Short term YM_F (Dow E-Mini Future) Elliott Wave view suggests the rally from 6/29 low is unfolding as a double three Elliott wave structure and ended with Minor wave W at 21628. Down from there, Minor wave X pullback unfolded as a running Elliott Wave flat. Minute wave ((a)) ended at 21457, Minute wave ((b)) ended at 21624, and Minute wave ((c)) of X ended at 21444. Index has since made a new high suggesting the next leg higher has started. Up from 21444 low, Sub Minutte wave a ended at 21640. And Sub Minutte wave b pullback ended at 21524, while above there expect Index to extend higher again.

Near term focus remains towards 21719-21769 100%-123.6% extension area from 21444 low to end the Minutte wave (w) higher. The index then has scope to see a pullback, which should then find buyer’s again in sequence of 3, 7 or 11 swings for further upside provided the pivot at 21444 low remains intact. We don’t like selling the Index and favors buying the dips against 21444 low in the first degree. If pivot at 21444 low fails, then the move higher from 6/29 (21138) can be seen as a 5 waves diagonal. In this case, Index should pullback in 3, 7, or 11 swing to correct cycle from 6/29 low before the rally resumes.

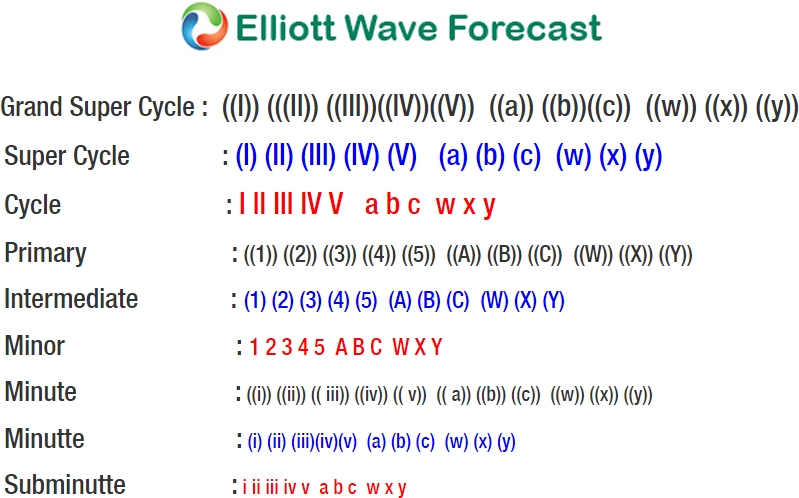

Dow E-Mini Future 1 Hour Elliott Wave View