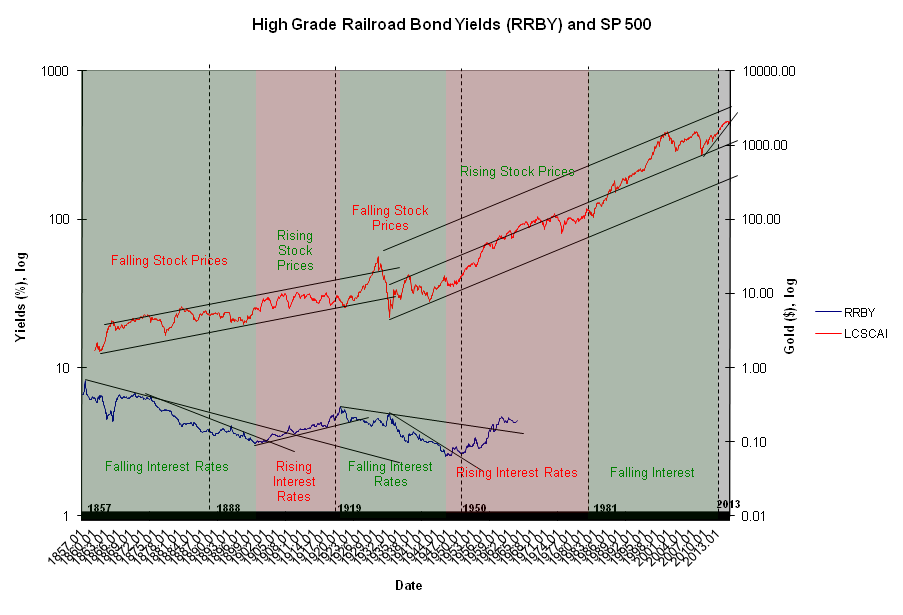

Any 'expert' that suggests 3% or higher yield on the 10-Year (rising rates) is bad for stocks should be ignored as 100% Grade A bullshit! Experts tend to understand trends (the world they live in) in terms of the cycle they grew up on. Unfortunately, their interpretations are worthless when the cycle changes on them.

History shows us that rising rates can be bullish for stocks. Please ignore them and follow us. Or, ignore us and follow our computer. Either works.

Charts High Grade Corporate Bonds Aaa