The Dow Chemical Company’s (NYSE:DOW) fully-owned unit, Dow AgroSciences has landed a licensing agreement with EAG Laboratories (“EAG”). Per the deal, EAG will utilize Dow AgroSciences' patented Plextein Technology, a high throughput method for detecting and quantitating multiple proteins in plants.

Plextein enables researchers to determine the required regulatory food allergen results through one analysis. The technology uses liquid chromatography with tandem mass spectrometry (LC-MS/MS) to simultaneously measure plant-derived proteins of interest to companies and government regulatory agencies.

Plextein was invented by Dow AgroSciences to rapidly identify and quantify allergens in soybeans. This helps soybean product developers to quickly and efficiently meet the increasing regulatory demands around the globe.

EAG provides seed and trait developers the unique combination of biotechnology and protein characterization expertise. The addition of Plextein to the company’s offerings will help it to bring the latest advancements in plant protein analyses to its customers.

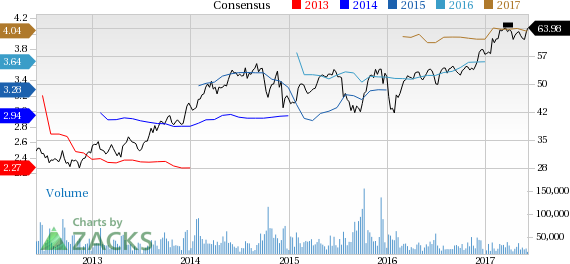

Dow Chemical has outperformed the Zacks categorized Chemicals-Diversified industry over the past six months. The company’s shares have moved up around 10.9% over this period, compared with roughly 5.8% gain recorded by the industry.

Dow is witnessing signs of positive economic momentum globally, amid sustained geopolitical risks and volatility. The company is also seeing early signs of gradual improvements in consumer-led markets in Latin America. The company believes that the strength of its portfolio coupled with its focus on consumer-led markets will continue to serve it well.

The company should gain from its productivity management actions as well as focus on consumer-led markets. Dow should also benefit from cost synergies associated with Dow Corning Silicones business and its strategic investments in the U.S. Gulf Coast and the Middle East. The planned merger with DuPont (NYSE:DD) is also expected to create significant synergies.

However, Dow’s agriculture business is affected by weak crop commodity prices and depressed demand in North America. Dow also faces feedstock cost pressure and headwinds associated with higher start-up and maintenance costs.

Dow Chemical Company (The) Price and Consensus

Zacks Rank & Stocks to Consider

Dow currently carries a Zacks Rank #3 (Hold).

Some top-ranked stocks in the chemical space include The Chemours Company (NYSE:CC) and Kronos Worldwide, Inc. (NYSE:KRO) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has expected long-term growth of 15.5%.

Kronos has expected long-term growth of 5%.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research