The Dow Chemical Company’s (NYSE:DOW) Packaging and Specialty Plastics (P&SP) unit exhibited its innovative packaging technologies and solutions that will meet Asia's growing appetite for sophisticated packaging, at Chinaplas 2017.

Currently, the company is focusing on more sustainable products that address consumer concerns like safety of food packaging, e-commerce logistics packaging, and easy-carry, convenient packaging that support today's modern lifestyles. The expanding middle class in the Asia Pacific region is increasingly seeking safer, quality and environmentally friendlier products.

Dow's series of innovative and sustainable solutions include Innate precision packaging resins, which is a landmark product in packaging resin technology. In fact, apart from addressing the leakage, and wear and tear problems, this product also provides distinct advantages for food and e-commerce packaging through its excellent stiffness, toughness and processability. This innovative technology has been widely used in flexible stand up pouches, heavy duty shipping bags, liquid packaging, and liquid container liners as it consumes less material due to higher performance.

Moreover, the company’s innovative enhanced expanded polyethylene (EPE) foam solution assist in smart shopping, especially in the e-commerce space. It is APAC-developed technology that enables material reduction and offers a reliable fix by blending LDPE with LLDPE, which has higher tear strength than 100% LDPE.

Also, Dow's ASPUN MB meltblown fiber resins helps in maintaining strength, durability, and processing efficiency in fabrics such as bico-SMS nonwovens, besides addressing the challenge of increasing softness and comfort in them. As a result, this new patent-pending family of polyethylene (PE) resins is an ideal solution for nonwovens in infant diapers, adult incontinence products, medical drapes and garments as well as filtration products.

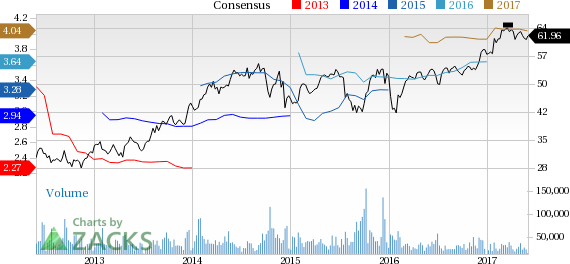

Dow has outperformed the Zacks categorized Chemicals-Diversified industry in the last six months. The company’s shares have rallied around 11.8% over this period compared with roughly 8.1% gain recorded by the industry.

The company registered adjusted earnings of $1.04 per share for the first quarter of 2017 that zoomed past the Zacks Consensus Estimate of 99 cents. Dow raked in net sales of $13,230 million, up roughly 23% year over year, also topping the Zacks Consensus Estimate of $12,367 million.

Dow is witnessing signs of positive economic momentum globally, amid sustained geopolitical risks and volatility. The company is also seeing early signs of gradual improvements in consumer-led markets in Latin America. The company believes that the strength of its portfolio coupled with its focus on consumer-led markets will continue to serve it well.

The company should gain from its productivity and portfolio management actions as well as focus on consumer-led markets. In addition, it should benefit from cost synergies associated with Dow Corning Silicones business and its strategic investments in the U.S. Gulf Coast and the Middle East. Furthermore, Dow’s planned merger with DuPont (NYSE:DD) is also expected to create significant synergies.

However, Dow’s agriculture business is still affected by weak crop commodity prices and depressed demand in North America. Also, it faces feedstock cost pressure and headwinds associated with higher start-up and maintenance costs.

Dow Chemical Company (The) Price and Consensus

Zacks Rank & Stocks to Consider

Dow currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the chemical space include The Chemours Company (NYSE:CC) and Kronos Worldwide, Inc. (NYSE:KRO) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has expected long-term growth of 15.5%.

Kronos has expected long-term growth of 5%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post