Dow Chemical’s (NYSE:DOW) fully owned subsidiary Dow AgroSciences LLC and TeselaGen Biotechnology Inc. entered a new phase in their partnership to produce a state-of-the-art biological design automation platform that can expedite discovery work. The terms of the partnership were not divulged.

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

The companies collaborated in 2016 to develop a new design platform which helped scientists to increase the flow of potential discovery by ten times.

With the new phase of collaboration, the companies are building a flexible modular platform with a powerful software module that adheres to a strict design-build-test methodology for industrial-scale cloning.

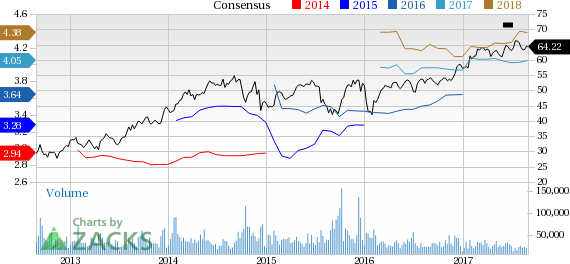

Dow has outperformed the industry it belongs to over a year. The company’s shares have moved up around 19.7% over this period, compared with roughly 17.9% gain recorded by the industry.

Dow topped earnings expectations in second-quarter 2017. The company reported adjusted earnings of $1.08 per share that beat the Zacks Consensus Estimate of $1.01. The company raked in net sales of $13,834 million, up roughly 16% year over year. Sales also surpassed the Zacks Consensus Estimate of $13,655 million.

Dow is witnessing improved global economic activity with strong momentum in manufacturing, investment and trade. While strength of the consumer is driving expansion in the U.S., improvement in Europe is expected to remain on a steady track. The company is also seeing signs of stabilization in Latin America, especially in the agriculture market. Dow also believes that it is well positioned to capture demand in consumer-led markets.

The company is expected to gain from its focus on consumer-led markets and its strategic investments in the U.S. Gulf Coast and the Middle East. Dow should also benefit from its productivity management actions and cost synergies associated with Dow Corning Silicones business. The planned merger with DuPont (NYSE:DD) is also expected to create significant synergies.

Dow Chemical Company (The) Price and Consensus

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post