Dow Chemical’s (NYSE:DOW) fully-owned subsidiary, Dow AgroSciences LLC and Arcadia Biosciences, Inc. has collaborated to develop and commercialize a breakthrough improved wheat quality trait in North America. The partnership will capitalize on Arcadia’s leading non-GM Tilling trait development platform along with Dow AgroSciences’ enabling technology platforms, high-quality elite germplasm and global commercial channels.

Per the agreement, both companies will further develop and commercialize an improved wheat quality trait which has completed initial field trials and is advancing to next-stage trials. Dow AgroSciences will introgress Arcadia’s trait into its proprietary elite germplasm lines and manage all aspects associated with the commercialization of the traits.

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Original post

Per the agreement, both companies will further develop and commercialize an improved wheat quality trait which has completed initial field trials and is advancing to next-stage trials. Dow AgroSciences will introgress Arcadia’s trait into its proprietary elite germplasm lines and manage all aspects associated with the commercialization of the traits.

Dow has underperformed the industry it belongs to over the last three months. The company’s shares have moved up around 2.8% over this period, compared with roughly 4.1% gain recorded by the industry.

Dow is witnessing improved global economic activity with strong momentum in manufacturing, investment and trade. While strength of the consumer is driving expansion in the U.S., improvement in Europe is expected to remain on a steady track. The company is also seeing signs of stabilization in Latin America, especially in the agriculture market. Dow also believes that it is well positioned to capture demand in consumer-led markets.

The company is expected to gain from its focus on consumer-led markets and its strategic investments in the U.S. Gulf Coast and the Middle East. Dow should also benefit from its productivity management actions and cost synergies associated with Dow Corning Silicones business. The planned merger with DuPont (NYSE:DD) is also expected to create significant synergies.

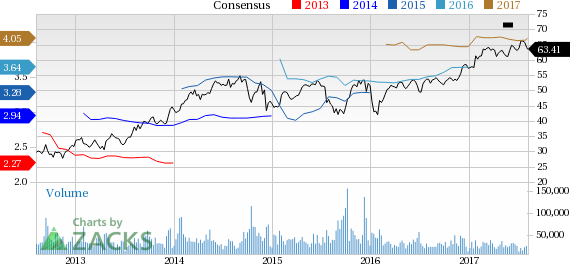

Dow Chemical Company (The) Price and Consensus

Dow Chemical Company (The) Price and Consensus

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Original post