The bullish sentiment in the options market for the SPDR Dow Jones Industrial Average (NYSE:DIA) has gotten overdone, and the ETF is due for a short-term downturn.

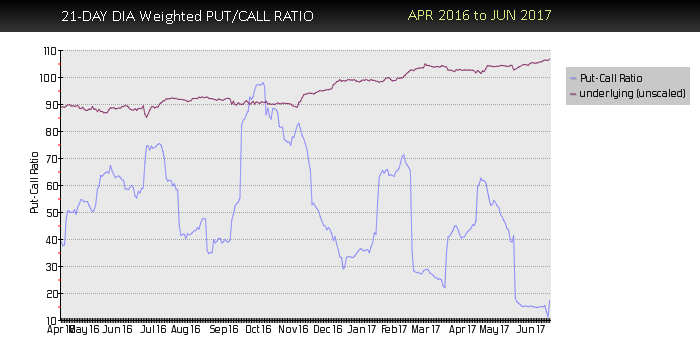

That’s the message from the options experts at McMillan Analysis Corp., who today published a note that their computer generated dollar weighted Put-Call Ratio Sell Signal has been visually confirmed by DIA’s chart (see below):

As you can see in the chart above, DIA’s put-call ratio has plunged to historically low levels on a dollar weighted basis. This means that far more bullish bets are being placed on DIA than bearish bets.

When this ratio gets to either extreme, the tendency is for a stock or ETF to correct in the near term as the very crowded trade unwinds. While not a guarantee that DIA will plunge, investors are wise to add this indicator to their toolbox because it has a solid track record as a prescient near-term signal.

For more on put-call ratio and its value as a contrarian indicator, here’s McMillan’s explanation:

Put-call ratios are useful, sentiment-based, indicators. The put-call ratio is simply the volume of all puts that traded on a given day divided by the volume of calls that traded on that day. The ratio can be calculated for an individual stock, index, or futures underlying contract, or can be aggregated – for example, we often refer to the equity-only put-call ratio, which is the sum of all equity put options divided by all equity call options on any given day. Once the ratios are calculated, a moving average is generally used to smooth them out. We prefer the 21-day moving average for that purpose, although it is certainly acceptable to use moving averages of other lengths.

The SPDR Dow Jones Industrial Average ETF was trading at $214.92 per share on Tuesday afternoon, flat on the day. Year-to-date, DIA has gained 8.81%, versus a 9.06% rise in the benchmark S&P 500 index during the same period.

DIA currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #5 of 75 ETFs in the Large Cap Value ETFs category.