Dow Chemical (NYSE:DOW) and DuPont (NYSE:DD) said that they have received all required regulatory approvals and clearances for their planned mega-merger. The companies expect their ‘merger of equals’ to complete after the market closes on Aug 31.

Shares of both the companies will cease trading at the close of the NYSE on Aug 31. Moreover, shares of the new combined entity, “DowDuPont” will start trading on the NYSE under the ticker symbol "DWDP" on Sep 1.

Following the completion of the merger, the combined entity would eventually break up into three independent companies through tax-free spin-offs. The planned breakup is still expected to take place within 18 months after the completion of the deal.

The merger is projected to deliver cost synergies of around $3 billion and growth synergies of roughly $1 billion.

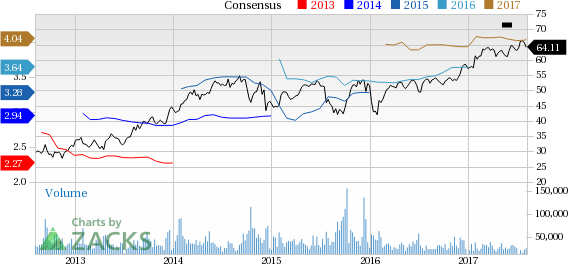

Dow’s shares gained 19.6% over the past year, modestly underperforming the 20.3% gain of the industry it belongs to.

Dow topped earnings expectations in second-quarter 2017, helped by its cost-cutting and productivity actions, improved pricing and continued focus on consumer-driven markets. The company’s adjusted earnings of $1.08 per share for the quarter trounced the Zacks Consensus Estimate of $1.01.

Dow’s revenues climbed 16% year over year to $13,834 million, also topping the Zacks Consensus Estimate of $13,655 million. The company saw higher sales in all operating segments and geographic areas in the quarter.

Dow, in its second-quarter call, said that is witnessing improved global economic activity with strong momentum in manufacturing, investment and trade. While strength of the consumer is driving expansion in the U.S., improvement in Europe is expected to remain on a steady track. The company is also seeing signs of stabilization in Latin America, especially in the agriculture market. Dow also believes that it is well positioned to capture demand in consumer-led markets.

Dow currently holds a Zacks Rank #3 (Hold).

Stocks to Consider

Better-placed companies in the basic materials space include Westlake Chemical Corporation (NYSE:WLK) and Air Products and Chemicals, Inc. (NYSE:APD) , both sporting a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Westlake has an expected long-term earnings growth of 7.2%.

Air Products has an expected long-term earnings growth of 12.1%.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Original post

Zacks Investment Research