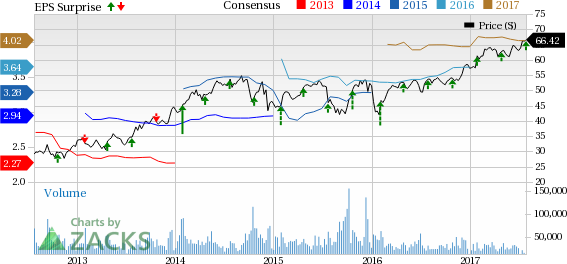

Dow Chemical (NYSE:DOW) topped earnings expectations in second-quarter 2017, helped by its cost-cutting and productivity actions, improved pricing and continued focus on consumer-driven markets.

The U.S. chemical giant registered adjusted earnings (barring one-time items) of $1.08 per share for the quarter that comfortably beat the Zacks Consensus Estimate of $1.01.

On a reported basis, the company registered a profit of roughly $1.3 billion or $1.07 per share, down around 58% from a profit of $3.1 billion or $2.61 per share recorded a year ago. The results in the reported quarter include costs related to transactions and productivity actions. Moreover, profit in the year-ago quarter was boosted by gains related to Dow Corning ownership restructure.

Dow raked in net sales of $13,834 million, up roughly 16% year over year. Sales also surpassed the Zacks Consensus Estimate of $13,655 million. The company witnessed sales gains across all operating segments and geographic areas in the reported quarter.

Volumes (excluding acquisitions) rose 3% in the quarter on gains across all segments and geographies. The company also saw a 5% rise in pricing on gains in all geographic areas.

Dow also achieved $215 million in productivity and cost savings during the reported quarter. The company also completed its restructuring program in the quarter.

Segment Highlights

Agricultural Sciences: Sales rose 3% year over year to $1.6 billion in the reported quarter on the back of double-digit gains in the seeds business. Volume went up 6% on gains in both seeds and crop protection businesses.

Consumer Solutions: Revenues from the division were $1.7 billion, up around 32%, supported by the contributions of the silicones business. Volumes rose 9% in the quarter on gains across all businesses.

Infrastructure Solutions: Sales from the division jumped around 34% to $2.8 billion in the quarter driven by the contributions of the silicones business, broad-based volume gains and a higher pricing.

Performance Materials & Chemicals: Revenues went up 13% to $2.6 billion in the quarter on gains across all geographies. Volume rose 3% while prices increased 10%.

Performance Plastics: Sales rose 8% to $5.1 billion in the reported quarter. Prices moved up 7% while volume increased 1%.

Financials

Dow had cash and cash equivalents of roughly $6.2 billion at the end of the quarter, down around 15% year over year. Total long-term debt was roughly $21 billion, flat year over year.

Outlook

Dow is witnessing improved global economic activity with strong momentum in manufacturing, investment and trade. While strength of the consumer is driving expansion in the U.S., improvement in Europe is expected to remain on a steady track. The company is also seeing signs of stabilization in Latin America, especially in the agriculture market. Dow also believes that it is well positioned to capture demand in consumer-led markets.

Dow is moving ahead with its proposed merger with DuPont (NYSE:DD) . The companies received the U.S. antitrust approval for the merger in June. Moreover, the European Commission conditionally approved the merger in Mar 2017.

The companies expect the closing of the merger to take place in Aug 2017. The merger is projected to deliver cost synergies of around $3 billion and growth synergies of roughly $1 billion.

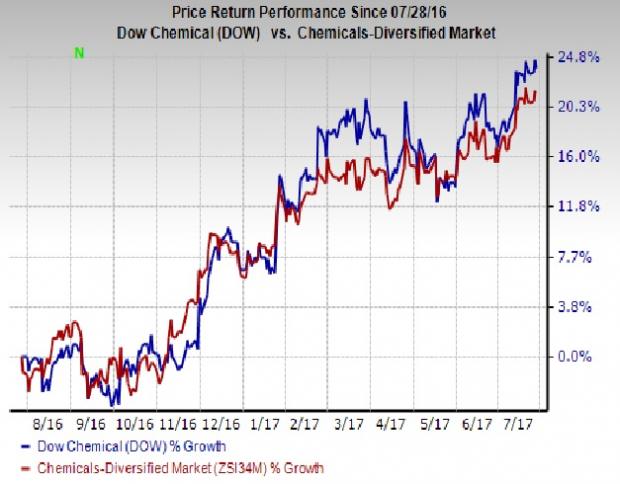

Price Performance

Dow’s shares have rallied 23.8% over the past year, outperforming the 21.8% gain of the industry it belongs to.

Zacks Rank & Stocks to Consider

Dow is a Zacks Rank #3 (Hold) stock.

Better-placed companies in the chemicals space include Westlake Chemical Corporation (NYSE:WLK) and The Chemours Company (NYSE:CC) , both sporting a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Westlake has an expected long-term earnings growth of 7.2%.

Chemours has an expected long-term earnings growth of 15.5%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Original post

Zacks Investment Research